Cubist Systematic Strategies LLC Increases Investment in CF Acquisition Corp. VII in 2023.

March 11, 2023

Trending News 🌥️

Cubist Systematic Strategies LLC has increased its ownership of CF ($NASDAQ:CFIV) Acquisition Corp. VII in 2023. This signals a long-term commitment to the Acquisition Corp., which focuses on acquiring businesses in the healthcare and financial services sectors. CF Acquisition Corp. VII is a publicly traded special-purpose acquisition company (SPAC), and its shareholders benefit from the added capital and resources of Cubist Systematic Strategies LLC. Cubist Systematic Strategies LLC is a global investment manager that is well known for its rigorous, data-driven investing approach. The company has a long history of making successful investments in private and public markets, and its increased ownership of CF Acquisition Corp. VII is an indication that the company believes in the long-term potential of this SPAC.

This commitment is likely to bring more resources, capital, and expertise to the Acquisition Corp. and help it grow in the future. The increased ownership of CF Acquisition Corp. VII by Cubist Systematic Strategies LLC also demonstrates the growing popularity of SPACs as a way for companies to go public quickly and easily. With the additional resources provided by Cubist Systematic Strategies LLC, CF Acquisition Corp. VII will be well-positioned to take advantage of this trend and further its mission of acquiring businesses in the healthcare and financial services sectors.

Stock Price

On Monday, the stock of CF ACQUISITION opened at $10.3 and closed at $10.3, demonstrating that investors are optimistic about the company’s future prospects. This increase in investment is likely to accelerate the company’s growth and development, helping it achieve its long-term goals. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cf Acquisition. More…

| Total Revenues | Net Income | Net Margin |

| 0 | 16.66 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cf Acquisition. More…

| Operations | Investing | Financing |

| -0.02 | 0.04 | -0.02 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cf Acquisition. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 502.71 | 4.55 | 7.84 |

Key Ratios Snapshot

Some of the financial key ratios for Cf Acquisition are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | -0.2% | -0.2% |

Analysis

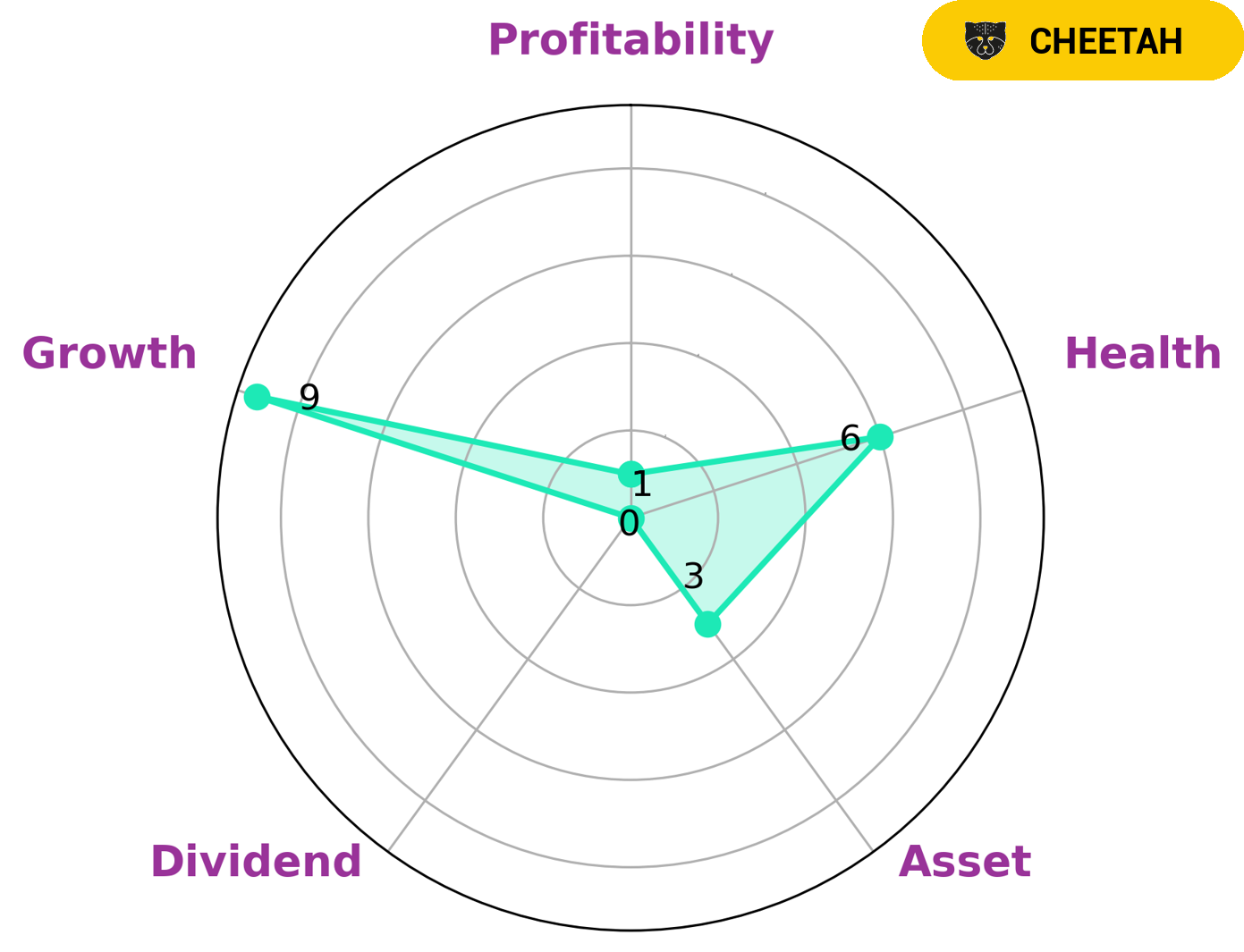

As GoodWhale’s analysis of CF ACQUISITION‘s financials shows, the company has an intermediate health score of 6/10. This means that CF ACQUISITION might be able to safely ride out any crisis without the risk of bankruptcy, given its current cashflows and debt levels. Looking at the Star Chart, it is clear that CF ACQUISITION is strong in growth, but weak in terms of asset, dividend and profitability. As such, CF ACQUISITION is classified as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. With this in mind, investors who are looking for high growth potential but can accept a certain degree of instability may be interested in CF ACQUISITION’s stock. More…

Peers

CF Acquisition Corp IV is an acquisition company that specializes in mergers and acquisitions. It faces competition from other acquisition companies such as Aequi Acquisition Corp, Bilander Acquisition Corp, and AltC Acquisition Corp. All of these companies are focused on providing corporate solutions to their clients through strategic and profitable mergers and acquisitions.

– Aequi Acquisition Corp ($NASDAQ:ARBG)

Aequi Acquisition Corp is a special purpose acquisition company formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. As of 2023, the company has a market cap of 291.81M and a negative Return on Equity of -0.25%. This indicates that the company has been unable to generate profits relative to the amount of equity or capital invested in the business. Aequi Acquisition Corp is still actively seeking potential targets for a potential merger or acquisition.

– Bilander Acquisition Corp ($NASDAQ:TWCB)

Bilander Acquisition Corp is a publicly traded special purpose acquisition company (SPAC) listed on the NASDAQ Global Market. The company has a market capitalization of 224.46M as of 2023. Bilander Acquisition Corp is focused on acquiring and investing in companies that are engaged in the development, production, and distribution of products and services in the healthcare, technology, media, and telecommunications industries. The company seeks to acquire businesses that have strong growth potential and that can create shareholder value over the long-term.

– AltC Acquisition Corp ($NYSE:ALCC)

AltC Acquisition Corp is a publicly-traded special purpose acquisition company (SPAC) formed in 2021. The company has a market cap of 646.53M as of 2023, and is focused on identifying and executing a merger or acquisition with a private company in the technology and media industries. The company’s management team has extensive experience in the technology, digital media, and entertainment sectors and is led by Chairman and CEO Victor Hwang. AltC Acquisition Corp is committed to creating long-term value for its shareholders through a combination of strategic acquisitions and organic growth.

Summary

CF Acquisition Corp. VII has seen an increase in investment from Cubist Systematic Strategies LLC in 2023. The investment marks a positive step for the company, as its current news coverage reflects a largely positive outlook from analysts. With an experienced management team and a wide range of products, CF Acquisition Corp. VII provides investors with the potential for long-term growth. The company’s strong financials and robust operations give it a competitive edge, making it an attractive target for investors.

In addition to the increased investment from Cubist Systematic Strategies LLC, the company also has strategic partnerships with top-tier financial institutions and other organizations. These strategic relationships could lead to further growth opportunities and allow the company to take advantage of new opportunities in the marketplace. As a result, CF Acquisition Corp. VII could be a great choice for investors looking to expand their portfolios.

Recent Posts