YIREN DIGITAL Reports Stellar Quarter with 40% Revenue and 131.1% Net Income Growth Year-Over-Year

June 14, 2023

☀️Earnings Overview

YIREN DIGITAL ($NYSE:YRD)’s total revenue and net income for the first quarter of FY2023, ending March 31 2023, rose 40.0% and 131.1% year over year to CNY 986.3 million and CNY 427.2 million respectively.

Analysis

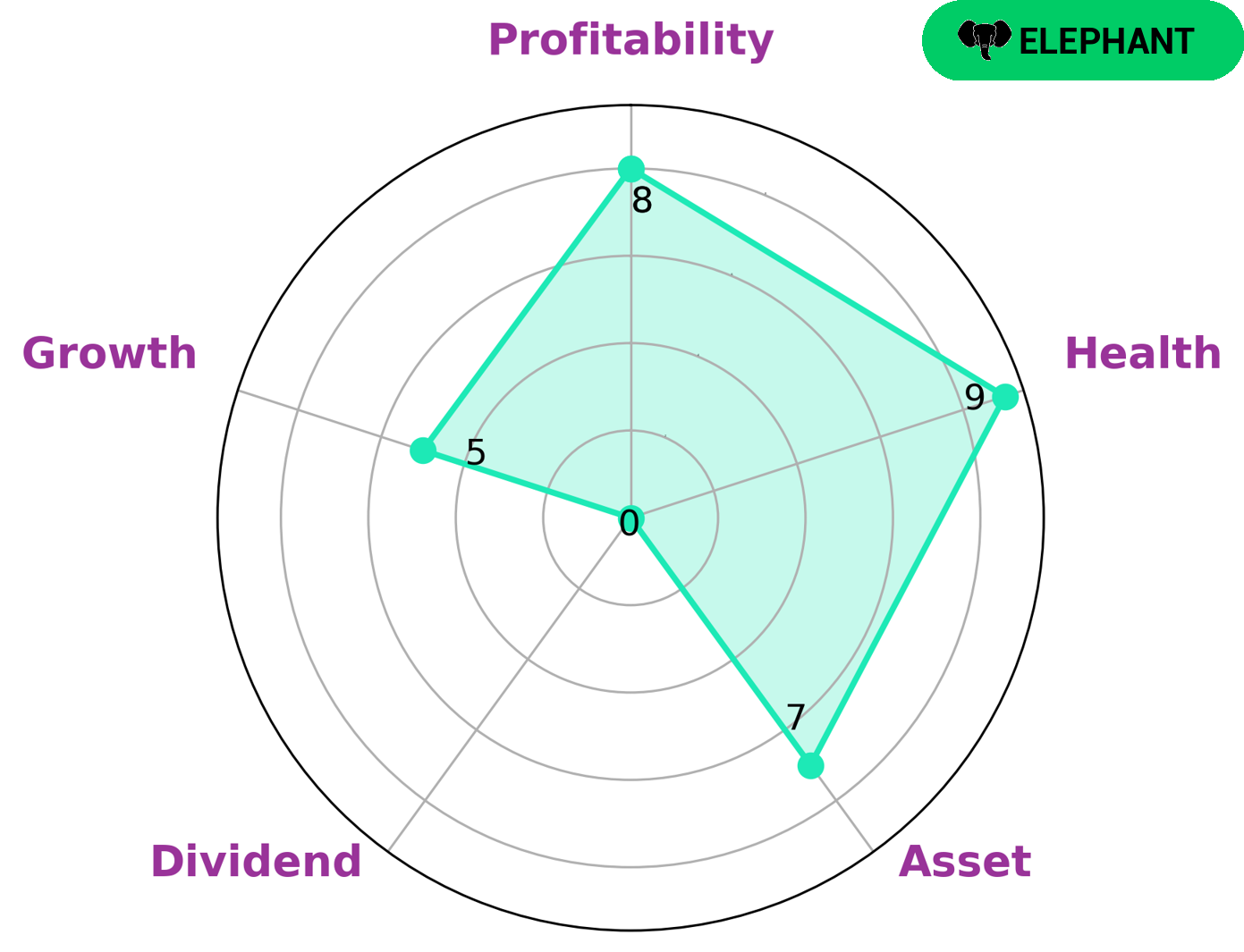

GoodWhale conducted an analysis of YIREN DIGITAL‘s financials and based on Star Chart YIREN DIGITAL has been classified as an ‘elephant’, meaning a company that is rich in assets after deducting off liabilities. This type of company may be of interest to investors looking for stability and low risk. YIREN DIGITAL has been given a high health score of 9/10 with regard to its cashflows and debt, indicating that the company is capable of safely riding out any crisis without the risk of bankruptcy. The analysis has also revealed that YIREN DIGITAL is strong in asset and profitability, medium in growth and weak in dividends. This information should provide investors with a better understanding of the company’s financial strength and how it can serve as an investment opportunity. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Yiren Digital. More…

| Total Revenues | Net Income | Net Margin |

| 3.72k | 1.44k | 38.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Yiren Digital. More…

| Operations | Investing | Financing |

| 1.85k | 52.56 | -489.12 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Yiren Digital. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.6k | 2.15k | 72.75 |

Key Ratios Snapshot

Some of the financial key ratios for Yiren Digital are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -21.4% | 25.3% | 48.1% |

| FCF Margin | ROE | ROA |

| 49.7% | 17.9% | 13.0% |

Peers

The competition between Yiren Digital Ltd and its competitors is fierce. Qudian Inc, FinVolution Group, and Lufax Holding Ltd are all major players in the digital lending space and are constantly innovating to stay ahead of the competition. Yiren Digital Ltd has been able to stay ahead of the pack so far, but it is clear that the competition is not going to let up anytime soon.

– Qudian Inc ($NYSE:QD)

Qudian Inc is a Chinese holding company that operates an online lending platform in China. The company’s platform connects borrowers with lenders and facilitates loans in a quick and convenient manner. Qudian Inc’s market cap as of 2022 is 214.1M, and its ROE is 2.23%. The company operates in the online lending space in China and is one of the leading players in the industry. Qudian Inc has a strong market position and is well-positioned to continue growing its business in the future.

– FinVolution Group ($NYSE:FINV)

As of 2022, FinVolution Group has a market cap of 1.27B and a Return on Equity of 14.08%. The company provides online financial services in China through its subsidiaries. These services include personal loans, small business loans, and merchant cash advances. The company was founded in 2006 and is headquartered in Beijing, China.

– Lufax Holding Ltd ($NYSE:LU)

As of 2022, Lufax Holding Ltd has a market cap of 3.2B and a return on equity of 14.07%. The company is an online finance platform that offers loans, wealth management, and insurance products. It was founded in 2003 and is headquartered in Shanghai, China.

Summary

YIREN DIGITAL has reported strong financials for the first quarter of FY2023, with total revenue of CNY 986.3 million and net income of CNY 427.2 million, both figures representing a significant increase year over year; total revenue rising 40.0% and net income increasing 131.1%. This has been reflected in the stock price, which rose on the same day, suggesting investors are encouraged by the financial results. As a result, YIREN DIGITAL looks attractive from an investing perspective, with investors likely to be drawn to its strong financials and positive outlook.

Recent Posts