Franklin Electric Acquires Assets of Action Manufacturing & Supply

December 6, 2023

☀️Trending News

Franklin Electric ($NASDAQ:FELE) Co., Inc. is a global leader in the manufacture and distribution of systems and components for the movement of water and fuel. Recently, the company’s subsidiary, Franklin Electric Motors & Controls, Inc., has acquired the assets of Action Manufacturing & Supply, Inc. The acquisition is expected to offer a number of benefits for Franklin Electric, including the ability to expand their product lines and gain access to new markets. With this acquisition, Franklin Electric will be able to increase their reach and offer even more solutions to their customers. The acquisition of Action Manufacturing & Supply is part of Franklin Electric’s strategy to grow their business and better serve their customer base. By expanding their product offering, Franklin Electric hopes to create more value for its customers through higher quality products and services.

Additionally, this acquisition will enable Franklin Electric to further strengthen their position in the global market.

Stock Price

On Monday, Franklin Electric Co., Inc. (FRANKLIN ELECTRIC) made a significant move in the industrial equipment segment of the market, announcing the acquisition of the assets of Action Manufacturing & Supply Inc. This announcement sent FRANKLIN ELECTRIC stock higher, as it opened at $90.1 and closed at $91.2, up 0.6% from its last closing price of 90.6. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Franklin Electric. More…

| Total Revenues | Net Income | Net Margin |

| 2.08k | 193.6 | 9.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Franklin Electric. More…

| Operations | Investing | Financing |

| 293.14 | -48.96 | -218 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Franklin Electric. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.73k | 541.65 | 25.59 |

Key Ratios Snapshot

Some of the financial key ratios for Franklin Electric are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.6% | 28.2% | 12.4% |

| FCF Margin | ROE | ROA |

| 12.0% | 13.9% | 9.4% |

Analysis

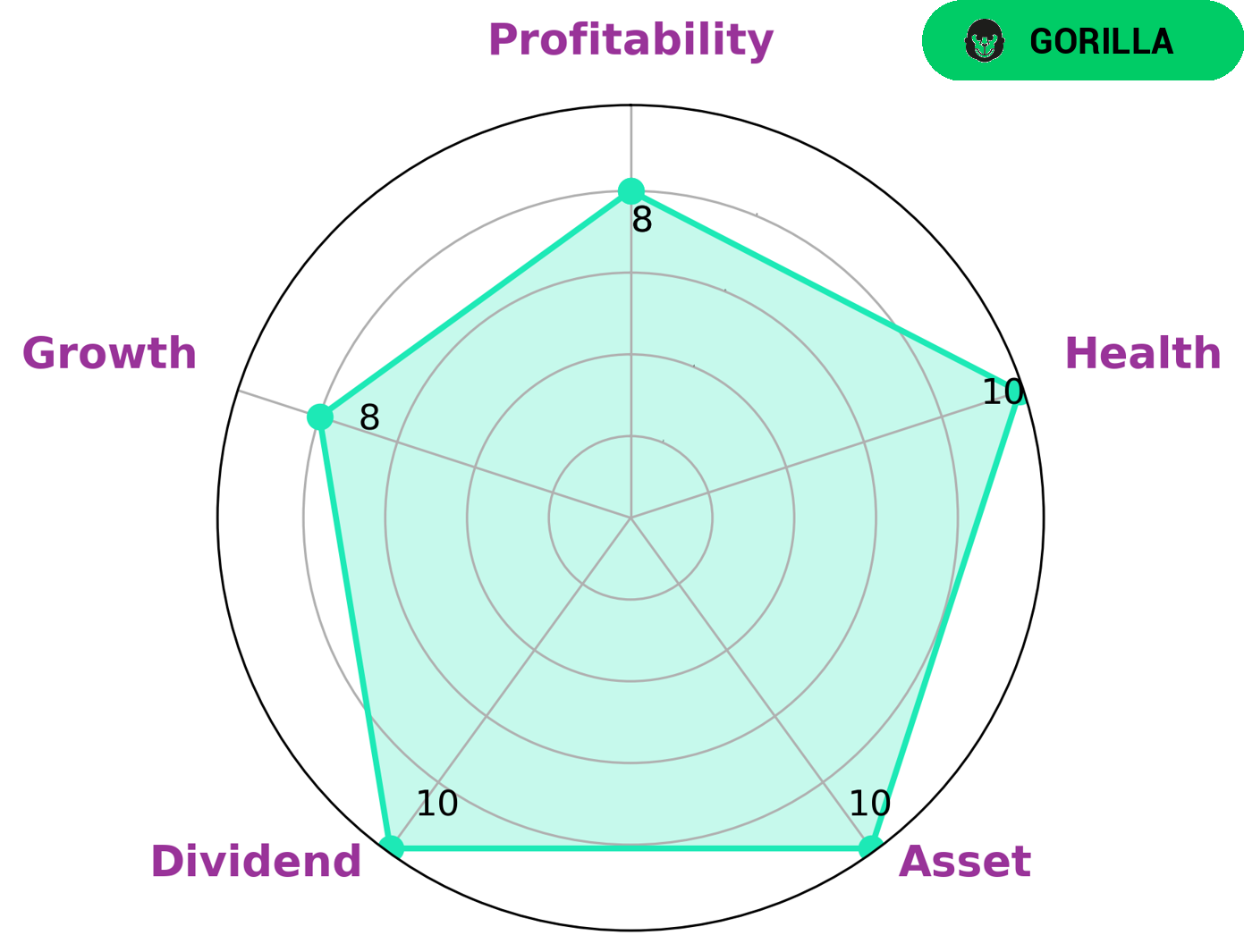

GoodWhale conducted an analysis of FRANKLIN ELECTRIC‘s wellbeing and the results are very positive. According to the Star Chart, FRANKLIN ELECTRIC is strong in asset, dividend, growth, and profitability. In addition, our analysis showed a high health score of 10/10 with regards to its cashflows and debt, indicating that the company is capable of paying off debt and funding future operations. This makes FRANKLIN ELECTRIC an attractive option for investors looking for long-term investments with potential for growth. Investors who are comfortable with taking on some risk in the hopes of higher returns may find this investment especially appealing. More…

Peers

Franklin Electric Co. Inc. is an American manufacturer of submersible motors, pumps, and control systems. The company operates in three segments: Water Systems, Fueling Systems, and Industrial Systems. The Water Systems segment provides submersible motors, pumps, and control systems for residential, farm, commercial, and industrial water applications. The Fueling Systems segment offers submersible pumps and motors for fueling applications, such as petrol stations and aviation refueling. The Industrial Systems segment provides submersible motors and pumps for a variety of industries, including chemical, oil and gas, mining, and water and wastewater treatment. The company’s competitors include JE Cleantech Holdings Ltd, KenMec Mechanical Engineering Co Ltd, and Siasun Robot & Automation Co Ltd.

– JE Cleantech Holdings Ltd ($NASDAQ:JCSE)

JE Cleantech Holdings Ltd is a solar energy company that designs, develops, manufactures, and sells solar photovoltaic modules and systems. The company has a market cap of 12.09M as of 2022 and a return on equity of -2.6%. JE Cleantech Holdings Ltd is headquartered in Hong Kong.

– KenMec Mechanical Engineering Co Ltd ($TPEX:6125)

KenMec Mechanical Engineering Co Ltd has a market cap of 5.89B as of 2022. Its Return on Equity is -5.05%. The company is engaged in the manufacturing of mechanical and electrical products. Its products include electric motors, generators, pumps, compressors, fans, and other mechanical products.

– Siasun Robot & Automation Co Ltd ($SZSE:300024)

Siasun Robot & Automation Co Ltd is a Chinese company that manufactures robots and automation equipment. The company has a market cap of 14.22B as of 2022 and a return on equity of -7.76%. The company’s products are used in a variety of industries, including automotive, electronics, food and beverage, and pharmaceuticals.

Summary

Franklin Electric is an American manufacturer of submersible pumps and motors, and related water-system products. Recently, the company has announced the acquisition of Action Manufacturing & Supply, a leading supplier of heating, ventilation, and air conditioning (HVAC) products. This move is expected to expand Franklin Electric’s product lines and customer base, while providing additional opportunities for growth. Analysts anticipate that the newly acquired assets will contribute to increased earnings per share and improved financial performance in the long-term.

However, investors should consider the risks associated with the acquisition as well as the company’s current financials before making an investment decision.

Recent Posts