DANAHER CORPORATION Reports Record-Breaking 24.6% Increase in FY2022 Q4 Revenue of USD 2.2 Billion.

February 8, 2023

Earnings report

DANAHER CORPORATION ($NYSE:DHR) is a science and technology-driven global conglomerate, with products ranging from biopharmaceuticals and diagnostics, to dental and environmental technologies. The company is listed on the New York Stock Exchange and trades under the symbol DHR. On January 24 2023, DANAHER CORPORATION reported its earnings results for FY2022 Q4, with total revenue of USD 2.2 billion, a 24.6% increase from the same quarter of the previous year. Net income came in at USD 8.4 billion, a 2.7% increase year over year as of December 31 2022. The strong financial performance reported by the company was driven by several factors, including healthy organic growth in core businesses, strong pricing, and cost-saving initiatives. The company’s core businesses—biopharma, medical technologies, and diagnostics—all experienced double-digit revenue growth.

In addition, DANAHER CORPORATION’s pricing strategy enabled it to capture higher margins on its products, leading to higher profits. Finally, the company’s focus on cost savings allowed it to reinvest in areas that will drive future growth and profitability. With a diversified portfolio of products and services, DANAHER CORPORATION is well-positioned to take advantage of future growth opportunities in its core markets. The company’s focus on innovation and cost savings should continue to drive long-term value creation for its shareholders.

Market Price

The company’s stock opened at $273.0 and closed at $271.6, down by 2.0% from the last closing price of 277.0. The increase in revenue was driven by strong performance of all four of its business segments, including Environmental & Applied Solutions, Life Sciences, Diagnostics, and Product Identification. The company has invested heavily in technological advancements over the past decade, leading to the development of cutting-edge products and solutions that have revolutionized the industries it serves. DANAHER CORPORATION’s commitment to innovation and customer satisfaction has also helped it solidify its position as one of the world’s leading providers of scientific and technological products and services. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Danaher Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 31.47k | 7.1k | 22.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Danaher Corporation. More…

| Operations | Investing | Financing |

| 8.52k | -2.23k | -2.57k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Danaher Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 84.35k | 34.26k | 64.55 |

Key Ratios Snapshot

Some of the financial key ratios for Danaher Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.7% | 38.5% | 27.0% |

| FCF Margin | ROE | ROA |

| 23.4% | 10.9% | 6.3% |

Analysis

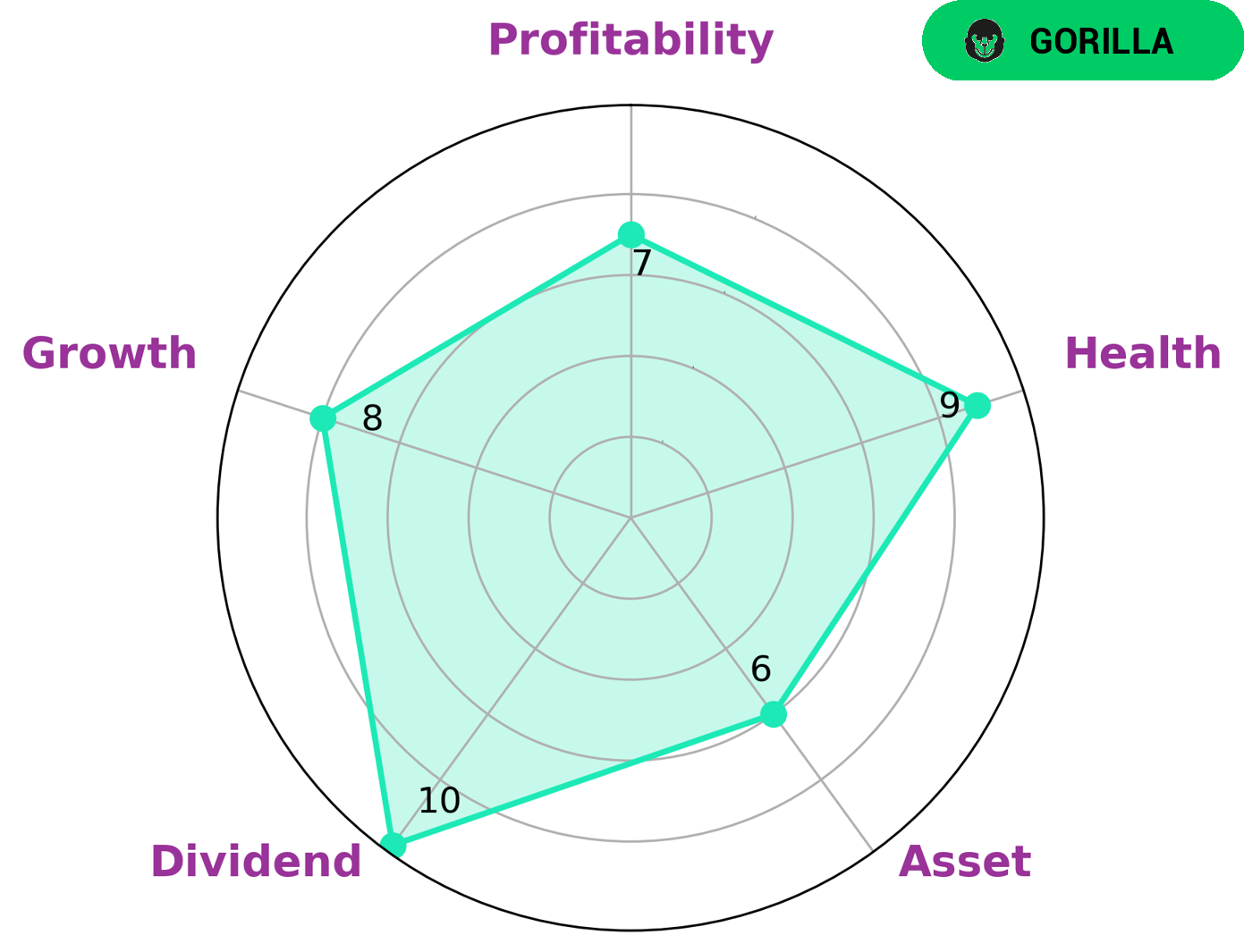

GoodWhale’s analysis of DANAHER CORPORATION‘s financials reveals that it is a strong company in terms of dividend, growth, profitability and medium in asset. It is classified as a ‘gorilla’, which refers to a company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given its strong financials, DANAHER CORPORATION is an attractive investment for many types of investors. Those who are looking for steady and reliable dividends, long-term growth prospects, and good profitability will find this company appealing. Similarly, those who are interested in investing in companies with strong competitive advantages and stable cashflows will find the company attractive. Furthermore, GoodWhale gave DANAHER CORPORATION a high health score of 9/10 considering its cashflows and debt, suggesting that the company is capable of sustaining future operations in times of crisis. This makes the company even more attractive to investors who are looking for reliable and secure investments. In conclusion, GoodWhale’s analysis of DANAHER CORPORATION’s financials suggests that it is a strong and reliable investment for many different types of investors. Its strong competitive advantage, stable cashflows, and high health score make it an appealing choice for those looking for long-term security and returns. More…

Peers

Danaher Corp is a large company that operates in many different industries. Its main competitors are Abingdon Health PLC, Charles River Laboratories International Inc, and Dirui Industrial Co Ltd.

– Abingdon Health PLC ($LSE:ABDX)

Abingdon Health is a medical technology company that develops, manufactures, and markets diagnostic products and services for the early detection and monitoring of disease. The company has a market capitalization of 8.22 million as of 2022 and a return on equity of -39.58%. Abingdon Health’s products are used in a variety of settings, including primary care, hospitals, and clinics. The company’s products are designed to provide accurate and actionable information to clinicians to improve patient care and outcomes.

– Charles River Laboratories International Inc ($NYSE:CRL)

River Laboratories is a global provider of drug discovery, development and manufacturing services. The company has a market cap of $10.15 billion and a return on equity of 13.86%. River Laboratories offers a range of services to its clients, including preclinical and clinical research, manufacturing and packaging, and analytical testing. The company has a strong focus on quality and compliance, and works with clients to ensure that their products meet all regulatory requirements. River Laboratories is headquartered in Wilmington, Massachusetts.

– Dirui Industrial Co Ltd ($SZSE:300396)

Drui Industrial Co Ltd is a company that manufactures and sells medical devices. The company has a market cap of 6.61B as of 2022 and a ROE of 8.7%. The company’s products include medical equipment, such as X-ray machines, ultrasound machines, and CT scanners. The company also manufactures and sells medical supplies, such as gloves, gowns, and masks.

Summary

Investing in DANAHER CORPORATION is a sound decision as the company has seen impressive growth over the past year. In the fourth quarter of FY2022, total revenue increased by 24.6%, and net income saw a 2.7% year-over-year increase as of December 31 2022. This suggests that the company is performing well and is likely to continue to do so in the future. With strong financials and a focus on innovation and sustainability, DANAHER CORPORATION is an attractive option for investors who are looking for long-term growth potential. The company’s success can be attributed to its strong management team and its commitment to quality and customer satisfaction.

Additionally, its diversified portfolio of products and services and its global presence make it a safe bet for investors.

Recent Posts