Concentrix Corporation Intrinsic Stock Value – Concentrix Corporation Strengthens International Reach with $4.8B Acquisition of Webhelp

March 31, 2023

Trending News ☀️

Concentrix Corporation ($NASDAQ:CNXC), a leading customer experience (CX) services provider, has announced its acquisition of Webhelp for $4.8B in a move to strengthen its international reach. Concentrix Corporation is a publicly traded company that specializes in technology-enabled solutions and services to help companies improve their customer experience, operational performance, and cost efficiencies. The company’s portfolio of services ranges from customer acquisition and engagement to customer service, analytics, and digital transformation solutions. With the acquisition of Webhelp, Concentrix is now in an even better position to provide its clients with a broader range of international customer experience solutions. The acquisition is expected to provide Concentrix with access to new markets, customers, and technology capabilities that will enable it to continue growing its business. The combination of Webhelp’s and Concentrix’s offerings will create a powerful platform for offering integrated customer experience solutions across multiple channels and countries.

In addition, the two companies will be able to leverage their collective expertise in analytics and artificial intelligence to develop innovative solutions for their clients.

Price History

On Thursday, CONCENTRIX CORPORATION announced a major acquisition of Webhelp, a global customer experience services provider, in a $4.8 billion deal. This acquisition bolsters CONCENTRIX’s international reach, significantly increasing its presence in the customer experience market. Following the announcement, the company’s stock opened at $116.0 and closed at $120.0, down 1.5% from the previous closing price of $121.8. This acquisition is expected to significantly bolster CONCENTRIX’s presence in the customer experience market, and could potentially open up new markets and opportunities for the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Concentrix Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 6.42k | 414.2 | 6.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Concentrix Corporation. More…

| Operations | Investing | Financing |

| 600.72 | -1.84k | 1.24k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Concentrix Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.62k | 3.82k | 54.7 |

Key Ratios Snapshot

Some of the financial key ratios for Concentrix Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.3% | 29.6% | 10.5% |

| FCF Margin | ROE | ROA |

| 7.2% | 15.3% | 6.3% |

Analysis – Concentrix Corporation Intrinsic Stock Value

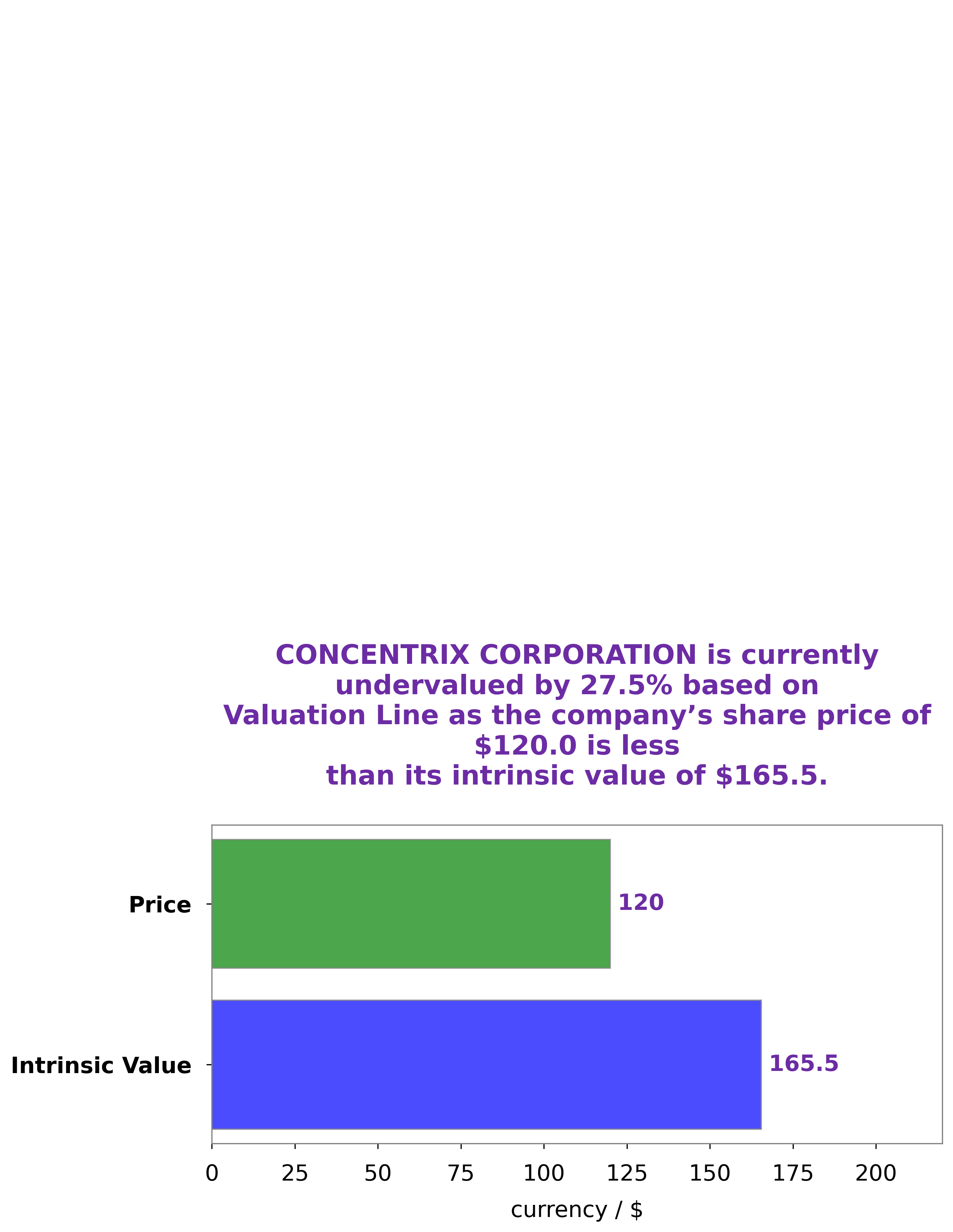

At GoodWhale, we have conducted an analysis of CONCENTRIX CORPORATION‘s fundamentals and our proprietary Valuation Line has determined that the fair value of the stock is around $165.5. Currently, CONCENTRIX CORPORATION is trading at $120.0, which is undervalued by 27.5%. This presents an opportunity for investors to buy a quality stock at a discounted price. More…

Peers

The company has a strong presence in the US, Europe, and Asia-Pacific regions. Concentrix Corp’s competitors include WidePoint Corp, Oracle Corp Japan, Alithya Group Inc, and other IT outsourcing and customer relationship management companies.

– WidePoint Corp ($NYSEAM:WYY)

As of 2022, WidePoint Corporation’s market capitalization is $22.18 million. The company’s return on equity is -30.85%. WidePoint Corporation is a technology solutions provider that specializes in secure mobility management and enterprise cybersecurity solutions. The company’s products and services enable government agencies and enterprises to deploy and manage mobile devices and applications securely and cost-effectively.

– Oracle Corp Japan ($TSE:4716)

Oracle Corporation Japan is a Japanese subsidiary of Oracle Corporation. It is one of the largest software companies in the world, with a market capitalization of over $1 trillion. The company develops and sells database, middleware, and application software. Oracle Corporation Japan has a return on equity of 37.48%.

– Alithya Group Inc ($TSX:ALYA)

Alithya Group Inc is a global technology and management consulting firm. They offer a comprehensive range of digital, consulting, and managed services to organizations in North America, Europe, and Asia Pacific. They have a market cap of 232M as of 2022 and a Return on Equity of -4.33%. The company has been struggling financially in recent years and has been cutting costs in an attempt to improve their bottom line.

Summary

Concentrix Corporation is a leading provider of customer experience services. It recently acquired Webhelp for $4.8B, a move that will expand its global presence significantly. Analysts have been bullish on the company’s prospects, citing its strong product portfolio, diversified customer base, and diversified geographic mix.

The company also has an impressive track record of successfully executing strategic acquisitions. Its capital structure is solid, with sufficient cash flows to support its operations and growth.

Recent Posts