APD Intrinsic Stock Value – Air Products Re-Appoints Dr. Seifollah Ghasemi as Chairman, President and CEO

May 20, 2023

Trending News 🌥️

Air ($NYSE:APD) Products and Chemicals, Inc. is a leading global producer of industrial gases and specialty chemicals. The company has a long history of providing innovative solutions to customers spanning a wide range of industries, including energy, construction, health care, and electronics. Recently, the company has announced the re-appointment of Dr. Seifollah Ghasemi as its Chairman, President and Chief Executive Officer. Dr. Ghasemi is a seasoned leader with a strong track record of success in business and industry. His extensive experience in the chemical industry has helped Air Products and Chemicals chart a course of profitable growth and expansion. Under his leadership, the company has delivered consistent financial and operational performance in recent years, while continuing to invest in new technologies.

In addition, Dr. Ghasemi’s strong focus on safety and sustainability has resulted in improved working conditions for employees across the company’s global operations. As Chairman, President and Chief Executive Officer, Dr. Ghasemi will continue to provide strategic direction to the company as it strives to build a brighter future for its customers, communities, and shareholders. With his expertise and guidance, Air Products and Chemicals is well positioned to capitalize on opportunities in the global industrial gases and specialty chemicals markets.

Market Price

On Thursday, Air Products and Chemicals stock opened the day at $275.7 and closed at $275.4, a slight decrease of 0.3% from the previous closing price of 276.2 amid news that the company has re-appointed Dr. Seifollah Ghasemi as Chairman, President and Chief Executive Officer (CEO). Dr. Ghasemi is an established leader in the global energy and industrial gas markets, with over four decades of experience in the industry. The company’s board of directors unanimously confirmed Dr. Ghasemi’s reappointment, citing his extensive experience in the energy and industrial gas markets as well as his understanding of the company’s core values and strategy.

Dr. Ghasemi will oversee the continued growth of Air Products and Chemicals as the company strives to meet its goals and objectives. He will be supported by a strong management team, including Chief Operating Officer Edward J. Campbell and Chief Financial Officer Scott Crocco. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for APD. More…

| Total Revenues | Net Income | Net Margin |

| 13.13k | 2.18k | 18.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for APD. More…

| Operations | Investing | Financing |

| 3.28k | -3.7k | 388.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for APD. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.44k | 14.75k | 63.29 |

Key Ratios Snapshot

Some of the financial key ratios for APD are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.5% | 4.4% | 21.9% |

| FCF Margin | ROE | ROA |

| -0.4% | 12.8% | 6.1% |

Analysis – APD Intrinsic Stock Value

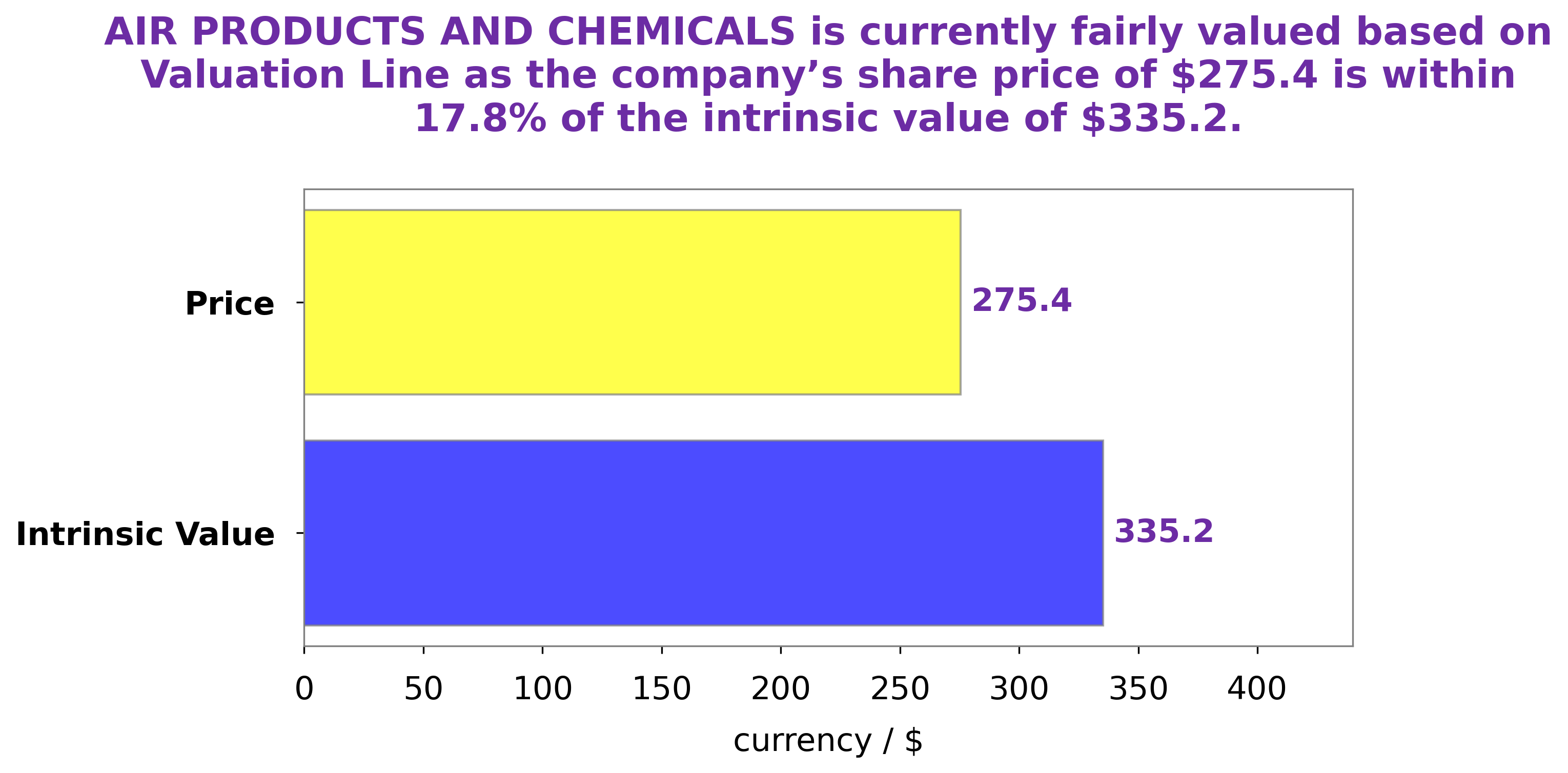

GoodWhale is proud to provide investors with analytics on the financials of AIR PRODUCTS AND CHEMICALS. Through our proprietary Valuation Line, we’ve determined that the fair value of AIR PRODUCTS AND CHEMICALS is around $335.2. This price is significantly higher than the current market price of $275.4, meaning that investors are undervaluing AIR PRODUCTS AND CHEMICALS by 17.8%. We recommend that investors take a closer look at the potential of this stock and consider adding it to their portfolio. More…

Peers

Air Products & Chemicals Inc is an American multinational corporation whose principal business is the supply of gases and chemicals for industrial uses. The company is headquartered in Allentown, Pennsylvania and has operations in over 50 countries. Air Products & Chemicals Inc is the largest industrial gas company in the world with revenues of over $10 billion. Air Liquide SA, Linde PLC, and Autris are its main competitors.

– Air Liquide SA ($LTS:0NWF)

As of 2022, Air Liquide SA has a market cap of 68.08B with a ROE of 11.4%. The company is engaged in the business of gas and service provider. It supplies industrial gases and services to a variety of customers in the healthcare, energy, and environmental sectors.

– Linde PLC ($NYSE:LIN)

The company’s market cap is 147.13B as of 2022 and its ROE is 8.63%. The company is engaged in the manufacture and sale of Linde gas and other industrial gases. The company has a strong presence in Europe, North America, and Asia Pacific.

– Autris ($OTCPK:AUTR)

Autris is a global leader in providing innovative solutions for the automotive industry. The company has a market cap of 690.7k as of 2022 and a return on equity of 146.32%. Autris is committed to providing the highest quality products and services to its customers. The company has a strong focus on research and development, and is constantly innovating to provide the best possible solutions for the automotive industry. Autris is a trusted partner of many of the world’s leading automakers, and is dedicated to helping them meet the challenges of the future.

Summary

Air Products and Chemicals Inc. has announced an extension of its Chairman, President and CEO Seifi Ghasemi’s term. The Board of Directors has cited Ghasemi’s “exceptional leadership” as the main reason for the extension. Under his tenure, Air Products and Chemicals Inc. has experienced considerable success in terms of revenue growth, improving customer relationships, and expanding its global reach.

Ghasemi’s development of various strategies for the company, coupled with his experience and industry-wide respect have made the company a strong contender not only in the US but in the global industrial gases market. Investors are confident that with Ghasemi at the helm, Air Products and Chemicals Inc. will continue to be a reliable long-term investment.

Recent Posts