MACOM Technology Solutions Acquires OMMIC SAS for €38.5M, Gaining Access to 3-inch and 6-inch Wafer Production Lines in 2023.

February 3, 2023

Trending News ☀️

MACOM ($NASDAQ:MTSI) Technology Solutions is a leading provider of semiconductor solutions that enable the world’s most advanced and innovative electronics. They specialize in the development and manufacture of RF, microwave, millimeter wave, and photonic semiconductor components and subsystems. Their products are used in a wide range of applications, from automotive to industrial to medical. The company has recently acquired the assets and operations of OMMIC SAS, based in Limeil-Brévannes, France, through one of its French subsidiaries for an approximate total consideration of €38.5M. OMMIC is currently running a 3-inch wafer production line and has recently installed a 6-inch line, although it is not yet in use. The acquisition of OMMIC is part of MACOM’s ongoing strategy to expand their product portfolio and capabilities across the globe.

It will also enable them to better serve their customers with a wider range of products and capabilities. The addition of OMMIC’s wafer production lines will help MACOM expand its presence in the European market, which is one of the largest markets for semiconductor products. The acquisition strengthens their ability to provide their customers with high-quality products and services to meet their needs. It will also allow them to better serve their customers with a wider range of products and capabilities.

Stock Price

The reaction to the news has been mostly positive with many industry experts praising the move. The acquisition is expected to expand the company’s existing capabilities and allow them to better compete in the semiconductor market.

However, the news had a negative effect on MACOM Technology Solutions’ stock. On Thursday, their stock opened at $68.5 and closed at $66.5, down by 2.9% from the previous closing price of 68.5. Market analysts have suggested that the stock price could be affected by the current market conditions, as well as investor uncertainty about how the acquisition will affect the company’s financials in the long run. Investors will be watching closely to see how this acquisition affects MACOM Technology Solutions in the coming years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MTSI. More…

| Total Revenues | Net Income | Net Margin |

| 675.17 | 439.95 | 65.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MTSI. More…

| Operations | Investing | Financing |

| 176.98 | -182.86 | -28.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MTSI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.57k | 729.07 | 8.51 |

Key Ratios Snapshot

Some of the financial key ratios for MTSI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.6% | -16.4% | 36.6% |

| FCF Margin | ROE | ROA |

| 22.3% | 26.0% | 9.8% |

Analysis

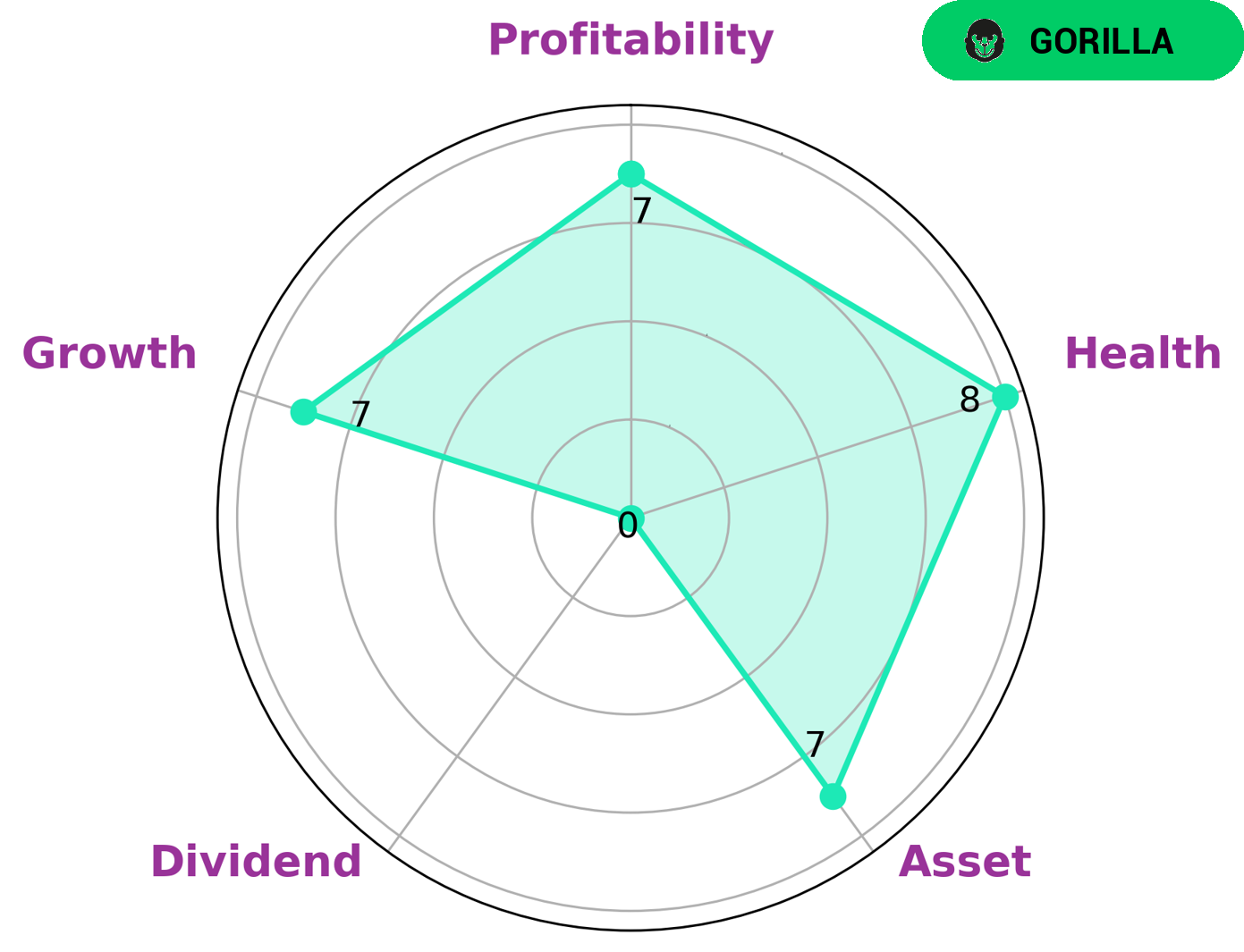

GoodWhale’s analysis shows that the company has strong assets, growth, and profitability, while weak in dividend. Additionally, MACOM TECHNOLOGY SOLUTIONS has a high health score of 8/10, indicating that it is capable of sustaining future operations in times of crisis. Furthermore, the company is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to a strong competitive advantage. For investors who wish to purchase stocks in MACOM TECHNOLOGY SOLUTIONS, they should consider the company’s fundamentals and its classification as a ‘gorilla’. This suggests that investors should look for long-term growth potential in the company, as well as its ability to withstand economic downturns. Furthermore, investors should look for signs that the company’s competitive advantage is sustainable over time. This can be done by looking at the company’s financial statements and capital structure, as well as its management team and strategies. In conclusion, MACOM TECHNOLOGY SOLUTIONS is an attractive option for investors who are looking for long-term growth potential and the ability to withstand economic downturns. Investors should consider the company’s fundamentals and its classification as a ‘gorilla’ before investing in it. By doing so, investors can ensure that they are making an informed decision that is best suited to their investing goals. More…

Peers

The semiconductor industry is intensely competitive, with companies vying for market share in a number of key areas. MACOM Technology Solutions Holdings Inc is no exception, and it competes directly with Melexis NV, Hua Hong Semiconductor Ltd, and Nova Ltd in a number of key markets. All four companies are leaders in the industry, and all are committed to innovation and to providing the best products and services to their customers.

– Melexis NV ($BER:MEX)

Melexis NV is a publicly traded semiconductor company with a market capitalization of 3.34 billion as of 2022. The company’s return on equity, a measure of profitability, was 28.95% in that same year. Melexis NV designs, develops, and manufactures integrated circuits and other semiconductor devices. Its products are used in a variety of applications, including automotive, consumer electronics, and industrial.

– Hua Hong Semiconductor Ltd ($SEHK:01347)

Hua Hong Semiconductor Ltd is a world-leading semiconductor foundry that offers advanced technologies and services for a wide range of applications. The company’s market cap as of 2022 is $34 billion, and its ROE is 9.22%. Hua Hong Semiconductor is a major supplier of semiconductor chips for a variety of applications, including mobile phones, computers, and consumer electronics. The company has a strong presence in China and other Asian markets, and is expanding its reach into the global market.

– Nova Ltd ($NASDAQ:NVMI)

Nova Ltd is a leading provider of integrated engineering solutions in the Asia-Pacific region. The company has a market cap of 2.48B as of 2022 and a ROE of 19.83%. Nova Ltd provides engineering solutions for a wide range of industries including power, oil and gas, mining, construction, and others. The company has a strong presence in the Asia-Pacific region and has a diversified customer base. Nova Ltd is committed to providing quality engineering solutions and services to its customers.

Summary

MACOM Technology Solutions has recently acquired OMMIC SAS for a value of €38.5M, granting the company access to 3-inch and 6-inch wafer production lines in 2023. This investment is seen positively by the media, and has sparked interest from investors. MACOM Technology Solutions is a US-based semiconductor company that produces products for radio frequency, microwave, millimeterwave, and photonic applications.

The company has a broad range of products for a wide variety of markets, including wireless networks and medical imaging. The company has seen strong growth in recent years and is expected to continue its success in the coming years.

Recent Posts