Mercer Global Advisors ADV Acquires Stake in Melco Resorts & Entertainment

June 1, 2023

☀️Trending News

Mercer Global Advisors Inc. ADV has recently announced their entry into Melco Resorts & Entertainment ($NASDAQ:MLCO), confirming in a filing with the Securities & Exchange Commission that they have taken a new stake in the company. Melco Resorts & Entertainment is an international entertainment, hospitality and gaming company, with its headquarters in Hong Kong and listed on the Nasdaq. It is one of the world’s leading resorts and entertainment providers, owning and operating casino facilities in Macau, the Philippines, Cyprus, and the United States.

Additionally, Melco offers integrated resort services from a range of world-class hotel brands, dining and entertainment, as well as retail outlets. Its resorts feature a variety of gaming experiences including table games, slots, electronic gaming machines, and sports betting. Melco is committed to the sustainability and responsible operation of their resorts, focusing on environmental conservation and responsible gambling. They aim to create memorable experiences for their guests and are dedicated to creating positive benefits for their local communities. By acquiring a stake in Melco, Mercer Global Advisors Inc. ADV has indicated their desire to support the continued success of this dynamic international entertainment and hospitality company.

Stock Price

Despite the news of the acquisition, the stock opened at $11.2 and closed at $10.8, representing a 2.8% decrease from the previous closing price of 11.1. This decrease came despite the positive news that the company was now backed by an institutional investor. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MLCO. More…

| Total Revenues | Net Income | Net Margin |

| 1.59k | -828.53 | -52.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MLCO. More…

| Operations | Investing | Financing |

| -619.43 | -806.11 | 1.78k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MLCO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.76k | 9.36k | -2.49 |

Key Ratios Snapshot

Some of the financial key ratios for MLCO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -32.7% | 27.2% | -36.2% |

| FCF Margin | ROE | ROA |

| -78.0% | 36.9% | -4.1% |

Analysis

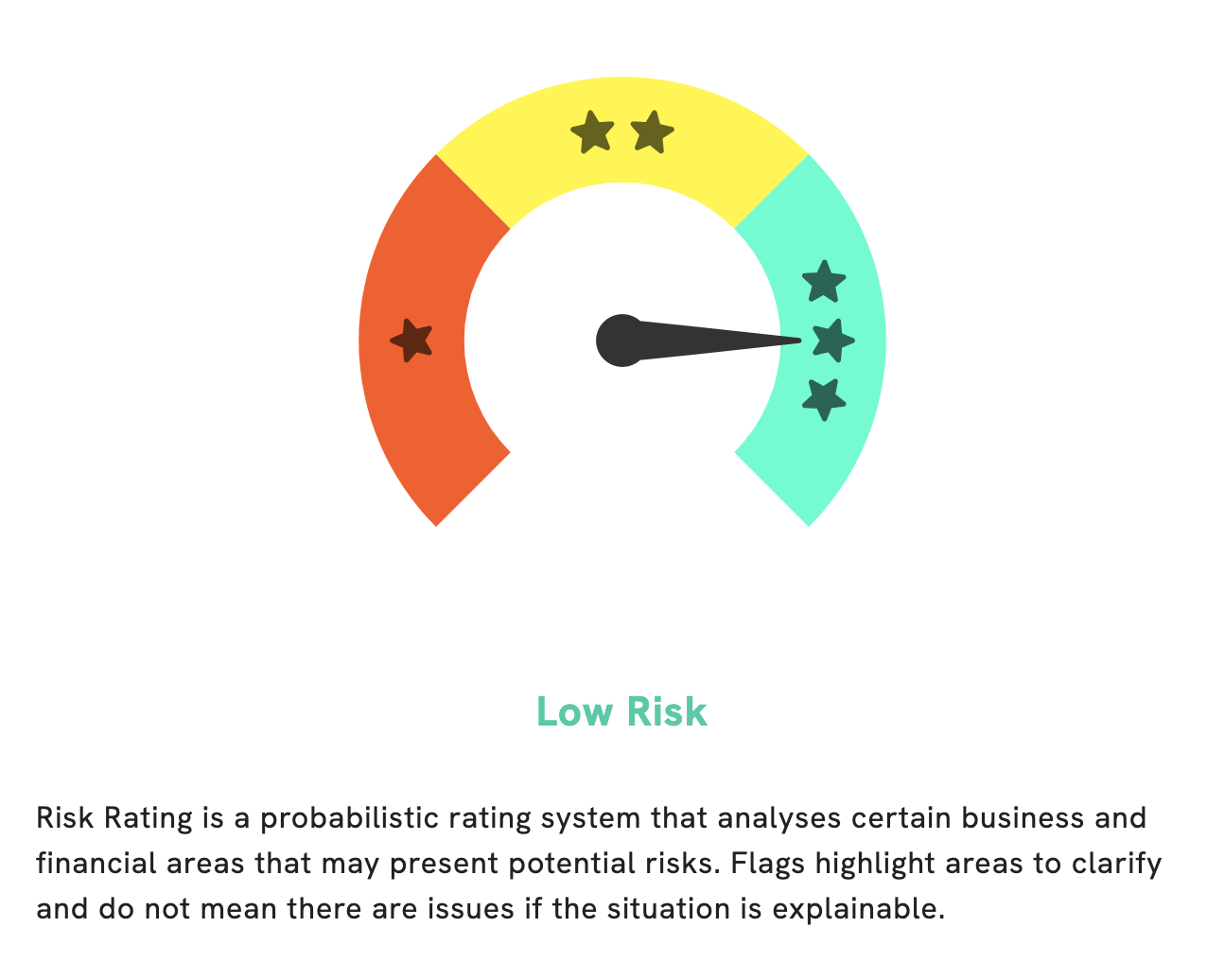

At GoodWhale, we believe that investing in companies should be done responsibly. That’s why we made it our mission to provide investors with comprehensive, data-driven analyses of the sustainability and wellbeing of companies. Our analysis of MELCO RESORTS & ENTERTAINMENT revealed that, based on its Risk Rating, it is a low risk investment in terms of financial and business aspects. However, we did detect one risk warning in the company’s balance sheet that investors should take note of. If you’d like to know more about this risk, please register with us to get more information. More…

Peers

Each of these companies has its own unique strengths and strategies to stay ahead of the game, creating a dynamic and intense competition between them.

– Las Vegas Sands Corp ($NYSE:LVS)

Las Vegas Sands Corp is an American casino and resort company based in the US state of Nevada. It is the parent company of the Venetian Casino Resort and the Sands Expo and Convention Center, among other properties. The company has a market cap of 36.73B as of 2022, which is a reflection of its market presence and business performance. Additionally, its Return on Equity (ROE) stands at -11.56%, indicating that it is not performing well in terms of generating shareholder value. Las Vegas Sands Corp is a leader in the gaming and hospitality industry, and it continues to be a major player in Las Vegas, Macau, and other international markets.

– Wynn Resorts Ltd ($NASDAQ:WYNN)

Wynn Resorts Ltd is a global hospitality and entertainment company, operating integrated resorts in Las Vegas, Macau, and other parts of the world. As of 2022, the company has a market capitalization of 9.34 billion dollars and a return on equity of 27.93%. This suggests that the company is performing relatively well and is able to generate a healthy return on the capital it has invested. The company has positioned itself as an international leader in the hospitality and entertainment industry, with a focus on providing high-quality experiences for its guests. The strong financial performance of the company indicates that its strategies are working and that it is well-positioned for future growth.

– MGM Resorts International ($NYSE:MGM)

MGM Resorts International is a leading global hospitality and entertainment company, based in Las Vegas, Nevada. The company operates a portfolio of destination resort brands including Bellagio, MGM Grand, Mandalay Bay, The Mirage, Park MGM, and New York-New York. With a market cap of 12.88 billion USD as of 2022, the company’s stock has been performing well in the market with a Return on Equity (ROE) of 20.62%. This indicates a strong financial performance and suggests that the company is utilizing its equity to generate profits and add value to its shareholders.

Summary

Melco Resorts & Entertainment has recently been targeted by Mercer Global Advisors Inc. ADV as a potential investment opportunity. Analysis of the company reveals that it is an international developer and operator of integrated resorts, gaming and entertainment in Asia. It operates in Macau, the Philippines, and Japan, providing attractive options for investors looking to capitalize on the potential for further growth in the Asia Pacific region.

Melco Resorts also offers various services such as hospitality, retail and leisure, catering, gaming and entertainment facilities, which makes it a promising investment with a diversified portfolio of businesses. With a strong financial track record and a well-established presence in Asia, Melco Resorts is poised to continue to deliver strong returns to investors.

Recent Posts