Ouster Stock Fair Value – Ouster’s Reverse Stock Split Approved, Shares Increase

May 12, 2023

Trending News ☀️

On Friday, Ouster ($NYSE:OUST) Inc. announced their approval of a reverse stock split, which saw their shares increase significantly. Ouster is an American lidar technology company that focuses on developing high-resolution sensors and software for self-driving cars and other autonomous systems. The company has been listed on the Nasdaq and is based in San Francisco, California. Despite the increased share price, the total number of shares outstanding decreased as a result of the split. The decision was made to increase the marketability of Ouster’s shares and make them more attractive to investors.

In addition, the reverse split will help Ouster maintain its listing on the Nasdaq and other major exchanges, which could lead to an increase in investor confidence. Overall, the decision to approve a reverse stock split was a smart move for Ouster, as it has already seen an increase in its share price in response to the news.

Price History

On Wednesday, OUSTER’s reverse stock split was approved and it resulted in shares increasing. The stock opened on Wednesday at $4.4 and closed at $4.2, resulting in a 3.2% decrease from the last closing price of 4.3. This reverse stock split is intended to help the company increase its shares and provide additional liquidity to shareholders. It should also stabilize the value of the stock, making it more attractive to investors. Ousters_Reverse_Stock_Split_Approved_Shares_Increase”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ouster. More…

| Total Revenues | Net Income | Net Margin |

| 41.03 | -138.56 | -337.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ouster. More…

| Operations | Investing | Financing |

| -110.69 | -5.15 | 55.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ouster. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 256.14 | 84.52 | 0.93 |

Key Ratios Snapshot

Some of the financial key ratios for Ouster are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 53.2% | – | -330.4% |

| FCF Margin | ROE | ROA |

| -283.0% | -45.0% | -33.1% |

Analysis – Ouster Stock Fair Value

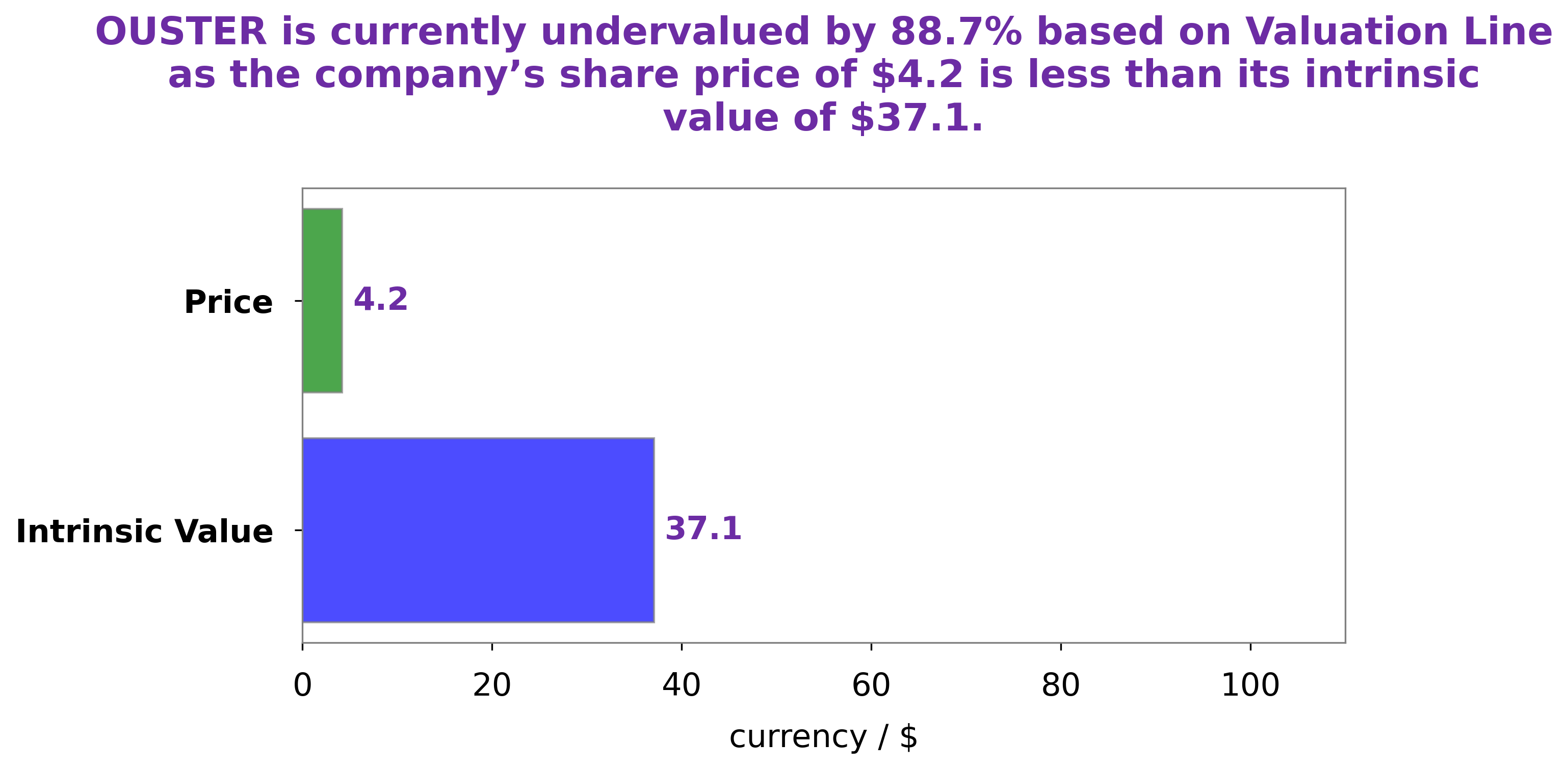

At GoodWhale, we have conducted an analysis of OUSTER’s fundamentals. Our proprietary Valuation Line has calculated the intrinsic value of OUSTER share to be around $37.1. Currently, OUSTER stock is traded at $4.2, indicating that it is undervalued by 88.7%. This means that investors can potentially take advantage of the price discrepancy and make profits from the difference. We advise investors to do their own due diligence and research before investing in OUSTER stock. Ousters_Reverse_Stock_Split_Approved_Shares_Increase”>More…

Peers

In the world of 3D LiDAR sensors, Ouster Inc. is a major player. Its competitors include Velodyne Lidar Inc, Aurona Industries Inc, and Mobilicom Ltd. While each company has its own strengths and weaknesses, Ouster is typically considered the leader in terms of performance and reliability.

– Velodyne Lidar Inc ($NASDAQ:VLDR)

In 2022, Velodyne Lidar Inc had a market cap of 201.76M and a Return on Equity of -45.39%. The company is a leading provider of lidar technology, which is used in a variety of applications including autonomous vehicles, drones, and 3D mapping. Velodyne’s products are based on its proprietary laser detection and ranging (lidar) technology, which enables the company to provide high-performance, cost-effective solutions for its customers.

– Aurona Industries Inc ($TPEX:8074)

Aurora Industries Inc is a leading manufacturer of aircraft parts and components. The company has a market cap of 1.44 billion as of 2022 and a return on equity of 4.32%. Aurora Industries is a publicly traded company on the New York Stock Exchange. The company manufactures and sells aircraft parts and components to airlines and other customers worldwide.

– Mobilicom Ltd ($ASX:MOB)

Mobileicom Ltd is a global provider of mobile communication solutions. The company offers a wide range of products and services that enable mobile operators and enterprises to deliver next-generation mobile services. Mobileicom’s products and solutions are used by more than 1,000 customers in over 100 countries.

The company has a market capitalization of 2.9 million as of 2022. The company’s return on equity is -102.29%. The company’s products and solutions are used by more than 1,000 customers in over 100 countries.

Summary

The stock price reacted negatively to this news, indicating that investors view this move as a dilutive one. It is still unclear how this move will affect OUSTER in the long run, though it could be beneficial by increasing the liquidity of its shares and potentially making them more attractive to institutional investors. It is important for investors to remain watchful of the effects of this move and any future impacts it may have on OUSTER’s performance.

Recent Posts