Repligen Corporation to Strengthen Portfolio with Acquisition of FlexBiosys

April 14, 2023

Trending News ☀️

Repligen Corporation ($NASDAQ:RGEN), an integrated bioprocessing partner to the biopharma industry, recently announced its plan to acquire FlexBiosys Inc. through a combination of cash and stock. This move is expected to strengthen Repligen’s product portfolio which currently includes chromatography columns & resins, single-use bioreactors, filtration products, and other bioprocess consumables. Repligen Corporation is a bioprocessing and biologics manufacturing company that provides technologies and products that enable the production of biological drugs. The company has a long history of providing innovative solutions for the bioproduct industry, and its acquisition of FlexBiosys Inc. is likely to further bolster its position as a leader in the sector. The acquisition of FlexBiosys Inc. is expected to help Repligen Corporation expand its suite of products and services.

It will also provide access to a larger customer base, giving Repligen the opportunity to leverage its existing expertise and further grow its revenue. With this acquisition, Repligen will be able to offer a more comprehensive portfolio of products, which will result in improved efficiency and cost savings for customers. Overall, Repligen Corporation’s acquisition of FlexBiosys Inc. is expected to be a mutually beneficial move for both companies as they look to build on their respective strengths to better serve the bioproduct market. The addition of FlexBiosys’s products and expertise to the Repligen portfolio will provide further strength and stability to the company’s business.

Share Price

On Wednesday, REPLIGEN CORPORATION announced that it had reached a definitive agreement to acquire FlexBiosys, Inc., a provider of protein purification and single-use system technologies. In response to the acquisition news, REPLIGEN CORPORATION’s stock opened at $173.4 and closed at $179.7, representing a 5.5% increase from the previous closing price of $170.4. The acquisition is expected to expand the company’s already strong portfolio of bioprocessing products and make them a leader in the space.

With this move, REPLIGEN CORPORATION will have access to FlexBiosys’s technologies, including its PuriKine family of rapid, high-affinity media and its FlowFold single-use chromatography systems. It is hoped that this acquisition will help REPLIGEN CORPORATION increase its presence in the bioprocessing market by allowing them to offer more comprehensive product offerings to their customers. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Repligen Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 801.54 | 185.96 | 19.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Repligen Corporation. More…

| Operations | Investing | Financing |

| 172.08 | -233.24 | -13.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Repligen Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.52k | 613.96 | 34.39 |

Key Ratios Snapshot

Some of the financial key ratios for Repligen Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 43.7% | 75.8% | 27.5% |

| FCF Margin | ROE | ROA |

| 4.8% | 7.4% | 5.5% |

Analysis

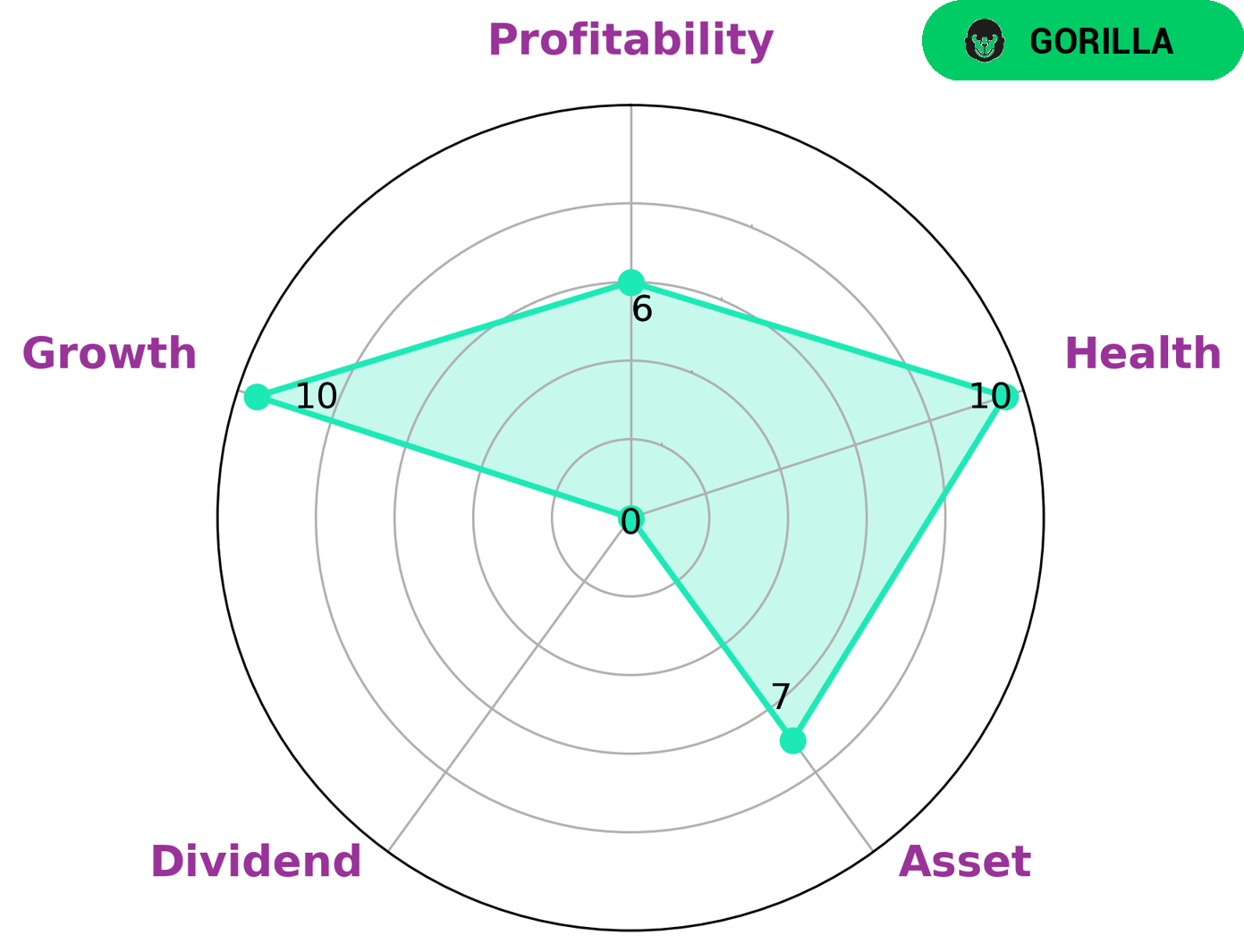

GoodWhale has conducted an analysis of REPLIGEN CORPORATION‘s fundamentals. Our Star Chart shows that REPLIGEN CORPORATION has a high health score of 10/10 with regard to its cashflows and debt, indicating that the company is capable to sustain future operations in times of crisis. We also see that REPLIGEN CORPORATION is strong in asset and growth, medium in profitability and weak in dividend. Based on our analysis, we classify REPLIGEN CORPORATION as a ‘gorilla’, a type of company that we conclude has achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes REPLIGEN CORPORATION attractive to a range of investors, from those looking for reliable cash flow from dividends to those seeking long-term capital growth. Aggressive investors may be interested in finding out more about the opportunities presented by this company. More…

Peers

The company’s products include proteins and antibodies for the treatment of cancer, central nervous system disorders, and infectious diseases. ReGen Biologics Inc, Tecan Group AG, Stevanato Group SPA are all competitors in the market for developing and commercializing therapeutics.

– ReGen Biologics Inc ($OTCPK:RGBOQ)

Regen Biologics, Inc. is a biotechnology company, which focuses on the development, commercialization, and marketing of products in the orthopedic regenerative medicine field. The company’s products include collagen-based scaffolds for use in orthopedic and sports medicine indications. It operates in the United States, Europe, and Asia. The company was founded by David A. Jay and Stephen J. Sacks in 1997 and is headquartered in Laguna Niguel, CA.

– Tecan Group AG ($OTCPK:TCHBF)

Tecan Group AG is a Swiss-based manufacturer of laboratory instruments and solutions for the life sciences sector. The company has a market cap of 4.54B as of December 2020 and a Return on Equity of 6.13%. Tecan Group AG’s products are used in academic and commercial research laboratories, as well as in clinical diagnostic laboratories. The company’s instruments are used for a variety of applications, including drug discovery and development, biopharmaceutical production, food safety testing, and environmental monitoring.

– Stevanato Group SPA ($NYSE:STVN)

Stevanato Group is a leading provider of integrated solutions for the pharmaceutical and biotech industry. The Group offers a complete range of services, from design and development to manufacturing and packaging of finished products. The Group’s products are used in a wide range of therapeutic areas, including cancer, immunology, infectious diseases and neurology.

Summary

Repligen Corporation is an American biotechnology company specializing in the development, manufacture, and commercialization of bioprocessing products used for the production of biologic drugs. It has recently acquired FlexBiosys in a cash-stock transaction, which has positively impacted its stock price as investors have responded positively to the acquisition. Its strong financial performance and strategic acquisitions have made it an attractive investment option for those looking to capitalize on the growth of the biopharmaceutical industry.

Recent Posts