Cytek Biosciences Expands US Presence with Acquisition of DiaSorin’s Flow Cytometry and Imaging Business.

February 14, 2023

Trending News ☀️

Cytek Biosciences ($NASDAQ:CTKB) is a US-based biotechnology company leading the way in the development of innovative solutions for the clinical, research, and life sciences markets. Recently, Cytek Biosciences announced their expansion of their US presence with the acquisition of DiaSorin’s flow cytometry and imaging business. DiaSorin is an Italian biotech specializing in medical technology for the diagnosis and monitoring of infectious disease, endocrinology, and hematology. The acquisition of their flow cytometry and imaging business has allowed Cytek to further strengthen its position as a leader in the US flow cytometry market, while providing DiaSorin with a global exit strategy. The terms of the agreement have not been disclosed. The combination of Cytek’s experience in the design and manufacturing of high-performance cytometers, with DiaSorin’s expertise in imaging technology, will create a powerful portfolio of products and services for the US healthcare industry.

The acquisition is expected to greatly improve the capabilities of Cytek’s flow cytometry systems, allowing them to better meet the demands of the clinical, research, and life sciences markets. Due to the agreement between Cytek Biosciences and DiaSorin, customers and researchers will now be able to access a wider range of products and services from one centralized location. This will enable researchers to conduct more comprehensive experiments in a fraction of the time, leading to faster results and improved treatments for patients. With this agreement, Cytek has now established itself as a leader in the US market, while DiaSorin has gained a valuable global exit strategy. By combining their expertise, they are able to provide customers with a comprehensive range of products and services that will lead to improved treatments and faster results.

Price History

This acquisition marks a major expansion for CYTEK BIOSCIENCES, allowing them to establish a stronger presence in the United States. It also provides additional resources to further develop their products, allowing them to offer innovative solutions to customers in the industry. This will provide CYTEK BIOSCIENCES with valuable resources to continue developing their products and services. CYTEK BIOSCIENCES’ products include the highly-regarded Cytek Aurora, a benchtop flow cytometer; the Cytek Northern Lights Series, a high-performance flow cytometer; and the Cytek Gemini Series, an imaging cytometer. The stock opened at $12.8 and closed at $13.0, up from prior closing price of 12.7.

This news indicates a strong future for the company, as the new resources will enable them to continue developing innovative solutions for their customers. CYTEK BIOSCIENCES’ expansion into the United States with this acquisition provides customers with more access to their high-quality products and services. With this new resource, they have the opportunity to continue to grow their business and become a leader in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cytek Biosciences. More…

| Total Revenues | Net Income | Net Margin |

| 154.59 | -0.95 | -1.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cytek Biosciences. More…

| Operations | Investing | Financing |

| -12.98 | -23.14 | 1.68 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cytek Biosciences. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 499.3 | 82.79 | 3.09 |

Key Ratios Snapshot

Some of the financial key ratios for Cytek Biosciences are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -0.0% |

| FCF Margin | ROE | ROA |

| -11.3% | -0.0% | -0.0% |

Analysis

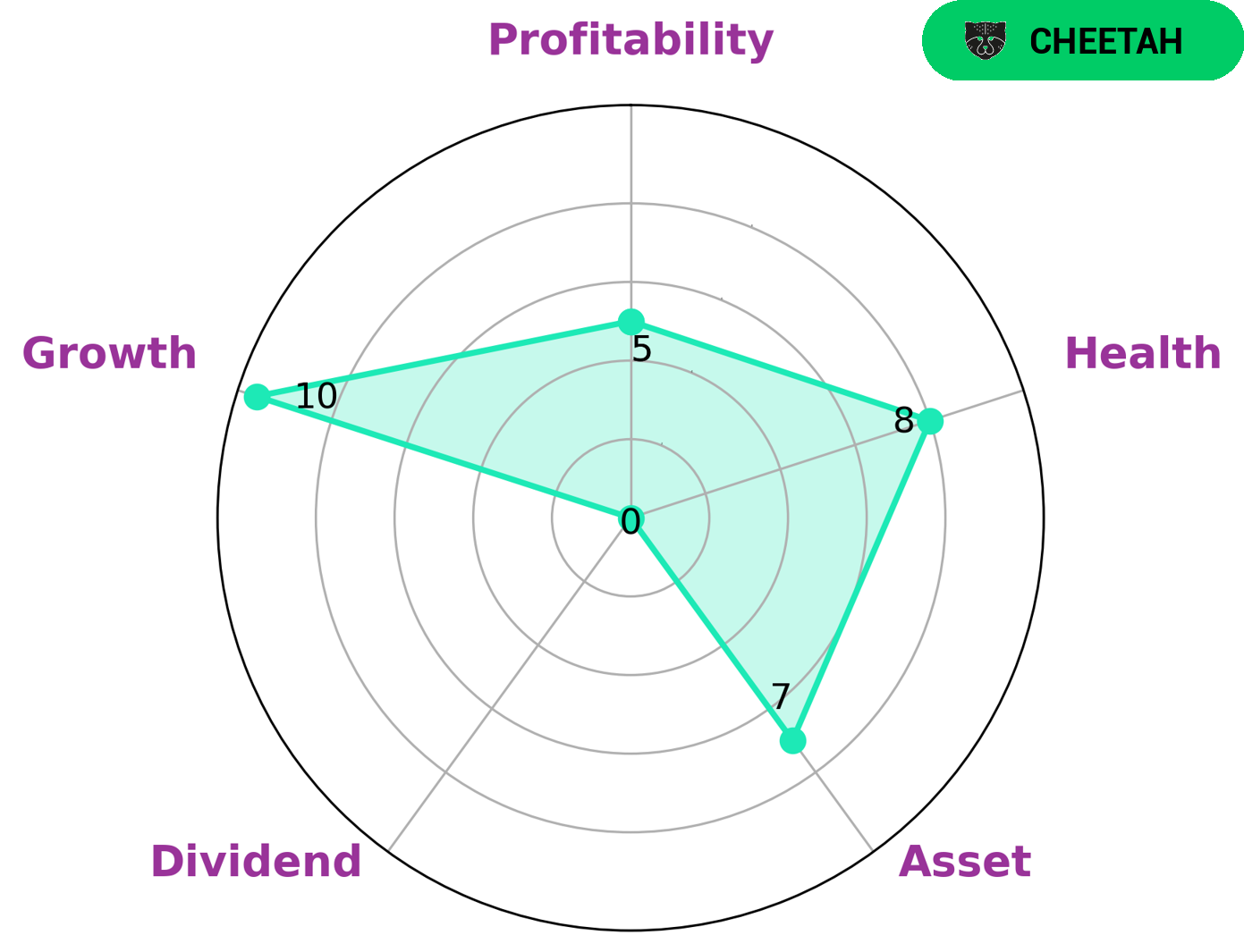

GoodWhale has conducted an analysis of CYTEK BIOSCIENCES‘ wellbeing, in which the company is classified as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Investors who may be interested in such a company could be venture capitalists, private equity firms, and other financial investors seeking higher returns in exchange for higher risk. CYTEK BIOSCIENCES is strong in asset and growth and medium in profitability, and weak in dividend. Despite its lower profitability, CYTEK BIOSCIENCES still boasts a high health score of 8/10 considering its cashflows and debt; this indicates the company is capable of safely riding out any crisis without the risk of bankruptcy. In addition, CYTEK BIOSCIENCES has good liquidity and low debt to equity ratio, which indicate the company is financially sound and can easily cope with any short-term obligations. Moreover, the company has good cash flow, which shows it has enough cash to cover its costs. Overall, this analysis shows that CYTEK BIOSCIENCES has a health score of 8/10 and could be a good option for risk-taking investors. The company has strong assets, growth and liquidity, and low debt to equity ratios. The company is also capable of riding out any crisis without the risk of bankruptcy due to its good cash flow. More…

Peers

Its competitors are Pressure BioSciences Inc, Delcath Systems Inc, Longport Inc.

– Pressure BioSciences Inc ($OTCPK:PBIO)

Pressure BioSciences Inc is a biotechnology company that develops, manufactures, and markets systems and consumables for sample preparation and analytical techniques used in the life sciences industry. The company’s products are based on the pressure cycling technology, which is a method of applying alternating cycles of hydrostatic pressure between ambient and ultra-high levels to biological samples in order to open or lyse cells and archives, release their contents for further analysis.

– Delcath Systems Inc ($NASDAQ:DCTH)

Delcath Systems Inc. is a commercial-stage pharmaceutical company focused on the treatment of primary and metastatic liver cancers. The Company’s product, Melphalan Hydrochloride for Injection for use with the Delcath Hepatic Delivery System (Melphalan/HDS), is an investigational drug delivery system that is designed to administer very high-dose melphalan, a chemotherapeutic agent, to the liver while minimizing exposure of other normal tissues.

Summary

CYTEK Biosciences recently made a large acquisition by buying the Flow Cytometry and Imaging Business from DiaSorin. This move is aimed at expanding CYTEK’s presence in the United States and increasing its potential for growth. The acquisition will strengthen CYTEK’s position in the flow cytometry and imaging markets, allowing the company to offer a wider range of products and services. Analysts expect that this move presents an interesting opportunity for investors, as it will open up more growth potential for CYTEK Biosciences.

Recent Posts