Compute Health Acquisition Corp. Short Interest Rises 6.0% in April.

May 7, 2023

Trending News ☀️

Compute Health Acquisition ($NYSE:CPUH) Corp., a publicly traded company, reported that its short interest had risen 6.0% in April. Defense World, a financial news source, announced the development. Compute Health Acquisition Corp. is a healthcare technology acquisition company focused on consolidating and modernizing the healthcare industry. It combines technology, data analytics, and strategic investments to bring innovative solutions to the healthcare sector.

The company is committed to partnership-driven growth and continues to invest in companies that are driving meaningful, disruptive innovation. Compute Health Acquisition Corp. has quickly become a leader in the healthcare technology sector and is poised to continue its growth with the rise of their short interest.

Analysis

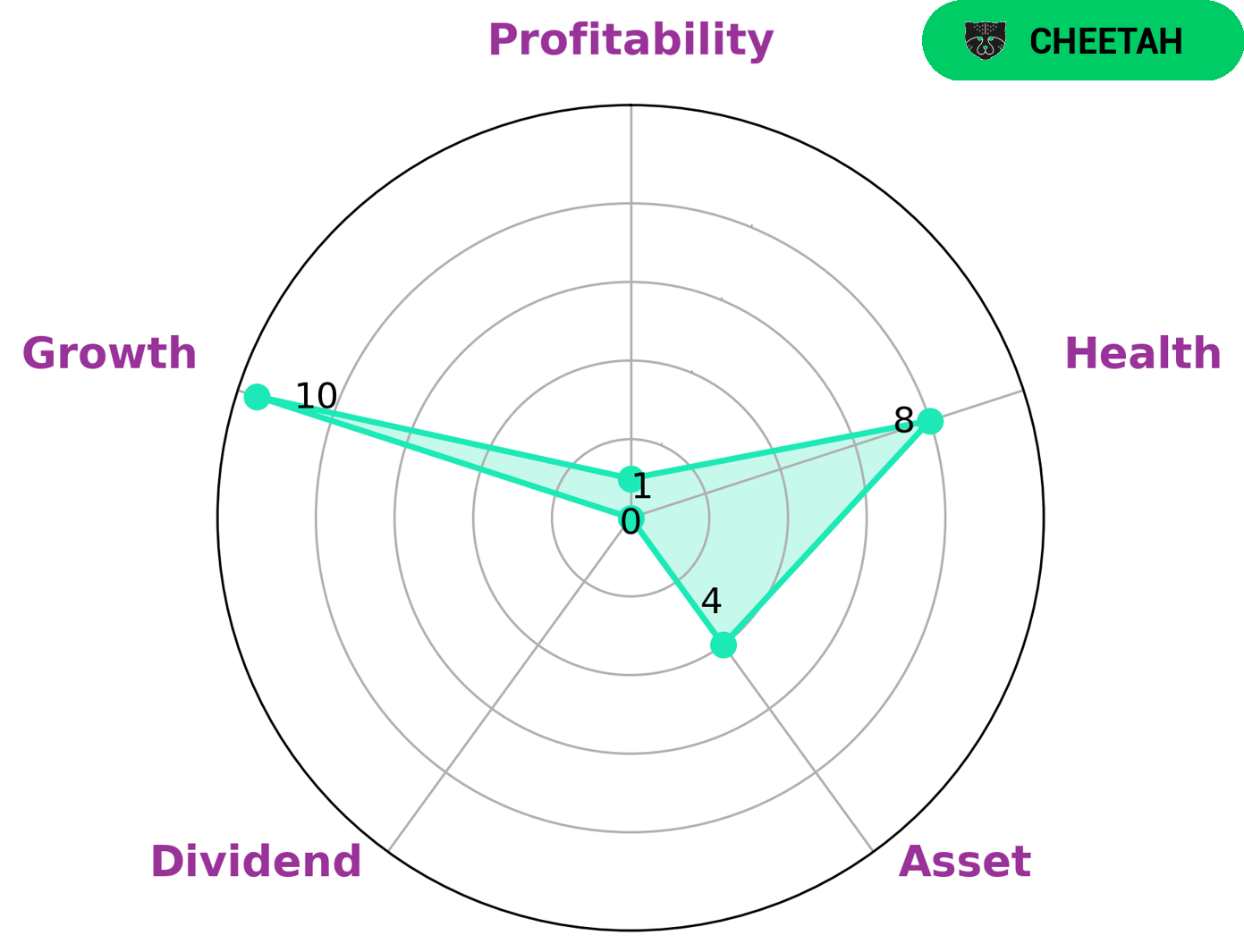

GoodWhale’s comprehensive analysis of the financial health of COMPUTE HEALTH ACQUISITION shows that it is strong in growth, medium in assets, and weak in dividends and profitability. According to our Star Chart, COMPUTE HEALTH ACQUISITION has a high health score of 8/10; this makes it well-positioned to survive in times of crisis and sustain future operations. From our analysis, we have concluded that COMPUTE HEALTH ACQUISITION is classified as a ‘cheetah’, meaning it achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be attractive to investors who are looking for high-growth companies but understand that there is a degree of risk involved. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CPUH. More…

| Total Revenues | Net Income | Net Margin |

| 0 | 32.37 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CPUH. More…

| Operations | Investing | Financing |

| -3.16 | 778.88 | -775.79 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CPUH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 95.34 | 9.21 | 7.72 |

Key Ratios Snapshot

Some of the financial key ratios for CPUH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | -0.6% | -3.1% |

Peers

Its competitors are PepperLime Health Acquisition Corp, Sanaby Health Acquisition Corp I, and DTRT Health Acquisition Corp.

– PepperLime Health Acquisition Corp ($NASDAQ:PEPL)

PepperLime Health Acquisition Corp is a publicly traded company that focuses on acquiring and operating healthcare businesses. The company has a market cap of 212.93M as of 2022 and a Return on Equity of 16.2%. PepperLime Health Acquisition Corp is headquartered in New York, NY.

– Sanaby Health Acquisition Corp I ($NASDAQ:SANB)

Sanaby Health Acquisition Corp I is a blank check company formed for the purpose of entering into a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. The company has a market cap of 228.96M as of 2022 and a ROE of -6.69%.

– DTRT Health Acquisition Corp ($NASDAQ:DTRT)

DTRT Health Acquisition Corp is a company that focuses on health and wellness. They have a market cap of 292.96M as of 2022. The company helps people live healthier lives by providing products and services that promote wellness and improve health. They offer a variety of products and services that include fitness, nutrition, and mental health.

Summary

Compute Health Acquisition Corp. (CHAC) saw a 6.0% increase in its short interest in April, according to a recent article by Defense World. This data reflects the growing interest in the company among investors, as it is indicative of the potential for significant gains due to significant trading volume in the future. Analysts are encouraged by CHAC’s strong balance sheet and attractive pipeline of products and services, which could lead to higher stock prices in the near term.

In addition, the company’s focus on healthcare software and technology provides some unique opportunities for investors. CHAC has also recently announced an expansion into the health insurance market, which could further boost investor confidence. Overall, short interest is an important indicator for investors, and the recent increase in CHAC’s short interest is a positive sign for investors looking to benefit from growth in the healthcare sector.

Recent Posts