Investment Advisors Trust Acquires Lamb Weston Holdings,

January 30, 2023

Trending News ☀️

Investment Advisors Trust (IAT) has recently acquired Lamb Weston ($NYSE:LW) Holdings, Inc., a leading frozen potato product company. Lamb Weston provides a variety of premium potato products, such as fries, tots, and mashed potatoes, to restaurants, retailers, and foodservice operators worldwide. The acquisition gives IAT a significant stake in the booming frozen potato industry and will enable it to capitalize on the tremendous growth potential of this sector. Over the years, it has grown to become one of the world’s largest and most successful frozen potato product companies. Lamb Weston has consistently been one of the top performers in the frozen potato industry. Its products are widely recognized for their top-notch quality, reliable supply chain management, and commitment to sustainability.

With IAT’s acquisition of Lamb Weston, the company stands to gain additional access to capital and resources, enabling it to further expand its operations and continue to develop innovative products and services. The acquisition of Lamb Weston by Investment Advisors Trust is a major step forward for both companies. The acquisition will allow IAT to diversify its investments and gain exposure to the highly profitable frozen potato industry. On the other hand, Lamb Weston will benefit from IAT’s expertise and resources, allowing it to take its business to even greater heights.

Market Price

Investment Advisors Trust announced the acquisition of Lamb Weston Holdings, Inc. on Monday and the news has been met with mostly positive media coverage. As a result of the acquisition, Lamb Weston stock opened at $97.2 and closed at $96.1, down by 0.4% from the prior closing price of 96.6. The acquisition of Lamb Weston will enable Investment Advisors Trust to gain a foothold in the lucrative potato products industry and expand its portfolio of investments. The stock market reaction to the acquisition was largely positive, with only a slight dip in share price. This indicates that investors believe that the acquisition will be beneficial for both companies in the long run.

The addition of Lamb Weston to Investment Advisors Trust’s portfolio is expected to bring in a steady stream of revenue and profits and generate significant returns over time. The acquisition of Lamb Weston is the latest example of Investment Advisors Trust’s commitment to diversifying its investment portfolio and seeking out new opportunities for growth. This acquisition is likely to be just the beginning of a long and fruitful relationship between the two companies. Investment Advisors Trust is confident that the acquisition will be beneficial for both companies in the long run and will help them to continue to be successful in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lamb Weston. More…

| Total Revenues | Net Income | Net Margin |

| 4.51k | 473.6 | 10.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lamb Weston. More…

| Operations | Investing | Financing |

| 498.6 | -473.9 | -240.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lamb Weston. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.57k | 4k | 3.98 |

Key Ratios Snapshot

Some of the financial key ratios for Lamb Weston are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.6% | -0.3% | 15.5% |

| FCF Margin | ROE | ROA |

| 2.7% | 80.6% | 9.6% |

VI Analysis

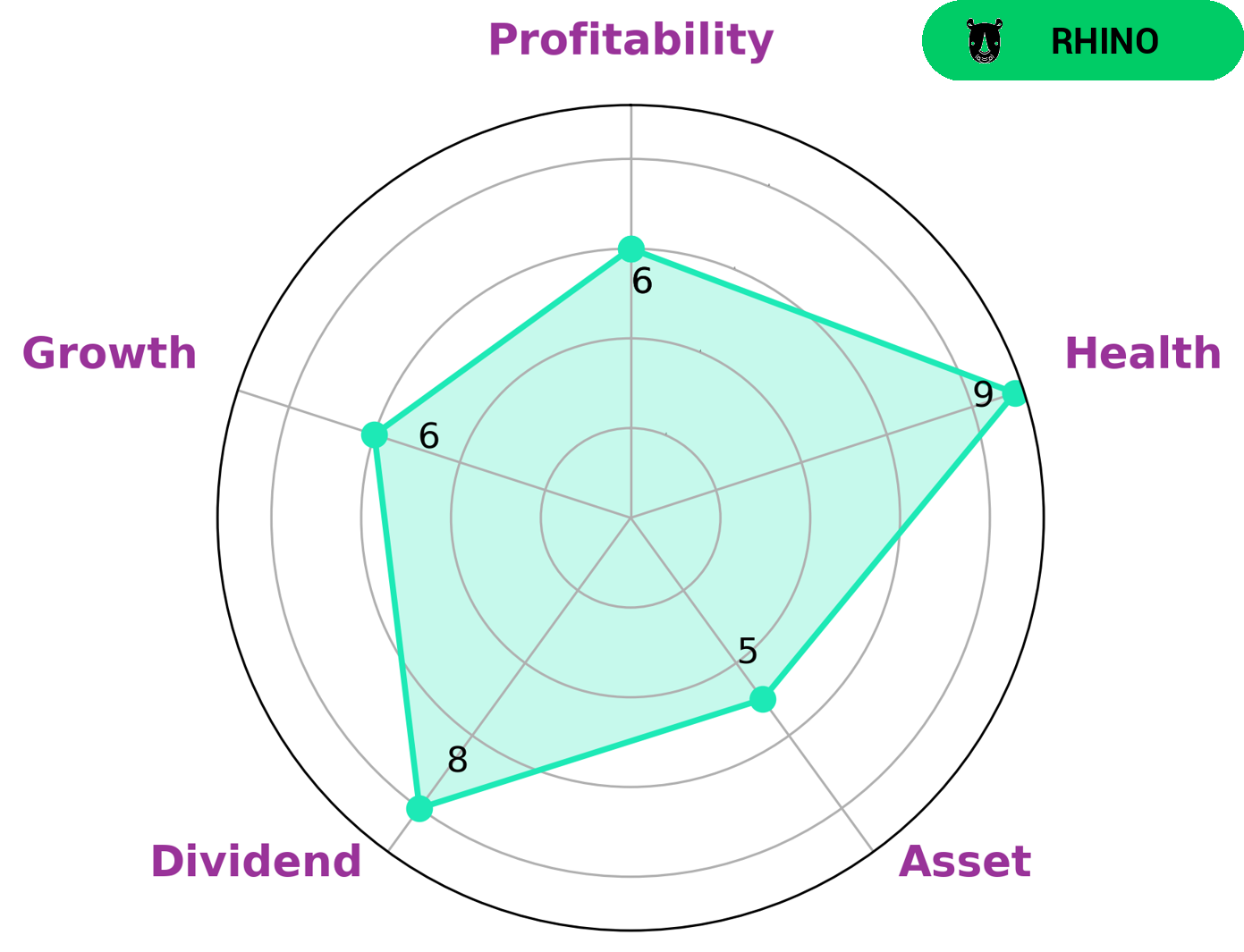

According to VI app, the company has a high health score of 9/10, indicating it is capable of sustaining future operations even in times of crisis. The company is classified as ‘rhino’, which implies moderate revenue or earnings growth. Investors interested in LAMB WESTON should be aware that the company is strong in dividend and medium in asset, growth, and profitability. In terms of cash flow, LAMB WESTON’s cash flow position is strong and its current ratio is also good. The company also has a low debt to equity ratio, meaning it is not heavily reliant on debt financing. Additionally, it has low liabilities and a relatively low debt-to-assets ratio. All of these indicate that the company has a good balance sheet and can handle financial stress. Furthermore, LAMB WESTON has a good track record of income growth over the past few years. This can be seen in its high return on equity and return on assets. Additionally, the company has a low payout ratio, indicating that its dividend payments are sustainable. This makes LAMB WESTON an attractive option for income investors. Overall, LAMB WESTON is a company with strong fundamentals that suggest long term potential. It has high health score, low debt to equity ratio, low liabilities, good income growth, and a low payout ratio. All of this make LAMB WESTON an attractive option for investors looking for a reliable dividend payer. More…

VI Peers

Its main competitors are Tyson Foods Inc, Pilgrims Pride Corp, and Beyond Meat Inc. All three companies are large, publicly traded companies with a significant presence in the US food industry.

– Tyson Foods Inc ($NYSE:TSN)

Tyson Foods is an American multinational corporation based in Springdale, Arkansas, that operates in the food industry. The company was founded in 1935 by John W. Tyson and is currently one of the world’s largest processors and marketers of chicken, beef, and pork. Tyson Foods also produces a wide variety of prepared foods, and is a major exporter of poultry products.

Tyson Foods has a market capitalization of $24.45 billion as of 2022. The company’s return on equity is 18.58 percent. Tyson Foods is one of the world’s largest processors and marketers of chicken, beef, and pork. The company also produces a wide variety of prepared foods.

– Pilgrims Pride Corp ($NASDAQ:PPC)

Pilgrims Pride Corporation is an American poultry company based in Greeley, Colorado. Founded in 1947, it is the second-largest poultry company in the United States and the largest in Mexico. The company has more than 40,000 employees and operates over 50 facilities in the United States and Mexico.

– Beyond Meat Inc ($NASDAQ:BYND)

As of 2022, Beyond Meat Inc has a market cap of 975.39M and a ROE of 5821.1%. The company produces and sells plant-based meat products. The products are made from pea protein, rice protein, and mung bean protein. Beyond Meat’s products are sold in grocery stores, restaurants, and online. The company has a strong presence in the United States and Canada. Beyond Meat is a publicly traded company on the Nasdaq Stock Exchange.

Summary

Investing analysis of Lamb Weston Holdings, Inc. has been largely positive since Investment Advisors Trust acquired the company. The company is a global leader in frozen potato, sweet potato, appetizer, and vegetable products and has a strong portfolio of retail and foodservice brands. Lamb Weston has a track record of generating consistent returns for investors due to its focused strategies and cost management initiatives. Furthermore, Lamb Weston has been successful in expanding its global presence by focusing on new markets such as Asia Pacific, Latin America, and Europe.

Additionally, the company has increased its focus on innovation and research to develop new products and services. Overall, Lamb Weston is an attractive investment opportunity due to its strong brand recognition, global presence, and long-term growth prospects.

Recent Posts