Goldenbridge Acquisition of SunCar Technology Completed by SPAC

May 19, 2023

Trending News 🌥️

Last week, SPAC Goldenbridge ($NASDAQ:GBRG) completed its acquisition of SunCar Technology, a Chinese-based company specializing in electric car technology. The merger marks a milestone for Goldenbridge, making it one of the first special purpose acquisition companies (SPACs) to acquire an Asian company. This marks a significant step forward in Goldenbridge’s goal of creating a global network of innovative electric vehicle technology. Goldenbridge is a publicly traded company that offers investors an opportunity to invest in innovative, disruptive companies without the risks of traditional venture capital investments. It provides a valuable platform for companies like SunCar Technology to access and leverage international markets while minimizing risk.

With the acquisition of SunCar Technology, Goldenbridge now has a strong foothold in the Chinese electric car market, giving them access to a rapidly growing customer base. The acquisition has been met with great excitement from investors and analysts alike, as it signifies a major step forward in Goldenbridge’s mission to create a global network of electric vehicle technology. The new partnership with SunCar Technology will bring together two leaders in the field of electrification, and the combination of their technologies could have far-reaching implications for the future of the electric vehicle market. With this acquisition, Goldenbridge has taken a major step towards becoming a major player in the global electric vehicle market.

Market Price

This transaction was highly anticipated by investors, and GOLDENBRIDGE ACQUISITION stock opened at $6.1 and closed at $6.1 on the day of the announcement. This acquisition marks a major milestone for GOLDENBRIDGE ACQUISITION as it furthers the company’s goal of providing cutting edge technology solutions to its customers. The acquisition of SunCar Technology brings together the best of both companies and provides a strong platform for future expansion in the industry. With the addition of SunCar Technology’s expertise and technologies, GOLDENBRIDGE ACQUISITION will be better positioned to take advantage of the growth opportunities in the market. The acquisition also reinforces GOLDENBRIDGE ACQUISITION’s commitment to providing quality products and services to its customers and partners.

The acquisition of SunCar Technology is expected to create long-term value for shareholders, as both companies are well positioned to capitalize on the growing demand for innovative technology solutions. The combination of GOLDENBRIDGE ACQUISITION’s experience and knowledge with SunCar Technology’s technical capabilities is expected to drive the future growth of the company. The acquisition is also likely to create new business opportunities in markets that have been largely underserved until now. With this latest addition, GOLDENBRIDGE ACQUISITION is well positioned to continue growing its business and delivering value to its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Goldenbridge Acquisition. More…

| Total Revenues | Net Income | Net Margin |

| 0 | 1.03 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Goldenbridge Acquisition. More…

| Operations | Investing | Financing |

| -0.67 | 40.85 | -40.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Goldenbridge Acquisition. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.5 | 3.92 | 4.09 |

Key Ratios Snapshot

Some of the financial key ratios for Goldenbridge Acquisition are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | -1.9% | -3.7% |

Analysis

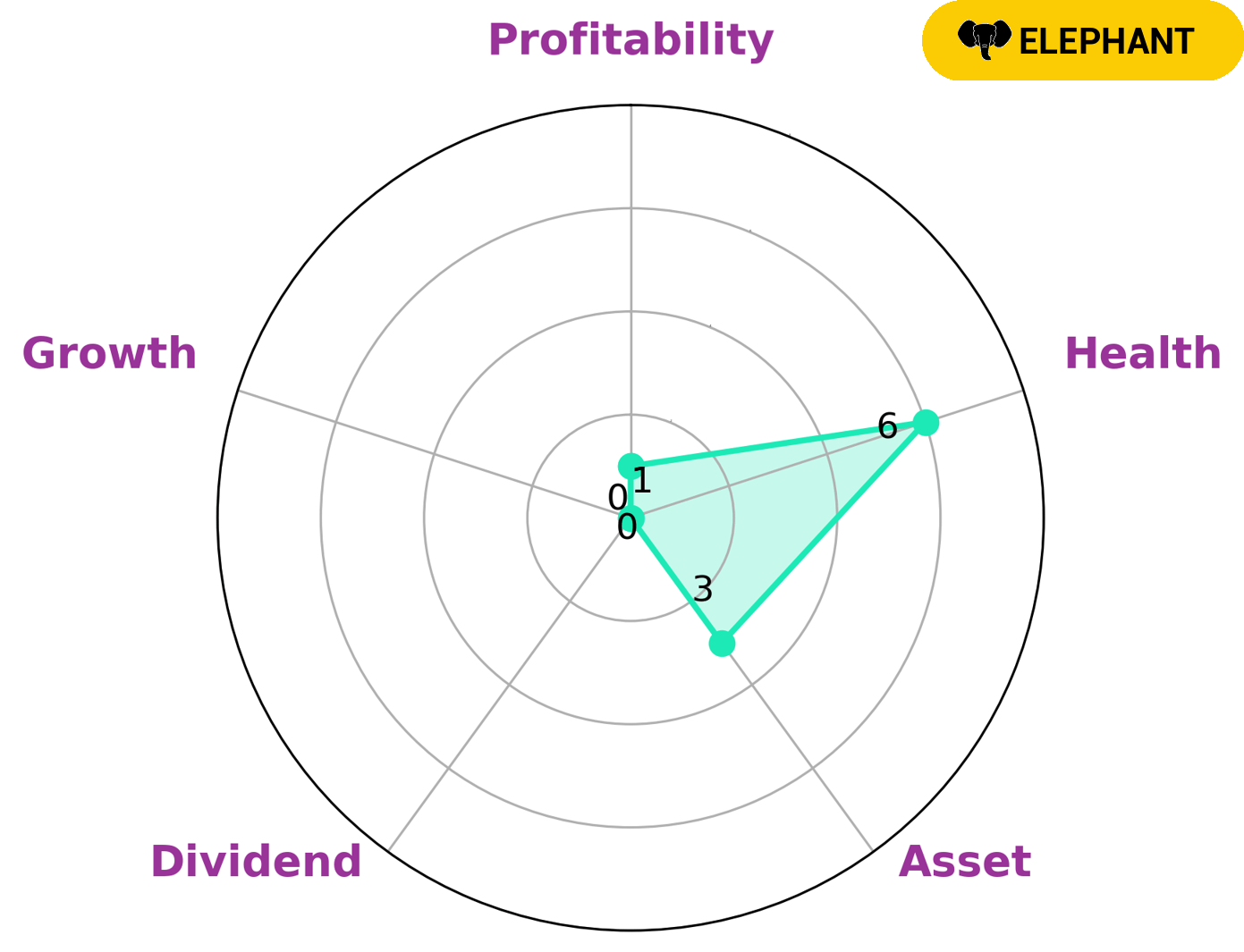

GoodWhale has conducted an analysis of GOLDENBRIDGE ACQUISITION‘s fundamentals. According to our Star Chart, GOLDENBRIDGE ACQUISITION is classified as an ‘elephant’ and is strong in terms of assets, but weak in terms of dividend, growth, and profitability. This type of company is rich in assets after deducting off its liabilities. With this in mind, we believe that investors who are looking for a stable source of income may be the most interested in investing in GOLDENBRIDGE ACQUISITION. Additionally, GOLDENBRIDGE ACQUISITION has an intermediate health score of 6/10 with regard to its cashflows and debt, suggesting that it might be able to sustain future operations in times of crisis. More…

Peers

As one of the top players in the field, they face competition from HH&L Acquisition Co, Avalon Acquisition Inc, and Roth CH Acquisition IV Co. Despite the competition, Goldenbridge is committed to providing superior services and products to their clients.

– HH&L Acquisition Co ($NYSE:HHLA)

HH&L Acquisition Co is a publicly-traded company that focuses on mergers and acquisitions of businesses in the food and beverage industry. With a market cap of 213.49M as of 2023, the company is well positioned to continue to take advantage of opportunities in the market. However, its Return on Equity of -0.69% indicates that there may be room for improvement in terms of operational efficiency and generating returns from investments.

– Avalon Acquisition Inc ($NASDAQ:AVAC)

Avalon Acquisition Inc is a publicly traded company with its headquarters located in the United States. It is primarily engaged in the acquisition, development, and management of commercial real estate assets. As of 2023, Avalon Acquisition Inc had a market cap of 274.88M and a Return on Equity of -0.64%. The company’s market cap can be used to measure the size of the company and its performance in the market relative to other companies. Negative ROE indicates that the company has returned less than its equity holders invested.

– Roth CH Acquisition IV Co ($NASDAQ:ROCG)

Roth CH Acquisition IV Co is a special purpose acquisition company that focuses on acquiring and investing in companies in the healthcare industry. As of 2023, it has a market capitalization of 59.43 million dollars, which is relatively small compared to other companies in the industry. In terms of return on equity, which measures how well the company is generating income relative to its shareholders’ equity, Roth CH Acquisition IV Co has a negative 4.91% return on equity, indicating that it is not generating a return on its investments.

Summary

Goldenbridge recently acquired SunCar Technology, a Chinese automotive technology company. This strategic move is expected to provide Goldenbridge with access to new markets and technologies, and help them to diversify their products and services. The acquisition is also expected to provide Goldenbridge with an increase in their competitive advantage over other automotive companies, as well as an opportunity to enter the lucrative Chinese market. Investors will likely benefit from this acquisition, as it could lead to increased profits and an improved stock price.

Additionally, the acquisition could help Goldenbridge to remain competitive in the future as they continue to expand their product offerings and strengthen their presence in the global automotive industry.

Recent Posts