Pontem Corporation to Liquidate by End of May Due to Failed Merger

May 17, 2023

Trending News 🌧️

Pontem Corporation ($NYSE:PNTM), a special purpose acquisition company (SPAC), is expected to be liquidated by the end of May due to the failed merger. Pontem Corporation is a publicly traded company listed on the Nasdaq Global Select Market and was formed to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. Prior to liquidation, Pontem Corporation had become one of the top performing SPACs on the market.

Unfortunately due to the failed merger, Pontem Corporation will no longer exist as a publicly traded company and its shares will be delisted from the Nasdaq Global Select Market. All shareholders who hold the company’s securities will receive distributions from the liquidation.

Stock Price

On Tuesday, PONTEM CORPORATION stock opened at $10.4 and closed at $10.4, up by 0.2% from previous closing price of 10.4. This marks a dramatic reversal for the company that had been seeking to expand its operations in the industry. The merger was seen as a potential game-changer for the company, but unfortunately it did not come to fruition. This news is expected to have a significant impact on the company’s shareholders as well as other stakeholders who have invested in the company.

This development is likely to have far-reaching implications for PONTEM CORPORATION and its operations. With the end of May rapidly approaching, it is highly likely that the company’s liquidation will be completed as planned. This announcement signals the conclusion of an era for PONTEM CORPORATION and its investors, who will now have to consider their options going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pontem Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 0 | 34.84 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pontem Corporation. More…

| Operations | Investing | Financing |

| -1.37 | 0 | 1.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pontem Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 700.22 | 33.15 | 7.73 |

Key Ratios Snapshot

Some of the financial key ratios for Pontem Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | -0.3% | -0.3% |

Analysis

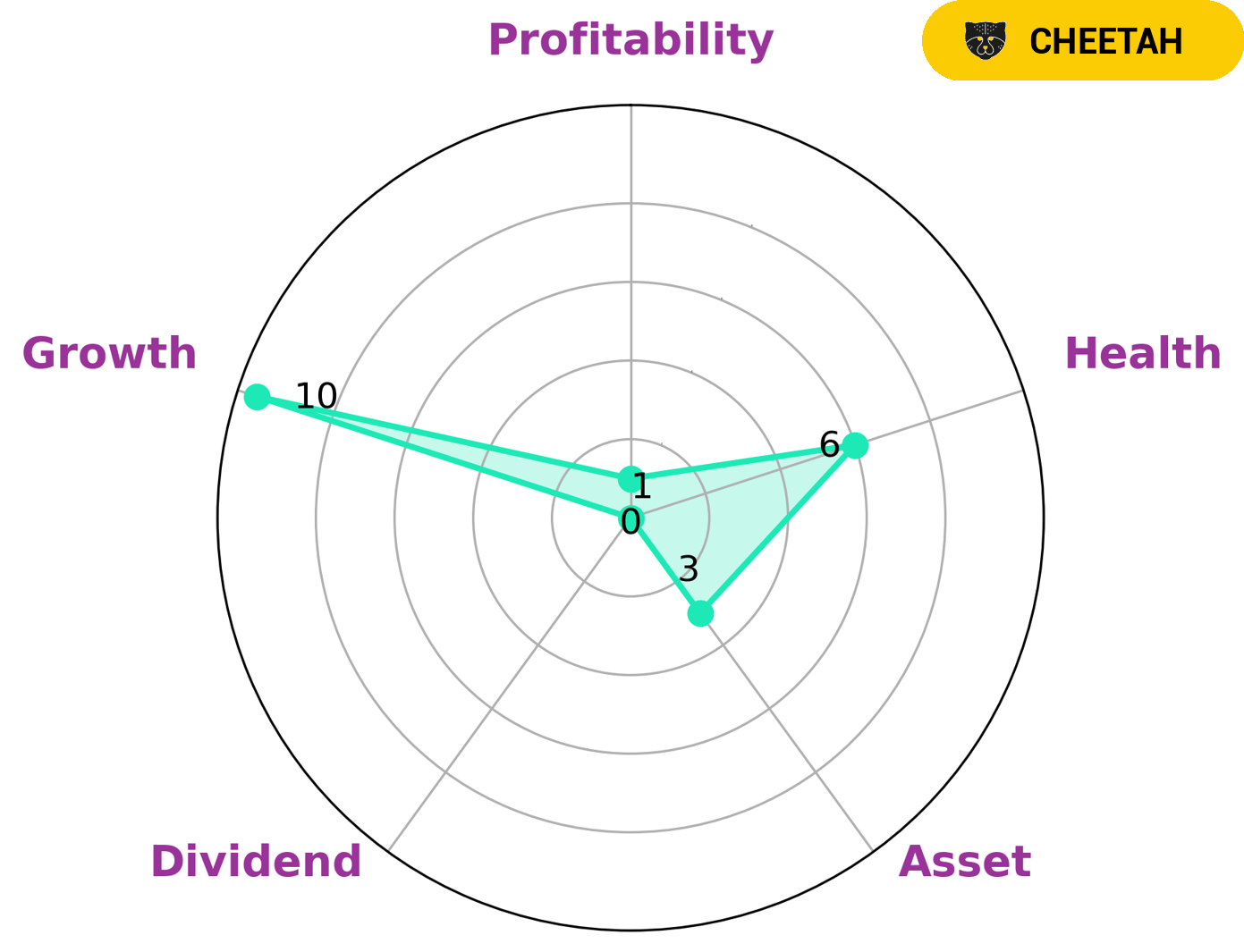

After analyzing PONTEM CORPORATION‘s financials, GoodWhale has classified the company as a ‘cheetah’. This type of company is recognized for having achieved high revenue or earnings growth, but is seen as less stable due to its lower profitability. This makes PONTEM CORPORATION attractive to investors who value high-growth, high-risk investments. GoodWhale has awarded PONTEM CORPORATION an intermediate health score of 6/10. This score is based on its cashflows and debt, and indicates that the company is likely to pay off debt and fund future operations. In addition, PONTEM CORPORATION is particularly strong in growth, but weak in asset, dividend, and profitability. For investors who are interested in companies with a higher risk profile, PONTEM CORPORATION may be a good option. More…

Peers

The corporate world is highly competitive, and Pontem Corp is no exception. In an increasingly crowded marketplace, Pontem Corp must compete with other major players such as HPX Corp, NewHold Investment Corp II and Levere Holdings Corp in order to stay ahead of the competition. All four of these corporations have the resources and skills necessary to drive the industry forward, and this competitive landscape will only become more challenging as the years go on.

– HPX Corp ($NYSEAM:HPX)

HPX Corp is a global financial services provider based in India. The company specializes in providing banking and financial services to individuals, businesses, and institutions. As of 2023, HPX Corp has a market cap of 84.65M, indicating its financial strength and market presence. Additionally, HPX Corp has a Return on Equity of -2.54%, indicating that the company is not generating value for its shareholders. Despite this, the company has continued to expand its operations and remains a key player in the financial services sector.

– NewHold Investment Corp II ($NASDAQ:NHIC)

Hold Investment Corp II is a financial services company based in the United States. The company provides a range of services, including asset management, retirement planning, and financial consulting. As of 2023, Hold Investment Corp II has a market cap of 247.28M, making it one of the larger financial services companies in the country. Its market cap reflects its size, scope of services, and financial performance over the past few years. The company has established itself as a reliable provider of financial services and is well positioned to continue to grow and expand its service offerings in the coming years.

– Levere Holdings Corp ($NASDAQ:LVRA)

Levere Holdings Corp is a diversified financial services company. It provides a wide range of banking and financial services to individuals, businesses, and government entities. The company has a market capitalization of 343.85M as of 2023, which means that it is a large company with a sizable presence in the market. Additionally, Levere Holdings Corp has a Return on Equity of -0.35%, which indicates that it is not performing well compared to its peers. This could be due to the company’s current strategy or market conditions, but overall the company’s performance is not strong.

Summary

Pontem Corporation is a company that has recently been undergoing a potential merger. This presents an interesting investment opportunity for those looking to capitalize on the situation. As a result, it is advisable to conduct due diligence in order to analyze the company and its potential before making any decisions. Possible areas of research include financials such as income statements, balance sheets, and cash flow statements, as well as analyzing current market trends that may affect Pontem’s stock price.

It is also important to look into legal aspects, including any potential liabilities that could arise from the liquidation process. Ultimately, investors must weigh the risks and benefits of making an investment in Pontem Corporation.

Recent Posts