NYS Teachers Retirement System Acquires Ready Capital Co. With Purchase of 13159 Shares

January 31, 2023

Trending News ☀️

The New York State Teachers Retirement System (NYS Teachers) has recently acquired Ready Capital ($NYSE:RC) Corporation (Ready Capital) through the purchase of 13159 shares. Ready Capital is a specialty finance company that focuses on originating, acquiring, investing in and managing performing and non-performing mortgage loans, as well as other mortgage-related investments. Ready Capital provides investors with access to a wide variety of real estate-related asset classes, including multifamily and commercial loans, mezzanine debt, and B-notes. Through their strategic partnerships with large banks, mortgage brokers, mortgage servicers, and other originators, they are able to source and manage a diversified portfolio of loans. Ready Capital also offers bridge loans to borrowers who need short-term financing, allowing them to meet their current financial obligations while they pursue more permanent solutions. In addition to their loan origination and investment activities, Ready Capital also provides asset management services.

This includes servicing of loans and other mortgage-related investments, as well as managing capital investments for both institutional and retail investors. They also provide risk management services, such as loan review, underwriting and monitoring of loan portfolios. Through this acquisition, NYS Teachers has gained access to a broad range of real estate products, as well as the expertise of Ready Capital’s management team. The acquisition is expected to be beneficial for both parties involved, allowing NYS Teachers to expand their portfolio of investments while providing Ready Capital with additional capital to continue building upon their success.

Market Price

On Monday, READY CAPITAL stock opened at $12.6 and closed at $12.8, representing a 2.0% increase from the prior closing price of 12.5. This move by the NYS Teachers Retirement System is seen as a major boost for the Ready Capital Co., given the size and importance of the acquisition. With this new influx of capital, the company is expected to have the resources to expand their operations and develop new products and services. The acquisition has been widely seen as a smart move by the NYS Teachers Retirement System. By investing in Ready Capital Co., they are now able to benefit from the company’s potential growth, as well as its current success in the market.

Moreover, this move also provides a safe and secure investment option for members of the retirement system. The additional funds and resources may allow them to explore new businesses and markets, which could result in increased profits for both parties involved. Overall, this purchase of 13159 shares by the NYS Teachers Retirement System is seen as a positive development for Ready Capital Co. By providing them with additional capital, it will allow them to better position themselves in the market and continue to grow their business. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ready Capital. More…

| Total Revenues | Net Income | Net Margin |

| 472.17 | 228.03 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ready Capital. More…

| Operations | Investing | Financing |

| 188.28 | -1.85k | 1.7k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ready Capital. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.86k | 9.88k | 15.4 |

Key Ratios Snapshot

Some of the financial key ratios for Ready Capital are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

VI Analysis

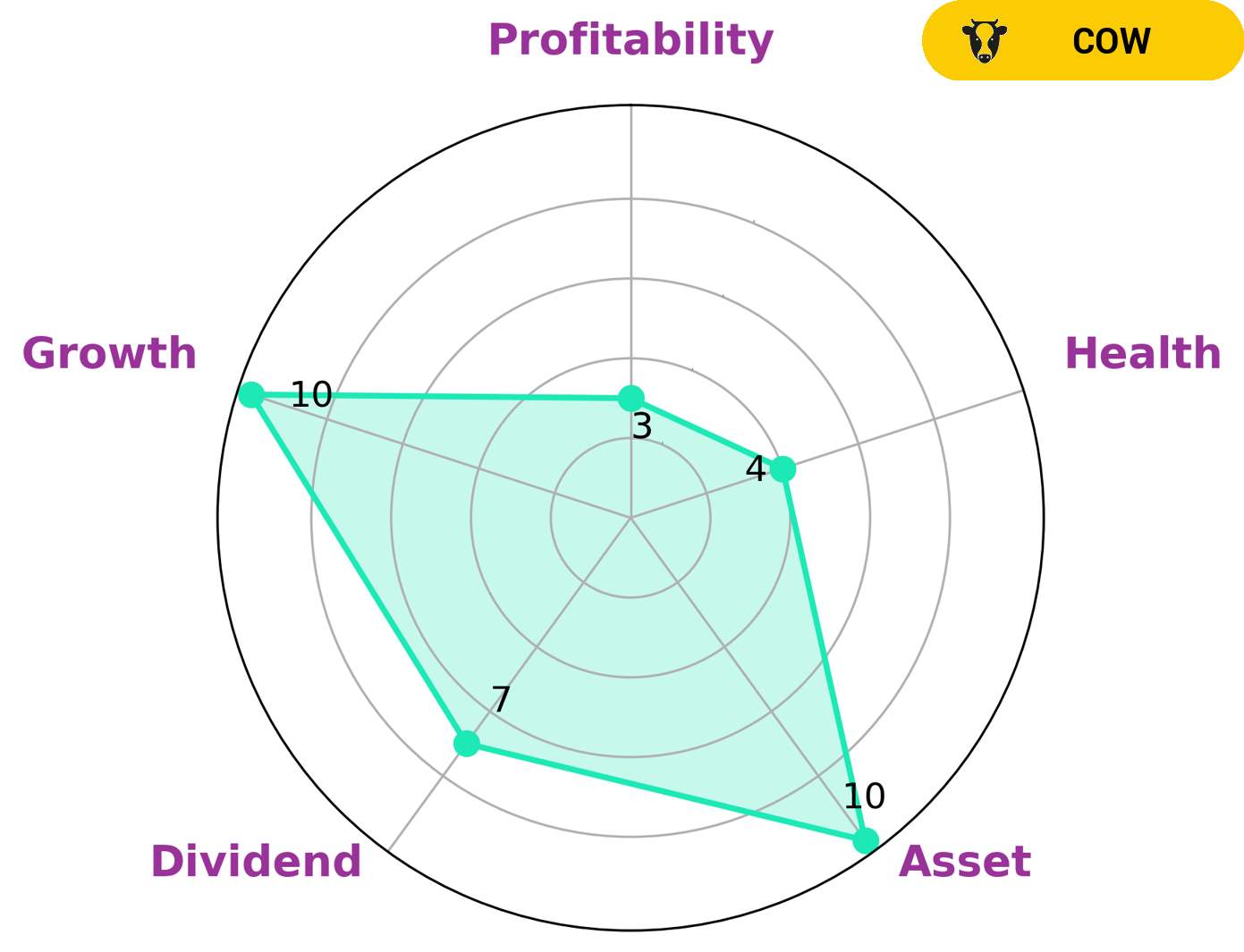

Ready Capital Corporation is classified as a ‘cow’ based on the VI Star Chart, which means it has a track record of paying out consistent and sustainable dividends. This makes it an attractive option for investors seeking a steady source of income, such as retirees and those looking to diversify their portfolios. Ready Capital also has an intermediate health score of 4/10 when it comes to its cashflows and debt, indicating that it is likely to be able to sustain future operations even in the event of a crisis. In terms of its fundamentals, Ready Capital is strong in asset, dividend, and growth, but weak in profitability. The company’s balance sheet reveals that it has a substantial amount of cash on hand and relatively low levels of debt, which is reassuring for potential investors. Additionally, the stock has had a steady increase in its dividend payouts over the years, making it an attractive option for dividend-seeking investors. Overall, Ready Capital Corporation is a company with a solid track record of dividends and a good balance sheet. This makes it a good option for investors looking for steady income with a low risk profile. The company’s fundamentals and performance suggest that it has the potential to be a long-term investment for those seeking consistent returns. More…

VI Peers

In the past decade, the commercial real estate lending landscape has shifted dramatically. New players have emerged and old ones have fallen by the wayside. Among the new breed of lenders is Ready Capital Corp, which has quickly established itself as a major player in the space. Ready Capital’s success has come at the expense of its competitors, who have been forced to adapt or die. Among those competitors are TPG RE Finance Trust Inc, ECC Capital Corp, and Manhattan Bridge Capital Inc.

– TPG RE Finance Trust Inc ($NYSE:TRTX)

TPG RE Finance Trust Inc is a publicly traded real estate investment trust that focuses on originating and acquiring senior loans collateralized by commercial real estate properties. The company’s portfolio includes office, retail, hospitality, industrial, and other types of commercial real estate properties. TPG RE Finance Trust Inc is headquartered in New York, New York.

– ECC Capital Corp ($OTCPK:ECRO)

ECC Capital Corp is a specialty finance company that provides financing solutions to small and medium-sized businesses in the United States. The company has a market cap of $7.81 million as of February 2022. ECC Capital Corp is headquartered in New York, New York.

– Manhattan Bridge Capital Inc ($NASDAQ:LOAN)

Manhattan Bridge Capital Inc is a real estate finance company that originates, services, and manages a portfolio of first mortgage loans. The Company operates in the New York metropolitan area. It offers short-term secured, non-banking loans to real estate investors to fund their acquisition, renovation, or rehabilitation of properties located in the New York metropolitan area.

Summary

Ready Capital Corporation is a specialty finance company that invests in, finances and manages a portfolio of real estate-related investments, including commercial real estate loans, residential mortgage investments, and other real estate investments. Investors are encouraged to research the company and its current financials to make an informed decision regarding potential investments. Additionally, the current sentiment surrounding the company appears to be overwhelmingly positive. Ready Capital is an attractive investment opportunity for those seeking to diversify their portfolios with real estate-related assets and receive potential returns on their investments.

Recent Posts