GoPro Reports Record-Breaking Q4 Non-GAAP EPS of $0.12 in 2023

February 3, 2023

Trending News 🌥️

GOPRO ($NASDAQ:GPRO): GoPro Inc. is an American action camera company based in San Mateo, California. GoPro is well known for its wide range of products including digital cameras, mobile phone accessories, and wearable technology. Recently, GoPro reported a record-breaking fourth quarter Non-GAAP earnings per share (EPS) of $0.12 in 2023, exceeding the expectations of $0.09. GoPro attributed this impressive performance to strong global demand for its products, as well as successful cost management initiatives.

Overall, GoPro’s impressive fourth quarter results demonstrate the company’s ability to remain competitive in a highly competitive market and its ability to deliver great products to its customers. With a strong customer base and increasing demand for its products, GoPro is well-positioned to continue to report strong earnings in the coming quarters.

Price History

GoPro reported record-breaking Q4 non-GAAP Earnings Per Share (EPS) of $0.12 in 2023, at a time when media exposure for the company is mostly negative. Despite the negative news, on Thursday, GoPro stock opened at $6.4 and closed at $6.5, up by 2.5% from its prior closing price of 6.3. The performance of GoPro has been remarkable over the past year, considering the uncertain economic environment due to the pandemic. The increase in earnings is largely attributed to strong sales of its products and services, as well as the successful launch of new products. The strong performance of GoPro in Q4 is a testament to the company’s focus on innovation. The company has been continually introducing new products and services to meet the changing needs of their customers. This strategy has enabled them to stay ahead of the competition, and capitalize on new opportunities in the market.

In addition to the strong performance in Q4, GoPro has also reported positive numbers for its full year 2023 results. This indicates that the company’s strategy of focusing on product innovation is paying off and has resulted in higher earnings for the company. GoPro’s strong performance in Q4 and the full year 2023 results are a clear indication that the company is on track to achieve its long-term growth objectives. The company has continued to focus on innovation, which has enabled them to stay ahead of competition and capture new opportunities in the market. The positive news from GoPro has provided investors with a reason to stay upbeat about the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gopro. More…

| Total Revenues | Net Income | Net Margin |

| 1.16k | 78.4 | 6.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gopro. More…

| Operations | Investing | Financing |

| 144.03 | -53.9 | -166.36 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gopro. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.09k | 486.98 | 3.9 |

Key Ratios Snapshot

Some of the financial key ratios for Gopro are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.7% | 0.7% | 8.1% |

| FCF Margin | ROE | ROA |

| 12.0% | 9.9% | 5.4% |

Analysis

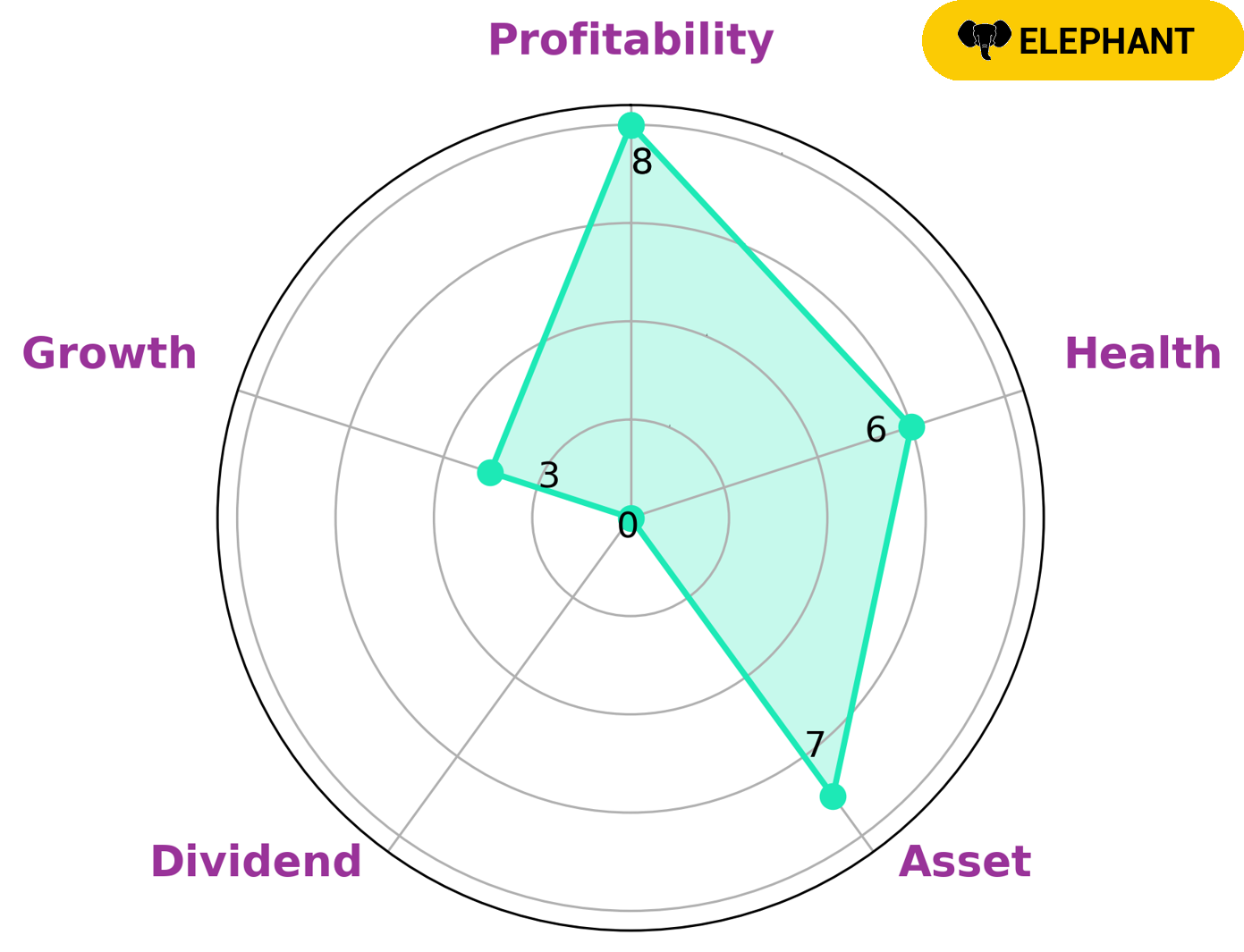

GoodWhale has conducted an analysis of GOPRO‘s wellbeing, using the Star Chart system. According to this analysis, GOPRO maintains an intermediate health score of 6 out of 10. This score indicates that the company has enough cashflow and manageable debt to sustain future operations in times of crisis. GOPRO is classified as an ‘elephant’ type of company, meaning that it has a strong asset base after deducting liabilities. This makes it attractive to certain types of investors, such as value investors who are looking to invest in companies with tangible assets. GOPRO is also strong in terms of profitability, making it suitable for income investors who are seeking a steady stream of profits. On the other hand, GOPRO is weak in terms of dividends and growth potential, so it may not be suitable for investors who are looking for these aspects. However, if the company can continue to focus on improving its cashflow and asset base, then it could become a more attractive prospect for investors. Overall, GOPRO is an intermediate health company that has some attractive features for certain types of investors. More…

Peers

In recent years, GoPro Inc has faced stiff competition from Sonos Inc, B&C Speakers SpA, Bang & Olufsen A/S, and other companies in the market for portable speakers. GoPro Inc has responded by innovating its product line and expanding its market share.

– Sonos Inc ($NASDAQ:SONO)

Sonos Inc is a publicly traded company that manufactures and sells wireless speakers and home audio systems. As of 2022, the company has a market capitalization of 1.81 billion dollars and a return on equity of 11.22%. Sonos was founded in 2002 and is headquartered in Santa Barbara, California. The company sells its products through a network of retailers and distributors worldwide.

– B&C Speakers SpA ($LTS:0OM7)

B&C Speakers SpA is a leading manufacturer of professional loudspeakers, PA systems, and related products. The company has a market cap of 118.99M as of 2022 and a Return on Equity of 25.26%. B&C Speakers SpA’s products are used in a wide range of applications, including live sound, recording, broadcast, and installed sound. The company’s products are sold through a network of authorized dealers and distributors worldwide.

– Bang & Olufsen A/S ($OTCPK:BGOUF)

Bang & Olufsen A/S is a world-renowned provider of high-end audio and visual products. The company has a market capitalization of 136.77 million as of 2022 and a return on equity of -4.5%. Bang & Olufsen was founded in 1925 and is headquartered in Denmark. The company’s products are sold in more than 100 countries worldwide. Bang & Olufsen is best known for its innovative, high-quality audio and visual products. The company’s product portfolio includes televisions, radios, sound systems, and portable speakers. Bang & Olufsen is committed to providing its customers with the best possible experience. The company’s products are designed to meet the needs of its customers and to exceed their expectations.

Summary

GoPro is a leading technology company in the action camera industry. The company recently reported record-breaking fourth quarter non-GAAP earnings per share (EPS) of $0.12, which is up from the previous year. Despite this positive news, the media attention surrounding the company has been mostly negative. For investors considering GoPro stock, it is important to consider the potential risks associated with investing in a technology company. The company faces competition from other camera manufacturers and could be affected by changes in consumer preferences.

Additionally, the company has a high debt-to-equity ratio, which could be a red flag for potential investors. Analyzing the financials of the company and understanding the competitive landscape are essential to making an informed decision when considering investing in GoPro.

Recent Posts