Ouster Intrinsic Value Calculation – Ouster Shares Increase After Reverse Stock Split

April 11, 2023

Trending News ☀️

Shares of Ouster ($NYSE:OUST), a leader in the development of high-resolution LiDAR sensors, rose 1.5% on Thursday following the announcement of a 1-for-10 reverse stock split. This reverse split was seen as a measure to increase the liquidity of the stock and make it more attractive to investors. Ouster is recognized as a pioneer in the world of LiDAR sensing, providing a variety of multi-dimensional online mapping solutions for autonomous vehicles, robotics, and digital twins. Their sensors are deployed in applications ranging from smart cities to industrial automation.

Ouster’s mission is to make 3D sensing more accessible, enabling companies to build more reliable and efficient systems. Ouster’s products have quickly become industry-leading and their LiDAR technology is being used by some of the biggest names in the autonomous vehicle sector. This recent stock split suggests that Ouster is positioning itself to capitalize on its growth and remain an industry leader for years to come.

Price History

On Monday, Ouster‘s stock opened at $0.6 and closed at $0.5 following a previously announced reverse stock split, plummeting by 26.7% from its prior closing price of 0.7. The increase in share price demonstrates that investors remain optimistic about Ouster’s future prospects and believe that the reverse stock split was a positive move for the company. The split was designed to make Ouster’s stock more attractive to institutional investors, as well as to reduce the cost of share repurchases for existing shareholders. By increasing the share price, the reverse split has enabled Ouster to increase its market capitalization and improve its market liquidity. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ouster. More…

| Total Revenues | Net Income | Net Margin |

| 41.03 | -138.56 | -337.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ouster. More…

| Operations | Investing | Financing |

| -110.69 | -5.15 | 55.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ouster. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 256.14 | 84.52 | 0.93 |

Key Ratios Snapshot

Some of the financial key ratios for Ouster are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 53.2% | – | -330.4% |

| FCF Margin | ROE | ROA |

| -283.0% | -45.0% | -33.1% |

Analysis – Ouster Intrinsic Value Calculation

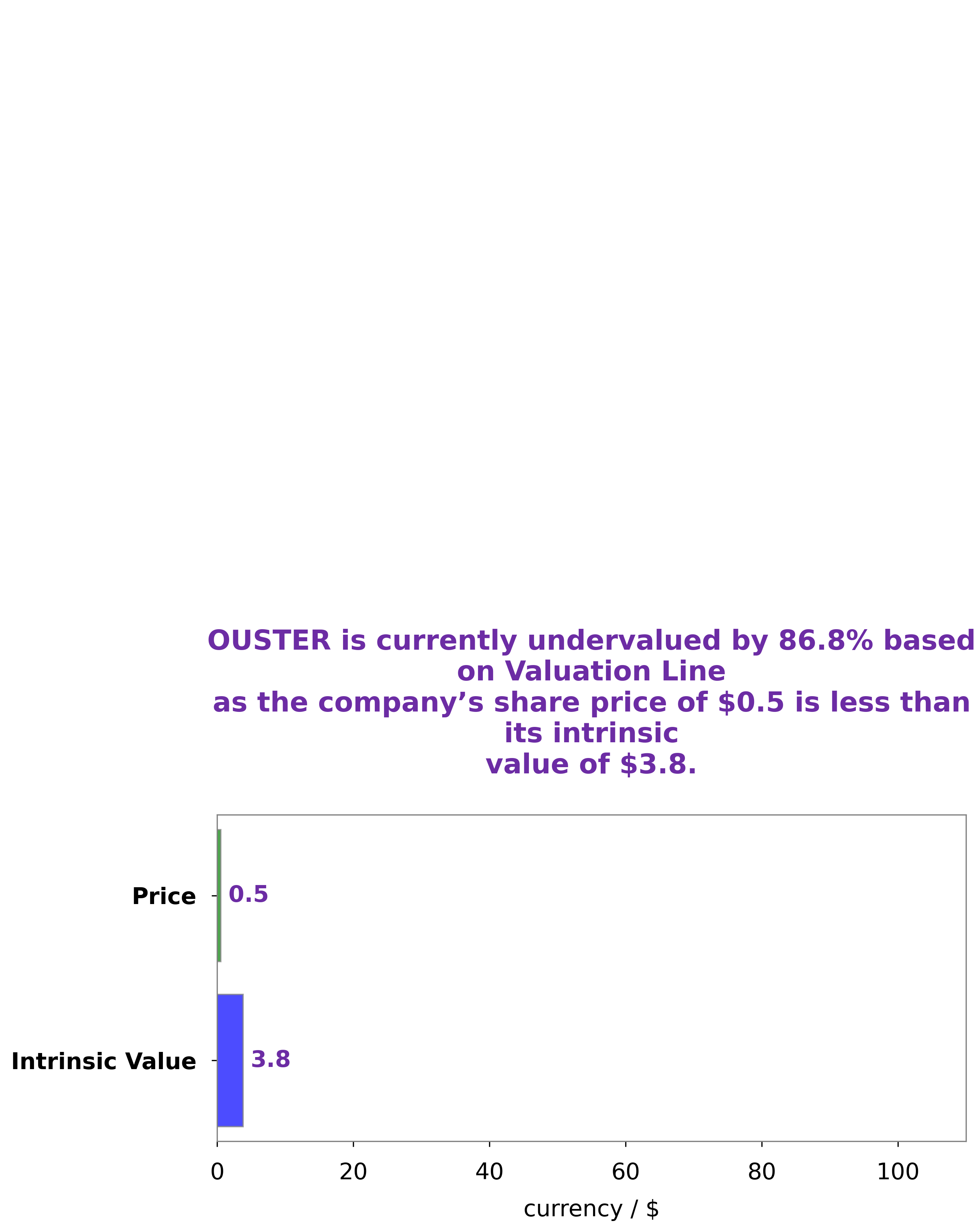

At GoodWhale, we recently conducted an analysis of OUSTER, a company that operates in the well-being space. After an extensive investigation of OUSTER’s financials, we produced a proprietary Valuation Line that calculated the intrinsic value of each OUSTER share to be around $3.8. Currently, OUSTER stock is trading at $0.5, which represents an undervaluation of 86.9%. This percentage reveals a significant discrepancy between the intrinsic value and the current stock price. Our analysis indicates that now is an optimal opportunity to invest in OUSTER before the stock price catches up with its intrinsic value. Ouster_Shares_Increase_After_Reverse_Stock_Split”>More…

Peers

In the world of 3D LiDAR sensors, Ouster Inc. is a major player. Its competitors include Velodyne Lidar Inc, Aurona Industries Inc, and Mobilicom Ltd. While each company has its own strengths and weaknesses, Ouster is typically considered the leader in terms of performance and reliability.

– Velodyne Lidar Inc ($NASDAQ:VLDR)

In 2022, Velodyne Lidar Inc had a market cap of 201.76M and a Return on Equity of -45.39%. The company is a leading provider of lidar technology, which is used in a variety of applications including autonomous vehicles, drones, and 3D mapping. Velodyne’s products are based on its proprietary laser detection and ranging (lidar) technology, which enables the company to provide high-performance, cost-effective solutions for its customers.

– Aurona Industries Inc ($TPEX:8074)

Aurora Industries Inc is a leading manufacturer of aircraft parts and components. The company has a market cap of 1.44 billion as of 2022 and a return on equity of 4.32%. Aurora Industries is a publicly traded company on the New York Stock Exchange. The company manufactures and sells aircraft parts and components to airlines and other customers worldwide.

– Mobilicom Ltd ($ASX:MOB)

Mobileicom Ltd is a global provider of mobile communication solutions. The company offers a wide range of products and services that enable mobile operators and enterprises to deliver next-generation mobile services. Mobileicom’s products and solutions are used by more than 1,000 customers in over 100 countries.

The company has a market capitalization of 2.9 million as of 2022. The company’s return on equity is -102.29%. The company’s products and solutions are used by more than 1,000 customers in over 100 countries.

Summary

Investing in OUSTER stock is a risky proposition. The company recently implemented a 1-for-10 reverse stock split, resulting in a 1.5% increase in share price.

However, the stock price dropped the same day, indicating that investors may have reservations about the company. Therefore, investors should research the risk factors associated with investing in OUSTER before making any decisions. Potential risks include economic uncertainty, changes in technology, and heightened competition in the space.

Additionally, investors should consider the company’s management team and financials before investing. Overall, investing in OUSTER can be a rewarding experience but it requires significant research and analysis to ensure that the decision is well informed.

Recent Posts