Ufp Industries Stock Intrinsic Value – UFP INDUSTRIES Completes Acquisition of Mexican Packaging Affiliates

December 3, 2023

🌥️Trending News

UFP ($NASDAQ:UFPI) Industries, Inc., a publically traded company listed on the NASDAQ as UFPI, recently announced that it had completed the acquisition of the remaining ownership interests in two of its Mexican packaging affiliates. The affiliates, Packaging Ideas de Mexico, SA de CV and Industrias Agro Forestal de Mexico, SAPI de CV, are based in Mexico and specialize in the production and distribution of corrugated packaging. UFP Industries, Inc. is a leading global manufacturer and supplier of wood and wood-alternative products. The company is based in Grand Rapids, Michigan and has operations around the world. UFPI offers a range of products in the areas of lumber, wood composites, hardwood plywood and veneer, particleboard, poles and pilings, and foam molded packaging.

It also provides services such as sawmill, dry kiln, and saw blade sharpening services. UFPI also has international sourcing operations in Asia, South America, and Africa.

Share Price

On Friday, UFP INDUSTRIES, a leading provider of packaging, components and industrial products, announced that it had completed the acquisition of its Mexican affiliates. The news sent shares of the company soaring as the stock opened at $109.0 and closed at $112.9, up 3.0% from the previous closing price of 109.6. The acquisition is expected to help UFP INDUSTRIES expand its presence in the Mexican market and bolster its global reach. The company also stated that the acquisition will help it further reduce costs, improve efficiency, and enhance customer service. UFP INDUSTRIES has been investing heavily in expanding its operations in Mexico and this acquisition is a testament to the success of those efforts. The acquisition is also expected to benefit UFP INDUSTRIES in terms of global competitiveness and expansion into new markets. With its increased presence in Mexico, the company will be well-positioned to capitalize on the growth of the country’s manufacturing sector.

The acquisition also further solidifies UFP INDUSTRIES’ commitment to its customers and their satisfaction. By continuing to focus on customer service and efficiency, UFP INDUSTRIES can be certain they are doing all they can to provide their customers with the best service available. Overall, the acquisition of its Mexican affiliates marks a major milestone for UFP INDUSTRIES. The move should help the company not only expand its reach within Mexico but also increase its global presence and competitiveness. Investors have responded positively to the news, as evidenced by the stock’s performance on Friday. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ufp Industries. More…

| Total Revenues | Net Income | Net Margin |

| 7.61k | 537.94 | 7.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ufp Industries. More…

| Operations | Investing | Financing |

| 1.01k | -318.77 | -184.78 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ufp Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.02k | 1.05k | 47.99 |

Key Ratios Snapshot

Some of the financial key ratios for Ufp Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.9% | 30.8% | 9.2% |

| FCF Margin | ROE | ROA |

| 10.8% | 15.0% | 10.8% |

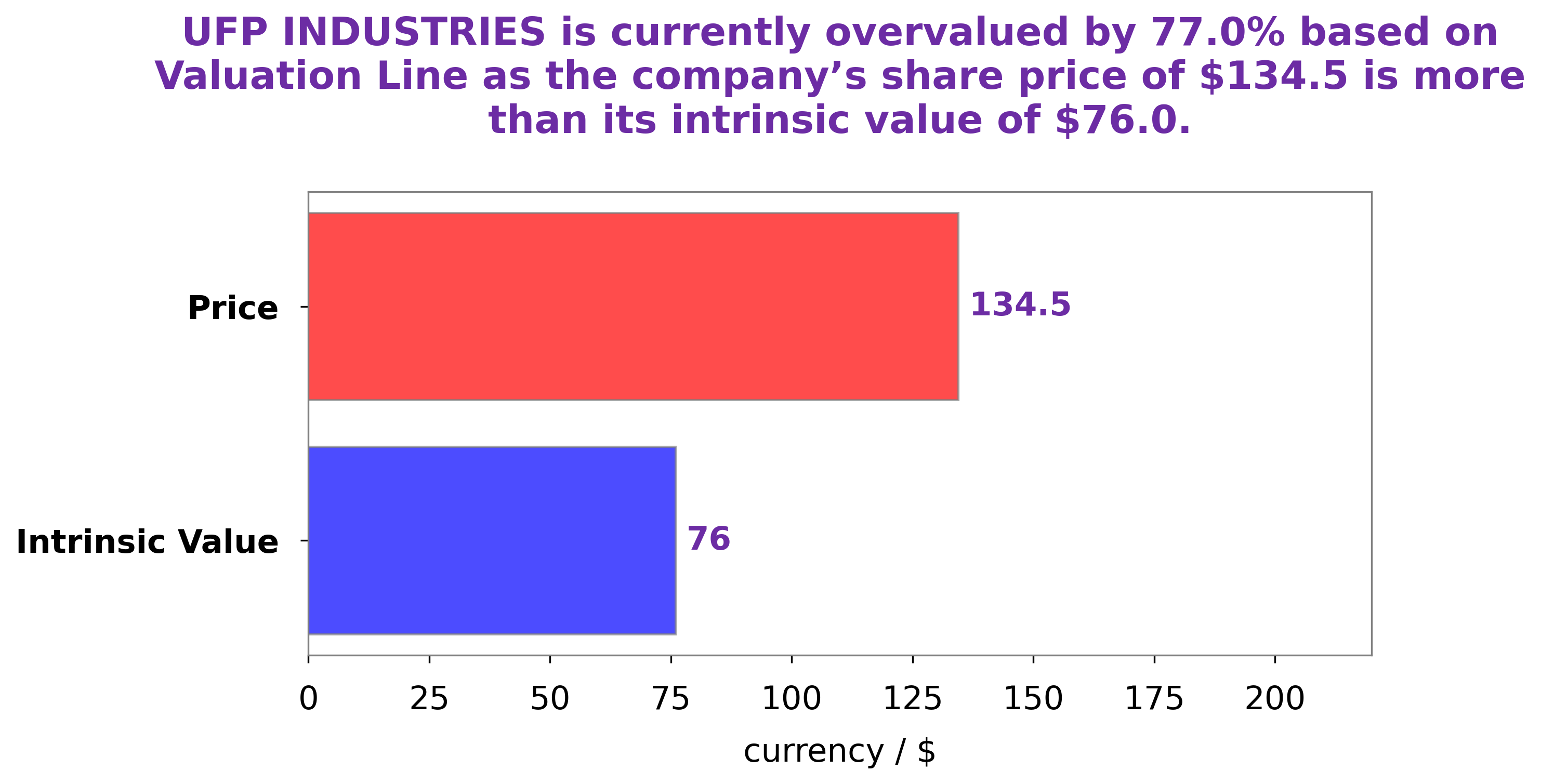

Analysis – Ufp Industries Stock Intrinsic Value

At GoodWhale, we recently conducted an analysis of the financials of UFP INDUSTRIES. After careful consideration, our proprietary Valuation Line indicated that the fair value of UFP INDUSTRIES share is around $75.0. However, at the moment, UFP INDUSTRIES stock is being traded at $112.9, which is overvalued by 50.5%. Our analysis suggests that investors should be cautious when considering investing in UFP INDUSTRIES at this time. More…

Peers

UFP Industries Inc is one of the largest producers of wood products in North America. The company’s competitors include Blue Star Opportunities Corp, Interfor Corp, and West Fraser Timber Co. Ltd.

– Blue Star Opportunities Corp ($OTCPK:BSTO)

Interfor Corp is a Canadian forestry company with operations in British Columbia, Washington state, and Oregon. The company has a market cap of 1.23 billion Canadian dollars as of 2022. The company’s return on equity is 34.77%. Interfor Corp is engaged in the business of growing and harvesting trees, and manufacturing and selling lumber and wood products. The company’s products are used in the construction, industrial, and retail markets.

– Interfor Corp ($TSX:IFP)

As of 2022, West Fraser Timber Co. Ltd. had a market capitalization of $8.54 billion. The company had a return on equity of 26.74%. West Fraser Timber Co. Ltd. is a forest products company that produces lumber, wood chips, and other forest products. The company was founded in 1955 and is headquartered in Vancouver, Canada.

Summary

UFP Industries, Inc., recently made a major move to acquire the remaining ownership interests in two of its Mexican packaging affiliates. This key strategic acquisition has been received positively by investors, as evidenced by a notable rise in UFP’s stock price on the same day of the announcement. UFP Industries’ financials have been quite encouraging in recent years, due to its diversified portfolio of products offering strong growth potential. The company has also been successful in optimizing its cost structure and maintaining healthy cash flows. With the acquisition of these two Mexican affiliates, UFP Industries stands to benefit from a more integrated supply chain, better economies of scale, and increased market presence.

In addition, UFP’s experienced management team is well-positioned to capitalize on the potential of the new acquisitions. Going forward, UFP Industries appears positioned for continued growth and profitability.

Recent Posts