Aristocrat Leisure to Acquire NeoGames S.A for $29.50 per Share in Cash

May 16, 2023

Trending News ☀️

NEOGAMES ($NASDAQ:NGMS): NeoGames S.A is a publicly traded company on the Nasdaq Global Market and is based in Israel. The company is a leading provider of online and mobile gaming solutions, primarily for regulated markets. It has an extensive portfolio of proprietary games, a variety of game content and advanced platform technologies. Aristocrat Leisure has recently announced an agreement to acquire NeoGames S.A in a cash transaction.

The acquisition of NeoGames will create a significant presence in the online gaming sector for Aristocrat, and will enable it to benefit from the growing opportunity in this segment. This acquisition marks a major milestone for both companies as it will allow Aristocrat to leverage NeoGames’ technology, portfolio and employees to enhance its digital products portfolio. NeoGames’ services will also help Aristocrat expand its presence in the digital gaming sector and broaden its customer base in Europe and other regulated markets around the world.

Stock Price

This marked a surge of 111.6% from the previous closing price of 12.8, and the stock opened at $27.4 before closing at $27.2. The transaction has been cleared by NEOGAMES’s board of directors and stands subject to approval by NEOGAMES’s shareholders as well as the satisfaction of customary closing conditions. If the transaction is successful, NEOGAMES S.A shareholders will receive a significant premium over the pre-announcement closing price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Neogames S.a. More…

| Total Revenues | Net Income | Net Margin |

| 201.98 | -18.95 | -3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Neogames S.a. More…

| Operations | Investing | Financing |

| 38.35 | -225.94 | 162.16 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Neogames S.a. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 474.8 | 326.26 | 4.44 |

Key Ratios Snapshot

Some of the financial key ratios for Neogames S.a are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 71.1% | – | -3.0% |

| FCF Margin | ROE | ROA |

| 5.2% | -2.6% | -0.8% |

Analysis

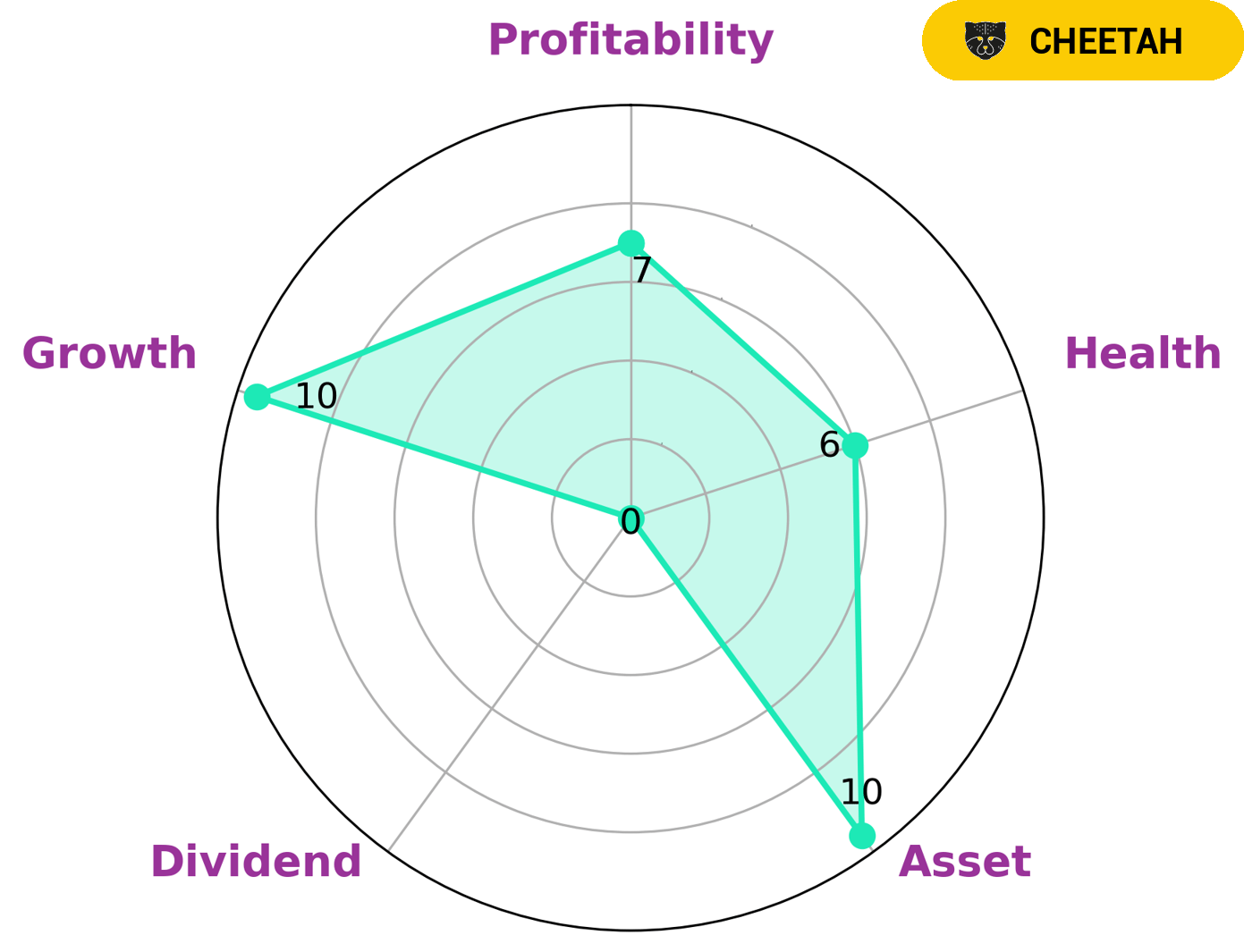

GoodWhale has conducted an analysis of NEOGAMES S.A‘s financials and has concluded that they have an intermediate health score of 6/10 with regard to their cashflows and debt. This means that they are likely to have enough money to pay off debt and fund future operations. NEOGAMES S.A is classified as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company would be attractive to investors looking for a higher return but with some additional risk. Specifically, NEOGAMES S.A is strong in terms of asset, growth, and profitability and weak in dividend. More…

Peers

The company has a strong presence in Europe, North America, and Asia-Pacific. NeoGames SA’s main competitors are Frontier Developments PLC, SocialPlay USA Inc, and Feiyu Technology International Co Ltd.

– Frontier Developments PLC ($LSE:FDEV)

Frontier Developments PLC is a British video game developer founded in 1994 by David Braben. The company is based in Cambridge, England. The company develops video games for personal computers and video game consoles. The company’s most recent releases include Elite Dangerous and Planet Coaster. Frontier Developments PLC has a market capitalization of 527.48 million as of 2022 and a return on equity of 0.83%. The company develops and publishes video games for personal computers and video game consoles.

– SocialPlay USA Inc ($OTCPK:SPLY)

SocialPlay USA Inc is a social media platform that allows users to connect with each other and share content. The company has a market cap of 118.7k and a ROE of 84.25%. SocialPlay USA Inc offers a variety of features that allow users to connect with each other and share content. The company also provides users with the ability to create and share content, as well as the ability to connect with other users.

– Feiyu Technology International Co Ltd ($SEHK:01022)

Feiyu Technology International Co Ltd is a Chinese company that manufactures drones and other drones accessories. The company has a market cap of 395.33M as of 2022 and a Return on Equity of -8.97%. The company’s products are used by both consumers and businesses.

Summary

NeoGames S.A. is an online gaming company that recently made headlines when Aristocrat Leisure announced their agreement to acquire the company for $29.50 per share in cash. This news was met with positive investor sentiment as the stock price rose on the day of the announcement. An investing analysis of NeoGames S.A. reveals a consistent yearly revenue growth, backed by a healthy balance sheet and a strong portfolio of gaming assets. The company’s strong fundamentals, combined with the announcement of the acquisition, make NeoGames S.A. a very attractive investment opportunity for long-term investors.

Recent Posts