Runway Growth Finance Secures $500M Credit Facility Increase

April 19, 2023

Trending News ☀️

Runway Growth Finance ($NASDAQ:RWAY), a leading financial services company, has announced a successful increase of their credit facility to a total of $500M. This is a significant step forward for the company that has become a major player in the financial marketplace. They offer financial advice and services to help business owners reach their goals more quickly and efficiently. This latest increase in their credit facility will allow Runway Growth Finance to continue to provide the highest quality financial services to their clients. The additional resources will allow them to maintain their competitive edge, while providing more options to businesses in need of financing solutions. This increase will also help them take on larger projects and give them a better ability to serve more customers around the world.

The increased credit facility will help Runway Growth Finance continue to provide top-notch financial services to their customers. With this increased capacity, they will be able to provide even more options, while continuing to maintain their commitment to excellence. Their services will continue to help businesses grow and reach their goals in a timely and efficient manner. Runway Growth Finance is poised to remain a leader in the financial services industry for years to come.

Price History

On Tuesday, RUNWAY GROWTH FINANCE (RGF) announced that it has secured an additional $500 million in credit facility from one of its long-term lenders. The additional $500 million credit facility will help RGF in funding some of its high potential growth ventures and continue to give the company a competitive edge in the industry. The company has been investing heavily in new technologies and innovations that have the potential to be game-changing in the long-term.

With the extra funds coming in, RGF is now well positioned to take advantage of any opportunities that might arise in the near future. This increase in its credit facility is a sign of confidence from its lender and is a positive step towards fuelling its growth ambitions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for RWAY. More…

| Total Revenues | Net Income | Net Margin |

| 42.19 | 32.25 | 76.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for RWAY. More…

| Operations | Investing | Financing |

| -359.85 | – | 360.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for RWAY. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.14k | 565.71 | 14.22 |

Key Ratios Snapshot

Some of the financial key ratios for RWAY are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.0% | – | – |

| FCF Margin | ROE | ROA |

| -853.0% | 3.5% | 1.8% |

Analysis

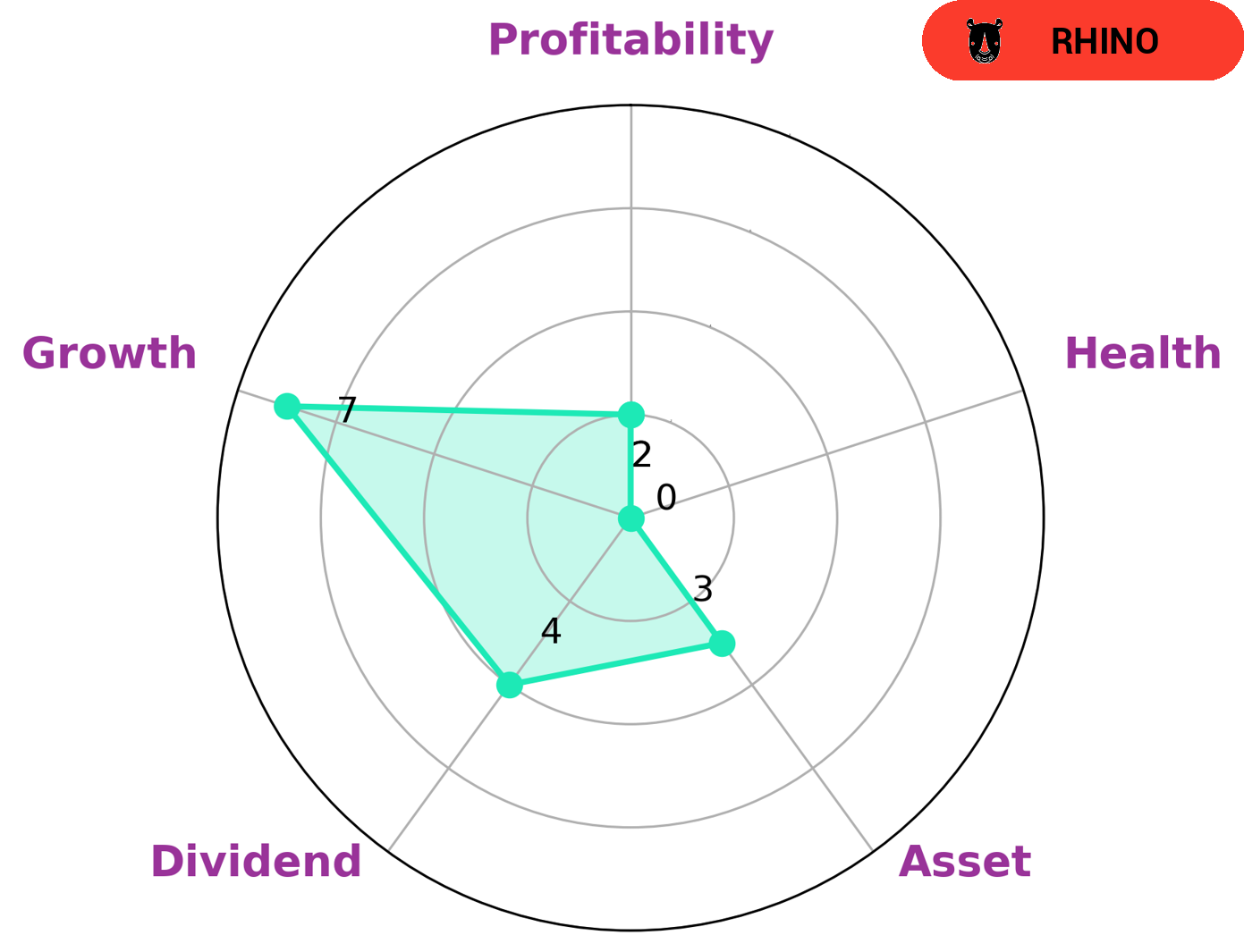

GoodWhale has analyzed RUNWAY GROWTH FINANCE’s financials, and the findings are concerning. Based on our Star Chart, RUNWAY GROWTH FINANCE has a low health score of 0/10 with regard to its cashflows and debt, making it less likely to pay off debt and fund future operations. Furthermore, RUNWAY GROWTH FINANCE is classified as a ‘rhino’, a type of company we conclude has achieved moderate revenue or earnings growth. RUNWAY GROWTH FINANCE is strong in growth, medium in dividend and weak in asset, profitability. This means that it may not be the best choice for investors looking for short-term gains. However, it may be an attractive option for investors looking to invest over a longer period of time in order to potentially benefit from the company’s growth. Investors who are willing to take on a higher risk for higher potential returns would also be interested in RUNWAY GROWTH FINANCE. More…

Peers

Its competitors include Sundaram Finance Ltd, PT Magna Finance Tbk, and PT Clipan Finance Indonesia Tbk.

– Sundaram Finance Ltd ($BSE:590071)

Sundaram Finance Ltd is an Indian non-banking financial company headquartered in Chennai, Tamil Nadu. Sundaram Finance is one of the largest non-banking financial services companies in India with over Rs 1 lakh crore in assets under management. The company offers a range of financial services including two wheeler and four wheeler loans, personal loans, home loans, commercial vehicle loans, SME loans, and agricultural loans.

– PT Magna Finance Tbk ($IDX:MGNA)

Magna Finance Tbk is a leading provider of finance and leasing services in Indonesia. The company offers a wide range of products and services, including consumer and corporate loans, financing for the purchase of motor vehicles, and leasing services. Magna Finance Tbk has a strong focus on providing quality customer service and has a well-established reputation in the Indonesian market. The company has a market cap of 50.15B as of 2022 and a Return on Equity of -21.02%.

– PT Clipan Finance Indonesia Tbk ($IDX:CFIN)

Clipan Finance Indonesia Tbk is one of the largest financial services companies in Indonesia with a market capitalization of 1.4 trillion as of 2022. The company offers a wide range of financial services including banking, insurance, asset management, and investment banking. Clipan Finance Indonesia Tbk has a strong focus on providing services to the retail and small and medium enterprise (SME) segments. The company has a return on equity of 9.09%.

Summary

Runway Growth Finance recently announced the expansion of its existing credit facility by $500M. This increase in capital could potentially provide additional opportunities for the company to finance new initiatives and grow its business. However, the stock price for the company dropped on the same day as the announcement, suggesting that investors may be weary of the impact the extra capital may have on the company’s financial health. Analysts should take this news into consideration in their own assessments of Runway Growth Finance and its ability to achieve long-term success.

Recent Posts