Applied UV Strengthens Leadership Team with Eugene Burleson as Chairman and Max Munn as CEO

April 13, 2023

Trending News ☀️

Applied ($NASDAQ:AUVI) UV, a leading provider of ultraviolet-curing products and technologies, has recently announced the appointments of Eugene Burleson as its new chairman and Max Munn as its CEO. The company is known for its innovations in UV curing systems, which are used in a variety of industries ranging from woodworking and plastics to printing and industrial manufacturing. With the addition of these two leaders, Applied UV is set to continue its success and expansion in the UV curing industry. He has held executive positions at several major companies, including Johnson & Johnson and General Motors. With his strong business acumen and proven track record, he will be a great asset to the company.

Max Munn brings decades of experience in the technology sector to his role as CEO of Applied UV. He has held executive positions in several leading technology companies, such as Microsoft and Google. His expertise in digital technology and innovation will help Applied UV create new products and services that will drive the industry forward. This dynamic duo is sure to bring fresh ideas, energy, and expertise to Applied UV’s portfolio of products and services.

Price History

This news was welcomed by investors, as APPLIED UV stock opened at $0.8 and closed at $0.8, up by 3.1% from the previous closing price of 0.8. This increase in stock price illustrates the confidence investors have in the new leadership team. The new leadership structure is expected to help APPLIED UV reach their goals and objectives more efficiently and effectively. With both Burleson and Munn’s expertise and experience in the field, the company is well-equipped to take on future challenges and capitalize on opportunities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Applied Uv. More…

| Total Revenues | Net Income | Net Margin |

| 20.14 | -18.02 | -55.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Applied Uv. More…

| Operations | Investing | Financing |

| -8.74 | -0.18 | 2.88 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Applied Uv. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 32.73 | 15.49 | 1.03 |

Key Ratios Snapshot

Some of the financial key ratios for Applied Uv are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.2% | – | -80.9% |

| FCF Margin | ROE | ROA |

| -43.5% | -47.3% | -31.1% |

Analysis

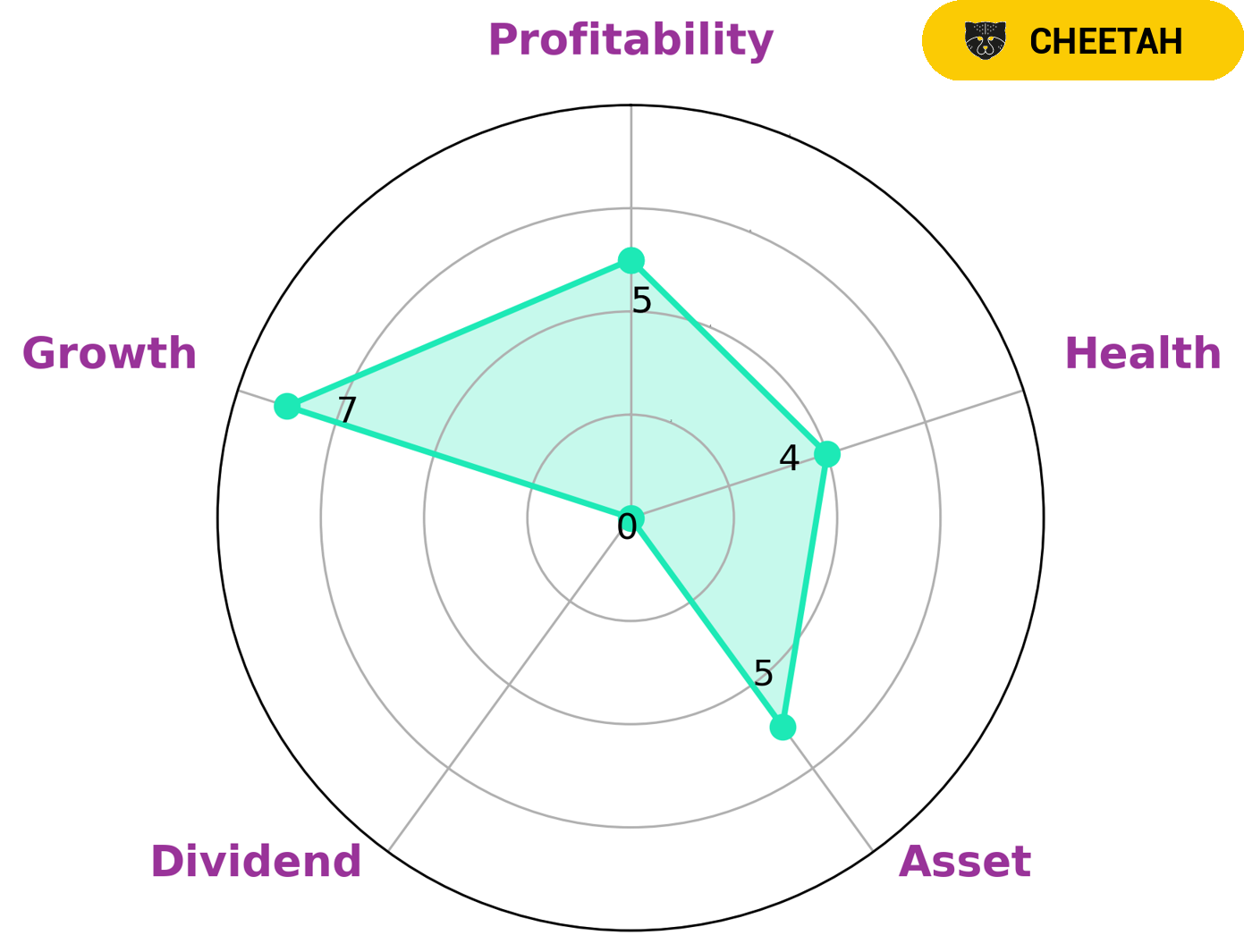

GoodWhale has conducted a comprehensive analysis of the fundamentals of APPLIED UV. According to Star Chart, APPLIED UV has an intermediate health score of 4/10 with regard to its cashflows and debt. While it may be able to pay off debt and fund future operations, this score is indicative of a company with only moderate financial strength. When evaluating APPLIED UV’s fundamentals, we found that it is strong in growth, medium in asset, profitability and weak in dividend. This indicates that the company has had recent success in increasing revenues or earnings, but may be struggling to generate a high level of profitability. Based on this assessment, we classify APPLIED UV as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given its classification as a cheetah, investors looking for a more stable company may not be interested in APPLIED UV. However, investors who are comfortable with higher risk may find the potential for high returns in a cheetah like APPLIED UV attractive. Therefore, investors who are looking for higher risk and higher returns may be interested in investing in APPLIED UV. More…

Peers

Its competitors are Healthcare Co Ltd, Signature International Bhd, and Kewaunee Scientific Corp.

– Healthcare Co Ltd ($SHSE:603313)

The company’s market cap is 4.74B as of 2022. The company’s ROE is -0.51%. The company’s business is providing healthcare services.

– Signature International Bhd ($KLSE:7246)

Signature International Bhd is a Malaysia-based investment holding company. The Company’s segments include Property development, which is engaged in the development of residential and commercial properties; Property investment, which is engaged in the holding of investment properties; Hotel operations, which is engaged in the operations of a hotel; and Others, which include provision of management services and trading of building materials. The Company’s subsidiaries include Signature Properties Sdn. Bhd., which is engaged in property development and investment; Signature Hotel Sdn. Bhd., which is engaged in hotel operations; and Wisma Signature Sdn. Bhd., which is engaged in property investment.

– Kewaunee Scientific Corp ($NASDAQ:KEQU)

Kewaunee Scientific Corporation is a publicly traded company on NASDAQ with the ticker symbol KEQU. The company is based in Statesville, North Carolina and designs, manufactures, and markets scientific equipment for use in research laboratories and pilot plants worldwide. Kewaunee Scientific’s primary product lines are fume hoods, casework, and adaptable modular systems used in a variety of scientific applications. The company also provides related services, including installation and after-market support.

Summary

Applied UV is an American manufacturing company specializing in ultraviolet (UV) technology and related products. Its lineup of products includes UV curing systems, UV disinfection systems, and UV measurement systems. The company’s stock price recently moved up after Eugene Burleson was named Chairman and Max Munn was named CEO. Investing analysts believe that Applied UV’s strong team of experienced executives, combined with its wide range of advanced UV-based products, will propel the company in the near future. Analysts cite the strong industry outlook for UV technology as one of the reasons for their optimism.

Additionally, the company’s focus on new research and development initiatives should position it to stay ahead of the competition.

Recent Posts