Lantheus Holdings Acquires Cerveau Technologies to Access Lead Asset MK-6240 for Alzheimer’s Disease Treatment.

February 7, 2023

Trending News ☀️

On Monday, Lantheus Holdings ($NASDAQ:LNTH), a biopharmaceutical company that develops and commercializes innovative diagnostic and therapeutic products, announced the acquisition of Cerveau Technologies. Cerveau Technologies is a leader in the field of molecular imaging, providing innovative imaging solutions for the development of therapies for Alzheimer’s disease and other cognitive disorders. Through this deal, LNTH has obtained Cerveau’s lead asset, MK-6240 – a positron emission tomography imaging agent that targets Tau tangles in Alzheimer’s disease – in addition to an upfront payment, with potential additional milestone payments. The acquisition of Cerveau Technologies’ asset MK-6240 gives Lantheus Holdings a much-needed boost to its portfolio. MK-6240 provides an interesting opportunity to develop therapies for Alzheimer’s disease and other cognitive disorders. The new imaging agent has the potential to be used in both preclinical and clinical studies to monitor the efficacy of Alzheimer’s disease treatments.

The acquisition of Cerveau Technologies is also a strategic move for Lantheus Holdings, as it allows them to access a range of new technologies and expertise to further expand their research and development capabilities. The new asset will give LNTH access to Cerveau’s existing customer base, as well as their existing collaborations with major pharmaceutical companies. This will give LNTH a competitive edge in the development of therapies for Alzheimer’s disease and other cognitive disorders. Lantheus Holdings is a publicly traded company on the Nasdaq stock exchange. This latest acquisition is expected to be a substantial contributor to LNTH’s growth in the near future, with potential additional milestone payments, as well as access to new technologies and expertise.

Market Price

The news was met with mostly positive reception and the stock opened on Monday at $60.8 and closed at $60.0, down by 1.3% from its previous closing price. The company is dedicated to providing innovative products and services to improve patient outcomes. The acquisition is expected to be beneficial for both companies. Cerveau Technologies will benefit from the access to Lantheus Holdings’ extensive resources, while Lantheus Holdings will benefit from the expertise of Cerveau Technologies in developing new treatments for Alzheimer’s disease.

In addition, the acquisition will give Lantheus Holdings access to MK-6240, which is currently in Phase II clinical trials and could potentially be a breakthrough treatment for Alzheimer’s disease. The acquisition is viewed positively by analysts and investors alike, as it could potentially open up new opportunities for both companies. The acquisition also marks a major milestone in Lantheus Holdings’ strategy to expand its portfolio of treatments and services for cardiovascular, neurological, and other diseases. It remains to be seen if this acquisition will bring positive results for both companies, but the news so far has been met with mostly positive reception. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lantheus Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 801.46 | 107.04 | 13.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lantheus Holdings. More…

| Operations | Investing | Financing |

| 190.32 | -16.37 | -8.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lantheus Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.1k | 457.89 | 9.27 |

Key Ratios Snapshot

Some of the financial key ratios for Lantheus Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 32.5% | 45.4% | 21.0% |

| FCF Margin | ROE | ROA |

| 21.5% | 17.4% | 9.6% |

Analysis

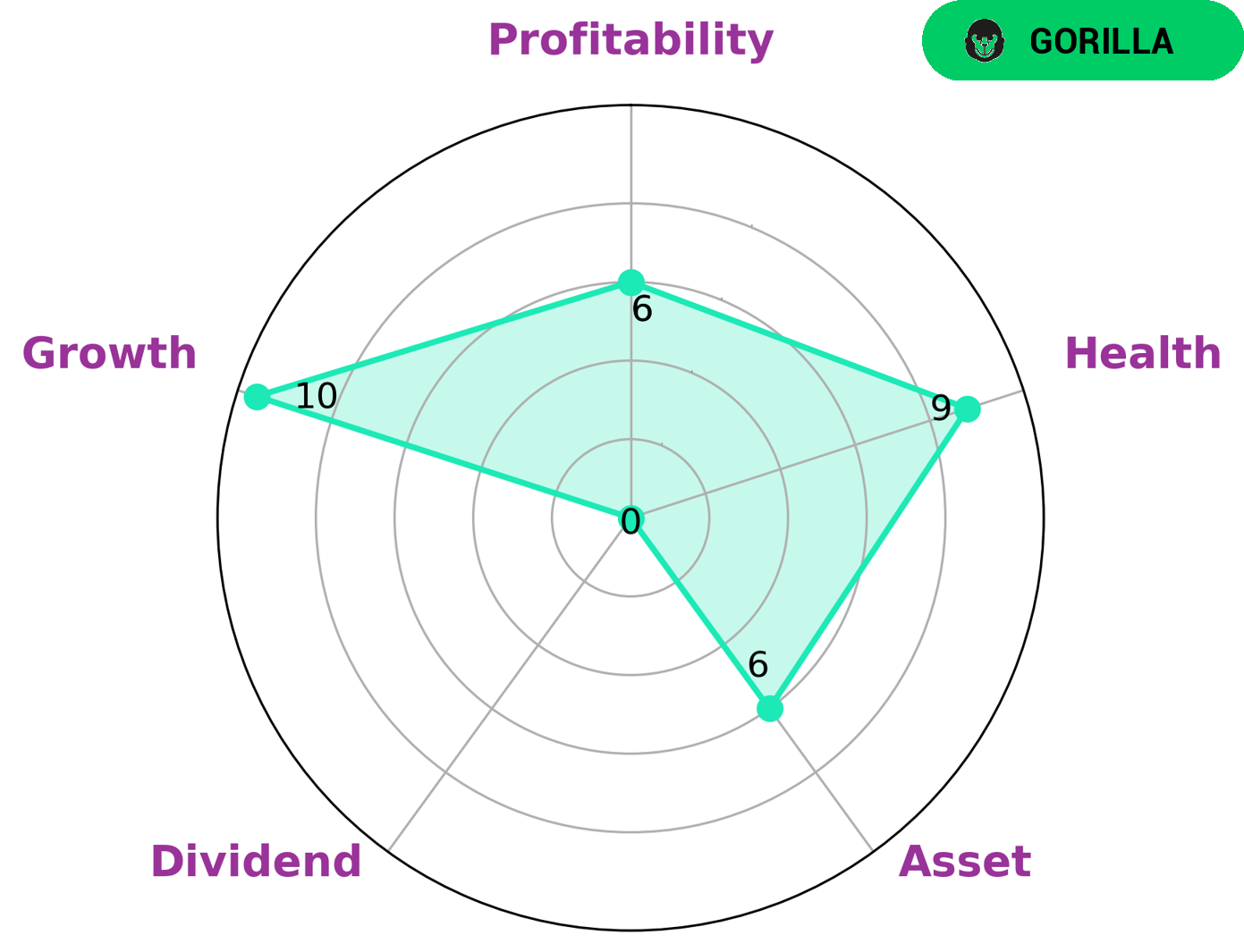

GoodWhale’s evaluation of LANTHEUS HOLDINGS‘ fundamentals has revealed that the company is strong in growth, medium in asset, profitability and weak in dividend. This is reflected in the Star Chart which rates the company as a ‘gorilla’ – a type of company which has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given the company’s strength in growth, LANTHEUS HOLDINGS is likely to be attractive to investors who are looking for long-term returns. These investors may include those who are seeking capital appreciation from stocks or those investing in a diversified portfolio looking for companies with strong fundamentals. In addition, LANTHEUS HOLDINGS has a high health score of 9/10 with regard to its cashflows and debt. This indicates that the company is capable of safely riding out any crisis without the risk of bankruptcy, making it attractive to conservative investors who are risk-averse. Overall, LANTHEUS HOLDINGS appears to be a strong investment opportunity for a variety of investors. It’s strength in growth and its ability to weather any economic storms makes it an attractive option for investors who are looking for long-term returns and those who are risk-averse. More…

Peers

The company operates through two segments, Diagnostic Imaging and Therapeutic Imaging. The Diagnostic Imaging segment provides contrast media products and related services used in diagnostic imaging procedures. The Therapeutic Imaging segment provides nuclear imaging products and services used in molecular and nuclear medicine procedures. Lantheus Holdings Inc’s competitors include RadNet Inc, Akumin Inc, and Todos Medical Ltd. RadNet Inc is a provider of outpatient diagnostic imaging services in the United States. Akumin Inc is a provider of diagnostic imaging services in the United States and Canada. Todos Medical Ltd is a biotechnology company that develops and commercializes blood tests for the early detection of cancer.

– RadNet Inc ($NASDAQ:RDNT)

RadNet, Inc. is a national provider of freestanding, fixed-site outpatient diagnostic imaging services in the United States. As of December 31, 2020, RadNet operated a network of 284 outpatient imaging centers located in California, Delaware, Maryland, Massachusetts, New Jersey, New York and Virginia. RadNet’s core business is providing high-quality diagnostic imaging services, including magnetic resonance imaging (MRI), computed tomography (CT), positron emission tomography (PET), nuclear medicine, mammography, ultrasound, digital x-ray, diagnostic radiology and fluoroscopy, at its outpatient imaging centers.

– Akumin Inc ($NASDAQ:AKU)

Akumin Inc is a holding company that, through its subsidiaries, provides outpatient diagnostic imaging services in the United States. It operates through the following segments: Imaging Centers and Mobile Imaging. The Imaging Centers segment consists of fixed-site imaging centers that provide magnetic resonance imaging, computed tomography, positron emission tomography, nuclear medicine, mammography, ultrasound, general x-ray, and diagnostic cardiology services. The Mobile Imaging segment acquires, leases, and operates mobile imaging equipment that provides magnetic resonance imaging, computed tomography, ultrasound, and general x-ray services. The company was founded on December 12, 2005 and is headquartered in Dallas, TX.

– Todos Medical Ltd ($OTCPK:TOMDF)

Todos Medical Ltd has a market cap of 19.09M as of 2022, a Return on Equity of 43.06%. The company is engaged in the business of providing diagnostic products and services for the early detection, diagnosis and prognosis of cancer and other diseases. The company’s products and services include blood tests, tissue tests and imaging services. The company’s blood tests are used to detect the presence of cancer cells in the blood, while its tissue tests are used to detect the presence of cancer cells in the tissue. The company’s imaging services are used to detect the presence of cancer cells in the body.

Summary

Lantheus Holdings has recently acquired Cerveau Technologies, a move that signals their interest in developing treatments for Alzheimer’s disease. The primary asset of the acquisition, MK-6240, has the potential to be a breakthrough in the industry. Investors should be aware that Lantheus Holdings is taking a proactive approach to the health and wellness sector, and this is likely to be a positive move in the long term.

Furthermore, the company’s financials are strong, with healthy cash flow and a solid balance sheet. Therefore, investors should consider Lantheus Holdings as an attractive investment opportunity.

Recent Posts