Vuzix Corporation Stock Soars as Company Projects Q1 2023 Sales of Over $4M

April 11, 2023

Trending News 🌥️

Vuzix Corporation ($NASDAQ:VUZI) is a leading provider of Smart Glasses and Augmented Reality (AR) technology, based in Rochester, New York. The company’s stock has been on a surge in recent days, rising by 4% in anticipation of its projected Q1 2023 sales of over $4M. This news has been welcomed by many investors and is expected to continue to provide a boost in the share price. Vuzix has established itself as a leader in the Smart Glasses market, with its products being used in various industries such as healthcare, industrial, and entertainment. The company provides an array of products that enhance the user experience through audio, video, and interactive technologies.

Vuzix has also developed Augmented Reality (AR) applications that provide an immersive experience with its Smart Glasses. With their projected Q1 2023 sales exceeding $4M, Vuzix is poised to capitalize on the growing market for Smart Glasses and Augmented Reality technology. The company’s stock is expected to continue its recent success as it continues to develop and innovate in the field. Investors are eagerly awaiting the results of the Q1 2023 sales figures, which could further drive up the share price.

Share Price

On Monday, VUZIX CORPORATION stock opened at $4.1 and closed at $4.2, a rise of 5.6% from its prior closing price of $4.0. This increase came as the company announced that it projects its sales for the first quarter of 2023 will exceed $4M. This news has sent their stock soaring, as investors are confident in their potential future growth.

The company’s products, which include augmented reality/virtual reality headsets and smart glasses, have been gaining in popularity in recent years. By focusing on this rapidly growing market, VUZIX CORPORATION is well-positioned to benefit from sustained growth in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vuzix Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 11.84 | -40.76 | -353.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vuzix Corporation. More…

| Operations | Investing | Financing |

| -24.52 | -21.17 | -1.95 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vuzix Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 132.31 | 15.58 | 1.84 |

Key Ratios Snapshot

Some of the financial key ratios for Vuzix Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.1% | – | -357.5% |

| FCF Margin | ROE | ROA |

| -366.6% | -21.8% | -20.0% |

Analysis

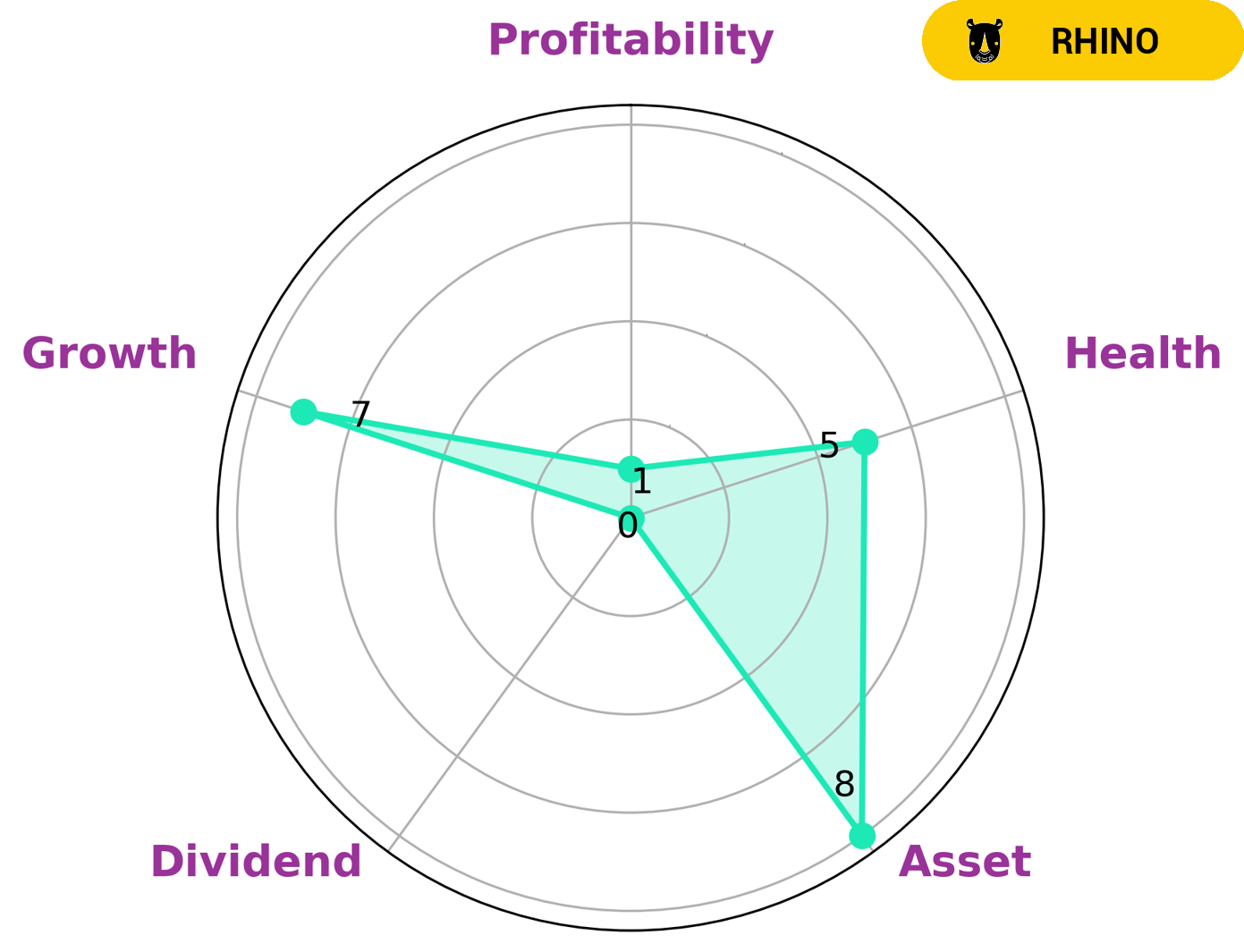

GoodWhale has conducted an analysis of the fundamentals of VUZIX CORPORATION and according to our Star Chart, the company has an intermediate health score of 5/10 with regard to its cashflows and debt. This means that VUZIX CORPORATION might be able to safely ride out any crisis without the risk of bankruptcy. We have classified VUZIX CORPORATION as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Given VUZIX CORPORATION’s strong assets, growth, and weaker dividend and profitability, we believe that investors who are looking for long-term capital appreciation may find this company a good investment. The company also has the potential to be a good source of income to investors who are looking for short-term returns or regular dividend payments. More…

Peers

The competition between Vuzix Corp and its competitors is fierce. Each company is fighting for market share and trying to differentiate themselves from the others. Anker Innovations Technology Co Ltd, VIZIO Holding Corp, and HTC Corp are all major players in the smart glasses market and are constantly trying to one-up each other.

– Anker Innovations Technology Co Ltd ($SZSE:300866)

Anker Innovations Technology Co Ltd is a Chinese consumer electronics company founded in 2011. It is headquartered in Shenzhen, Guangdong. The company specializes in manufacturing and selling mobile phone chargers, batteries, and other electronic accessories. As of 2022, Anker had a market capitalization of 24.15 billion US dollars and a return on equity of 12.73%.

– VIZIO Holding Corp ($NYSE:VZIO)

VIZIO is a California-based company that manufactures and distributes televisions and other electronics. As of 2022, it has a market capitalization of $1.93 billion and a return on equity of -8.09%. The company sells its products through retailers such as Best Buy, Costco, and Walmart.

– HTC Corp ($TWSE:2498)

HTC Corporation, formerly High Tech Computer Corporation, is a Taiwanese consumer electronics company headquartered in New Taipei City, Taiwan. Founded in 1997, HTC began as an original design manufacturer and original equipment manufacturer, designing and manufacturing laptop computers. In 1998, HTC started manufacturing handheld devices, and has since become the world’s largest manufacturer of Android smartphones. The company has a market cap of $43.45 billion as of 2022 and a return on equity of -6.75%. HTC designs, manufactures, and markets a range of smartphones and tablets under the HTC, HTC One, Desire, Butterfly, and Wildfire brands. The company also provides services for the development of mobile applications, as well as cloud services.

Summary

Vuzix Corporation is an American supplier of wearable display technology and augmented reality company. The recent stock price surge of 4% suggests positive investor sentiment towards the company’s future. Analysts are expecting the Q1 2023 sales to reach $4M which is indicative of the potential growth of the company in the near future. Investors should consider conducting further research into Vuzix Corporation’s financials, products and services, competitor landscape and management team to evaluate the company’s investment potential.

Additionally, monitoring the company’s current stock price performance and staying abreast of any analyst forecasts would be prudent for prospective investors.

Recent Posts