ContextLogic: Learn How To Avoid Being Fooled By Reverse Stock Splits

April 15, 2023

Trending News 🌧️

CONTEXTLOGIC ($NASDAQ:WISH): ContextLogic Inc is a leading e-commerce company based in San Francisco, California. It operates several popular online shopping platforms including Wish, Geek, and Home. In recent news, the company announced a 1-for-10 reverse stock split, creating a lot of confusion for investors. It is important to understand what a reverse stock split is and how it can affect investors. A reverse stock split is when a company reduces the amount of shares of its stock outstanding by dividing up its current shares into fewer shares. While this may seem like a good thing for a company, as it raises the value of each share, it can actually be a sign of trouble. In some cases, companies may use reverse stock splits to hide financial problems or to delay delisting from the stock exchange due to the stock price being too low. It is important for investors to understand the risks of investing in a company that has undergone a reverse stock split. If the stock price falls significantly after the split, then the investor may not have made a good investment.

Additionally, if the company does not have strong financials or has other signs of trouble, then the reverse stock split may be a sign that the company is not in a good position. For investors looking to invest in ContextLogic Inc., it is important to do research on the company and its financials before investing. This will help you make an informed decision about whether or not to invest in the company. By understanding the risks associated with reverse stock splits, you can avoid being fooled by them and make better decisions when it comes to investing in stocks.

Market Price

On Thursday, CONTEXTLOGIC INC stock opened at $8.0 and closed at $8.1, up by 1.6% from its prior closing price of 8.0. Investors should be aware that a reverse stock split can significantly change the valuation of a company’s stock, meaning that investors should take caution when looking at stocks that have recently undergone, or are about to undergo, a reverse split. Given this, CONTEXTLOGIC INC is an excellent example of a company that investors need to be aware of when considering their options in the stock market. A reverse stock split is when the number of shares of a company is drastically reduced, leaving each existing shareholder with proportionally fewer shares. Generally, this is done when a company’s stock is trading at very low prices, and the company wants to raise the price of their stock so they appear more attractive to investors. The downside of this tactic is that it can be used to manipulate the stock price and mislead investors into believing that the company is more profitable than it actually is.

In this case, CONTEXTLOGIC INC has done a reverse stock split to increase its stock price, but it doesn’t necessarily mean that their business is doing well. As such, investors should look beyond the stock price when researching a company before investing. They should consider the fundamentals of the company, such as its financials, its competitive landscape, and its management team. This will help them make an informed decision on whether or not they should invest in a company’s stock. With CONTEXTLOGIC INC, investors should look beyond the surface and conduct thorough research to ensure they don’t get fooled by the reverse stock split. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Contextlogic Inc. More…

| Total Revenues | Net Income | Net Margin |

| 571 | -384 | -67.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Contextlogic Inc. More…

| Operations | Investing | Financing |

| -422 | -47 | -22 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Contextlogic Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 799 | 322 | 0.85 |

Key Ratios Snapshot

Some of the financial key ratios for Contextlogic Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -33.0% | – | -69.7% |

| FCF Margin | ROE | ROA |

| -74.3% | -47.3% | -31.1% |

Analysis

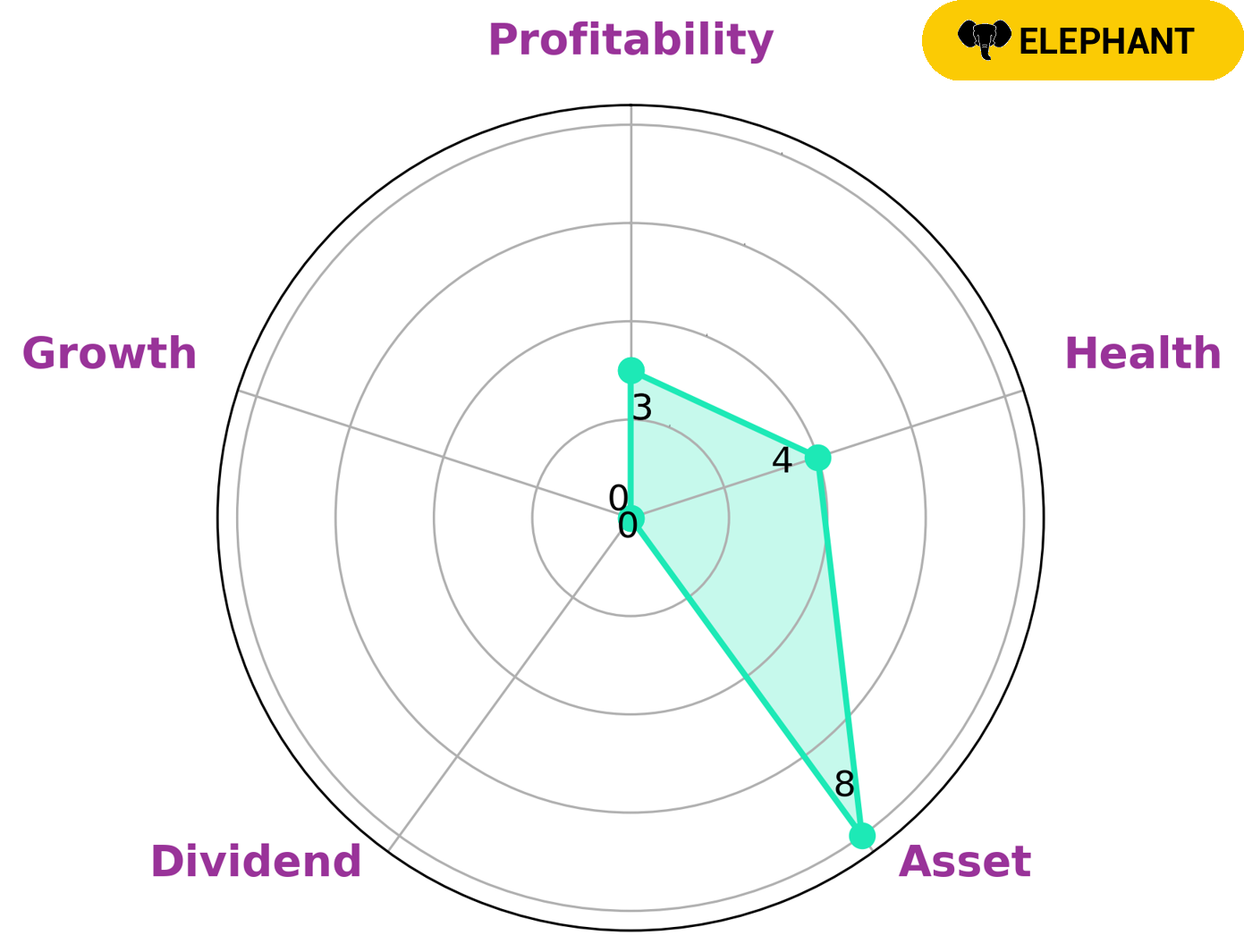

GoodWhale conducted an analysis of CONTEXTLOGIC INC‘s financials and our findings show that CONTEXTLOGIC INC is strong in asset and weak in dividend, growth, and profitability. The Star Chart illustrates this information. We determined that CONTEXTLOGIC INC has an intermediate health score of 4/10 with regard to its cashflows and debt, indicating that the company is likely to safely ride out any crisis without the risk of bankruptcy. Furthermore, we classified CONTEXTLOGIC INC as an ‘elephant’, meaning that the company is rich in assets after deducting from liabilities. Investors who are interested in companies such as CONTEXTLOGIC INC may be attracted to its strong asset base, and the fact that it is likely to survive a crisis. Furthermore, those investors who are looking for growth and high dividend returns may instead choose to look elsewhere. More…

Peers

There is intense competition between ContextLogic Inc and its competitors: eBay Inc, Amazon.com Inc, MercadoLibre Inc. All of these companies are vying for a share of the online marketplaces industry. Each company has its own strengths and weaknesses, and it is up to the consumer to decide which company they want to use.

– eBay Inc ($NASDAQ:EBAY)

eBay Inc. is an American multinational e-commerce corporation based in San Jose, California, that facilitates consumer-to-consumer and business-to-consumer sales through its website. eBay was founded by Pierre Omidyar in 1995, and became a notable success story of the dot-com bubble. Today, it is a multibillion-dollar business with operations in about 30 countries.

– Amazon.com Inc ($NASDAQ:AMZN)

Amazon.com Inc is an American multinational technology company based in Seattle, Washington, that focuses on e-commerce, cloud computing, digital streaming, and artificial intelligence. It is one of the Big Five companies in the U.S. information technology industry, along with Google, Apple, Microsoft, and Facebook. The company has a market cap of 1.05T and ROE of 6.29%. Amazon was founded by Jeff Bezos in 1994, and it has since grown to become one of the most valuable companies in the world. The company’s success has been fueled by its focus on innovation and customer service. Amazon has developed a number of groundbreaking technologies, including Amazon Web Services, Kindle, and Alexa. Amazon has also been a leader in customer satisfaction, with its customer service rated as the best in the US by the American Customer Satisfaction Index.

– MercadoLibre Inc ($NASDAQ:MELI)

MercadoLibre is a leading e-commerce platform in Latin America. It has a market cap of $44.39B as of 2022 and a return on equity of 23.4%. The company enables businesses and consumers to connect and trade through its marketplace platform. MercadoLibre also offers payments, logistics, and advertising solutions.

Summary

ContextLogic Inc. is an e-commerce company that is currently undergoing a reverse stock split. This process, which involves reducing the number of shares outstanding and increasing the price of each share, is often seen as a sign of financial distress. As a result, it is important for investors to understand the potential risk associated with investing in ContextLogic. Before investing, investors should consider analyzing the company’s fundamentals, such as financials, current market trends, and management’s track record.

Additionally, investors should research the company’s competitive landscape, including its current and potential competitors, to understand the potential opportunities and risks associated with investing in ContextLogic. Ultimately, investors should be cautious when investing in ContextLogic’s stock and should carefully assess the potential risks and rewards of investing in the company.

Recent Posts