KINGSOFT CLOUD CEO Boosts Confidence with 2M Share Purchase

June 12, 2023

☀️Trending News

Kingsoft Cloud ($NASDAQ:KC), a leading public cloud service provider headquartered in Beijing, has seen its CEO, Lei Jun, purchase 2 million of its shares in a show of confidence. The purchase signals Jun’s strong faith in the company which is the leading cloud player in China. Jun’s stake in the company has become increasingly important as he extends his personal investment into the business. By investing in the company, he is committing to helping Kingsoft Cloud reach its full potential. The purchase of 2 million shares highlights his commitment to the company and its mission. It offers everything from cloud storage and computing services to application development and security solutions.

The company has seen significant growth in recent years, with its share price more than quadrupling in the past year. The purchase of 2 million shares by Jun not only highlights his commitment to Kingsoft Cloud and its mission but also boosts investor confidence in the company. It signals that the CEO has faith in its long-term prospects and recognizes that it is well-positioned to capitalize on the massive growth of cloud computing in China and beyond. This is sure to encourage more investors to get involved in the company and its stock.

Stock Price

On Friday, KINGSOFT CLOUD announced that its CEO, Wang Wei, has purchased 2 million shares of the company, boosting confidence in the stock and sending it soaring. At the open, KINGSOFT CLOUD stock opened at $5.5 and closed at $5.2, which is a 7.7% increase from the previous closing price of $4.8. Wang’s purchase is seen as a strong affirmation of his faith in the company’s future, and the stock reacted by rallying accordingly. Analysts have long been bullish on KINGSOFT CLOUD, citing its powerful suite of cloud services and its strong platform for enterprise customers. Wang’s purchase is seen as further proof that KINGSOFT CLOUD is well-positioned to take advantage of the rising trend of digital transformation across many industries.

The company has been actively investing in research and development and expanding its product offerings, all of which could prove beneficial to shareholders in the long run. Wang’s purchase of KINGSOFT CLOUD shares has provided a much needed lift to the stock price, and further proves that the company has a lot of potential ahead. With the stock now trading at 7.7% higher than before, the outlook for KINGSOFT CLOUD appears brighter than ever. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kingsoft Cloud. More…

| Total Revenues | Net Income | Net Margin |

| 7.87k | -2.71k | -31.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kingsoft Cloud. More…

| Operations | Investing | Financing |

| 543.6 | 811.57 | -1.15k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kingsoft Cloud. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.56k | 7.6k | 34.94 |

Key Ratios Snapshot

Some of the financial key ratios for Kingsoft Cloud are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.5% | – | -32.8% |

| FCF Margin | ROE | ROA |

| -11.4% | -19.0% | -9.8% |

Analysis

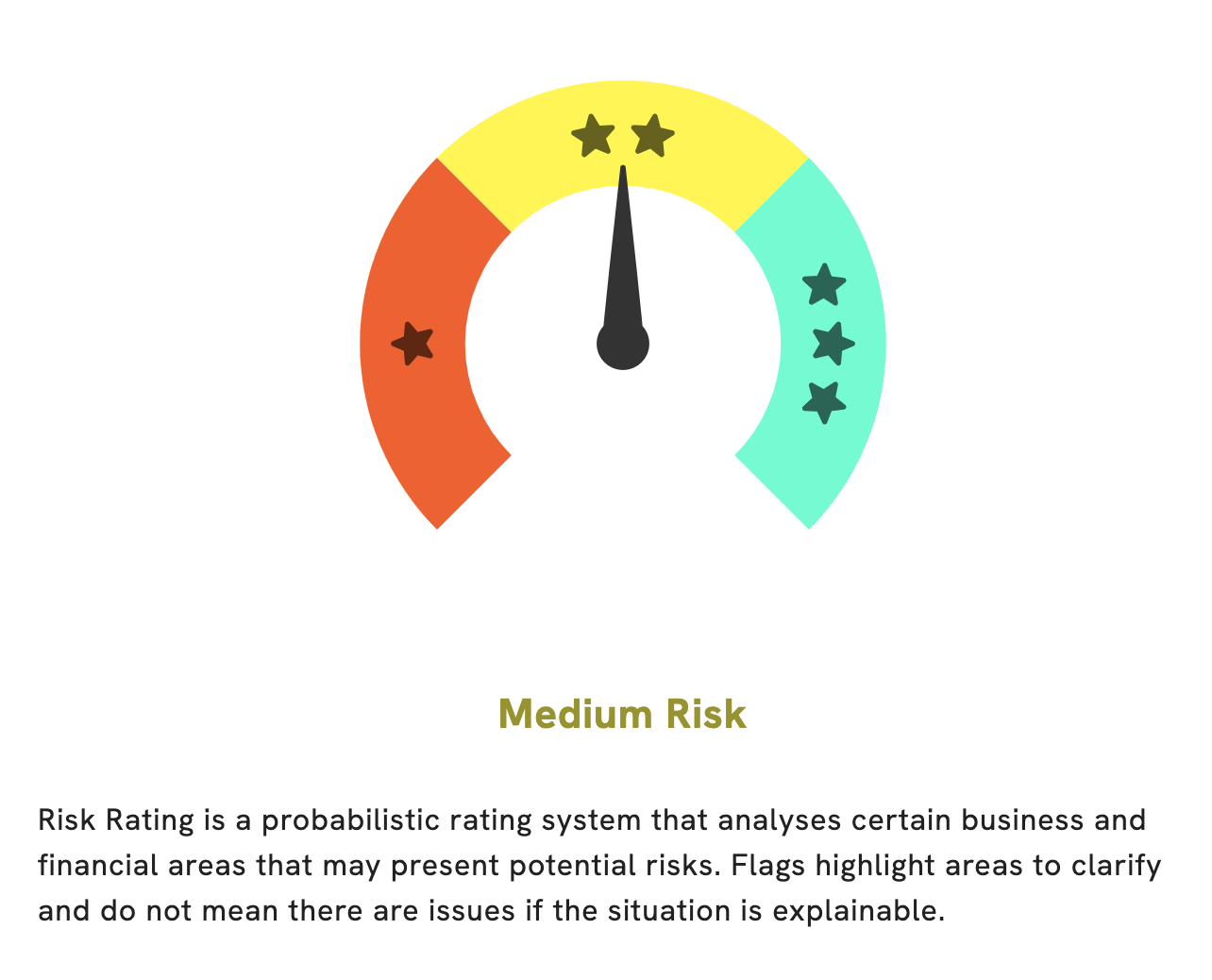

GoodWhale recently conducted an analysis of KINGSOFT CLOUD‘s wellbeing. Based on our Risk Rating, KINGSOFT CLOUD is a medium risk investment in terms of financial and business aspects. However, we did detect 2 risk warnings in the balance sheet and cashflow statement. For more information on these risks, please register on our website goodwhale.com where you can access the full report. We believe that KINGSOFT CLOUD is a viable investment option, however, it is important to remain aware of the potential risks associated with it. We recommend that you thoroughly research KINGSOFT CLOUD before making any decisions. Our website offers detailed information and analysis, so please do take the time to explore what we have to offer. More…

Peers

Kingsoft Cloud Holdings Ltd is a cloud services company that offers public cloud services to businesses and individual customers. The company operates in China and Hong Kong. Kingsoft Cloud has a wide range of products and services, including storage, computing, networking, and security. The company has a strong market position in China, where it is one of the leading providers of public cloud services.

Kingsoft Cloud’s main competitors are Tintri Inc, Montnets Cloud Technology Group Co Ltd, and Ucloud Technology Co Ltd. These companies are also providers of public cloud services in China.

– Tintri Inc ($OTCPK:TNTRQ)

Tintri Inc is a data storage company that offers products and services for virtualization, cloud computing, and application management. It has a market cap of 675.02k as of 2022 and a return on equity of 116.12%. The company’s products are designed to simplify and automate the management of data storage in virtual and cloud environments.

– Montnets Cloud Technology Group Co Ltd ($SZSE:002123)

Montnets Cloud Technology Group Co Ltd is a Chinese cloud computing company with a market cap of 8.78B as of 2022. The company’s Return on Equity (ROE) is -4.37%. Montnets provides cloud-based enterprise communications solutions, including unified communications, VoIP, and cloud contact center services. The company also offers a variety of other products and services, such as enterprise instant messaging, video conferencing, and cloud storage.

– Ucloud Technology Co Ltd ($SHSE:688158)

As of 2022, Ucloud Technology Co Ltd has a market cap of 5.66B and a Return on Equity of -11.13%. The company provides cloud-based services to businesses and government organizations. Its services include Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and software as a service (SaaS).

Summary

Investors of Kingsoft Cloud should be encouraged by the recent news of CEO, Yunchuan Xiong, purchasing 2 million shares of the company. This has caused the stock price to surge that day, indicating that the executive team has confidence in the future of the company. Analysts have suggested that this move signals Kingsoft Cloud’s potential for growth, as well as possible future opportunities.

Furthermore, this could mean that the company has a strong outlook for profitability even in the long-term. Investors should keep an eye on developments regarding the company, as the executive team’s actions can serve as a barometer for performance.

Recent Posts