BetterWorld Acquisition Terminates Merger with Heritage Distilling

May 20, 2023

Trending News 🌥️

BETTER WORLD ACQUISITION ($NASDAQ:BWAC) (BWAC) has announced the termination of its merger agreement with Heritage Distilling, a Washington-based craft distiller, citing the current market conditions for its decision. BWAC, a publicly traded special purpose acquisition company (SPAC), is a blank check company created to acquire and invest in businesses. BWAC had intended to use the proceeds of the merger with Heritage Distilling to acquire and invest in additional business.

However, due to the current market conditions, BWAC has determined that it would be in the best interest of its shareholders to terminate the agreement. BWAC believes that investing in another company under these economic conditions would be too risky. The termination of the merger agreement will not impact BWAC’s existing investments. BWAC will continue to focus on identifying and investing in businesses that have strong growth potential. Investors in BWAC will still benefit from any success of the investments made by the company. BWAC will continue to remain focused on delivering value to its shareholders by seeking out new opportunities and investments that can create a better world for generations to come.

Market Price

On Friday, BETTER WORLD ACQUISITION announced that it had terminated its planned merger with Heritage Distilling. The company’s stock opened at $10.8 and closed at $10.8, up by 0.2% from previous closing price of 10.8. The merger was meant to create a leading U.S. producer of specialty spirits, but the companies mutually agreed to discontinue the deal due to “various factors” that “impact the value of the transaction.” Both companies are currently evaluating other options to maximize shareholder value and will provide updates when appropriate. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BWAC. More…

| Total Revenues | Net Income | Net Margin |

| 0 | 3.25 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BWAC. More…

| Operations | Investing | Financing |

| -1.33 | 84.77 | -83.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BWAC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 44.74 | 3.86 | 5.31 |

Key Ratios Snapshot

Some of the financial key ratios for BWAC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | -3.4% | -3.1% |

Analysis

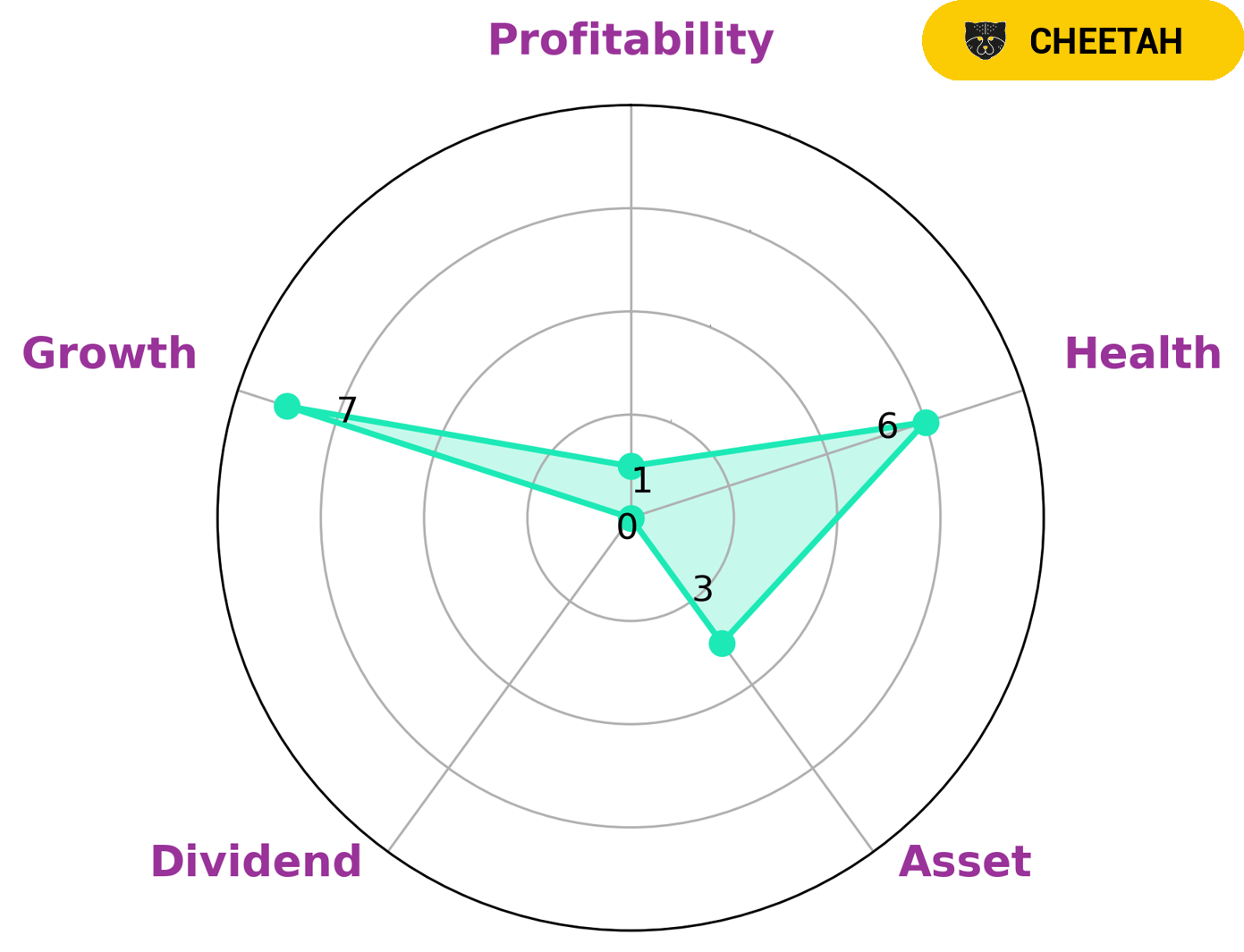

At GoodWhale, we have analyzed BETTER WORLD ACQUISITION’s fundamentals and concluded that they are classified as a ‘Cheetah’ company. This type of company has experienced high revenue or earnings growth, but may be considered less stable due to lower profitability. For investors looking to invest in companies with a high potential for growth, BETTER WORLD ACQUISITION may be a good choice. They have strong growth potential, but are weak in asset management, dividend payments, and profitability. As a result, investors should evaluate their investment strategy and the risks associated with such a company. In addition, BETTER WORLD ACQUISITION has an intermediate health score of 6/10 with regard to its cash flows and debt. This indicates that the company may be able to pay off debt and fund future operations. Investors should take this into account when assessing the company’s risk-return profile. More…

Peers

Better World Acquisition Corp is an acquisition corporation that focuses on merging companies in the technology sector. It is one of many companies that specialize in this field, such as Worldwide Webb Acquisition Corp, Capitalworks Emerging Markets Acquisition Corp, and Forbion European Acquisition Corp. All of these corporations strive to acquire companies with innovative ideas and products to create a better world through improved technology.

– Worldwide Webb Acquisition Corp ($NASDAQ:WWAC)

Worldwide Webb Acquisition Corp is a diversified holding company that acquires and manages a portfolio of operating companies. As of 2023, its market cap has reached 293.83M. Its Return on Equity (ROE) is -7.16%, indicating that the company is not generating positive returns on its equity investments. This could be due to a variety of factors, such as its acquisition strategy, competitive landscape, or management decisions.

– Capitalworks Emerging Markets Acquisition Corp ($NASDAQ:CMCA)

Capitalworks Emerging Markets Acquisition Corp is a publicly traded special purpose acquisition company (SPAC) that was launched in 2023. The company focuses on acquiring and investing in companies in emerging markets and has a market cap of 297.56M as of 2023. Capitalworks Emerging Markets Acquisition Corp is backed by a team of experienced investors and professionals with over 25 years of experience in these markets. The company is focused on identifying and acquiring companies with high growth potential, and it has already made several investments in companies such as e-commerce and consumer Internet businesses, financial technology, energy and clean technology, and health care.

– Forbion European Acquisition Corp ($NASDAQ:FRBN)

Forbion European Acquisition Corp is a publicly traded company that specializes in venture capital investments. The company has a market cap of 163.82 million as of 2023, indicating its relatively large size in the venture capital industry. Forbion European Acquisition Corp focuses on providing long-term capital to early stage life sciences companies in Europe, with a particular focus on Germany, the Netherlands, and Belgium. The company seeks to maximize returns for its investors and provide value-enhancing strategic assistance to its portfolio companies.

Summary

Better World Acquisition Corp. announced the termination of its proposed merger with Heritage Distilling Co. (HDSL). However, after careful consideration, the parties decided to terminate the merger due to a number of factors, including their differing business philosophies and plans. Investing analysis suggests that investors should watch for any upcoming corporate announcements regarding strategic plans moving forward. Additionally, investors should take note of the company’s financial condition and potential impacts from the termination of the merger.

Recent Posts