Exponent Intrinsic Value Calculation – EXPONENT Reports 10.5% Revenue Increase for Fourth Quarter of FY2022

April 1, 2023

Earnings Overview

On February 2, 2023, EXPONENT ($NASDAQ:EXPO) revealed that their total revenue for the fourth quarter of FY2022, concluding on December 31, 2022, had increased 10.5% to USD 22.5 million, compared to the same period in the prior year. Furthermore, their net income reported had grown 12.2% to USD 127.4 million year-over-year.

Transcripts Simplified

Highlighting our focused recruiting, utilization for the year was 69%, down from 70% in the same period a year ago as we continue to balance headcount growth and utilization. The realized rate increase was approximately 4% for the full year as compared to the same period a year ago. In the fourth quarter of 2022, cash from operations was $40.6 million and capital expenditures were $2.9 million. During the quarter, we distributed $12.2 million to shareholders through dividend payments and repurchased $13.2 million of common stock at an average price of $87.76.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Exponent. exponent-reports-10.5%-revenue-increase-for-fourth-quarter-of-fy2022″>More…

| Total Revenues | Net Income | Net Margin |

| 513.29 | 102.33 | 22.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Exponent. exponent-reports-10.5%-revenue-increase-for-fourth-quarter-of-fy2022″>More…

| Operations | Investing | Financing |

| 93.81 | -12.04 | -215.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Exponent. exponent-reports-10.5%-revenue-increase-for-fourth-quarter-of-fy2022″>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 586.66 | 265.91 | 6.33 |

Key Ratios Snapshot

Some of the financial key ratios for Exponent are shown below. exponent-reports-10.5%-revenue-increase-for-fourth-quarter-of-fy2022″>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.2% | 18.3% | 27.4% |

| FCF Margin | ROE | ROA |

| 15.9% | 27.5% | 15.0% |

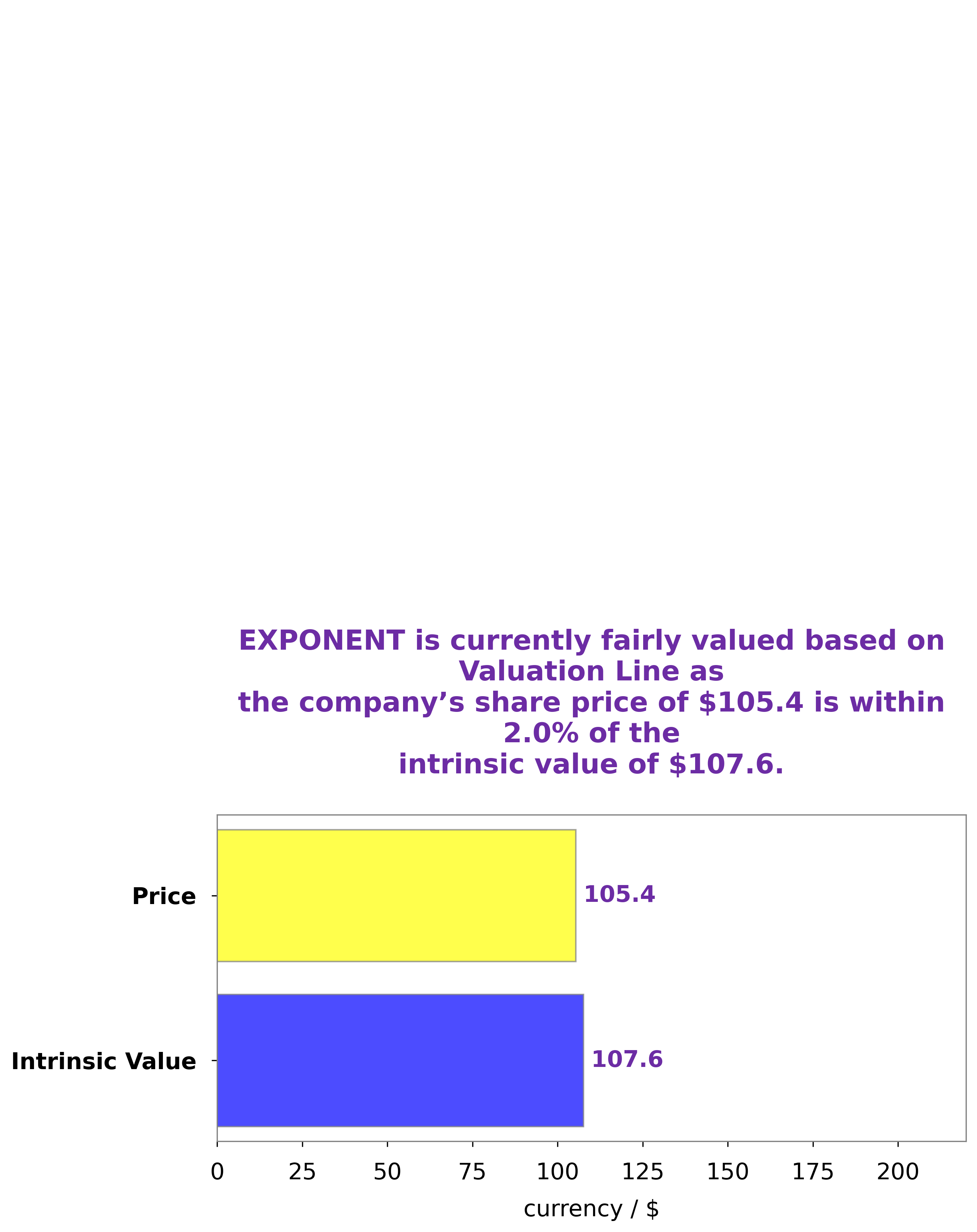

Market Price

As a result, EXPONENT’s stock opened at $103.5 and closed at $105.4, up by 1.8% from its last closing price of 103.6. The company credited its fourth-quarter success to its focus on innovation and product development, as well as its expansion into new markets. EXPONENT is now well-positioned for further growth and profitability in the coming years, as the company continues to pursue its ambitious goals of becoming a market leader in its industry.

This further indicates the company’s success in its strategic objectives and should be seen as a positive sign for investors, as it is further proof that the company is on track to achieving its goals. With the continued focus on innovation and expansion into new markets, there should be no doubt that the company is set to become an even bigger success in the years to come. exponent-reports-10.5%-revenue-increase-for-fourth-quarter-of-fy2022″>Live Quote…

Analysis – Exponent Intrinsic Value Calculation

At GoodWhale, we analyzed the fundamentals of EXPONENT and our proprietary Valuation Line resulted in a fair value of about $107.6 for each share. Currently, the EXPONENT stock is traded at $105.4, indicating that it is undervalued by 2.1%. We believe this presents an opportunity to purchase a quality stock at an attractive price. exponent-reports-10.5%-revenue-increase-for-fourth-quarter-of-fy2022″>More…

Peers

With over 3,000 employees in more than 85 offices around the world, Exponent has the breadth and depth of expertise to support our clients with multidisciplinary solutions to solve the most complex problems. We work with a range of clients in the oil and gas, chemical, pharmaceutical, power, manufacturing, and technology industries, as well as government agencies and nonprofit organizations.

– Zhenhai Petrochemical Engineering Co Ltd ($SHSE:603637)

Zhenhai Petrochemical Engineering Co Ltd is a Chinese company that provides engineering, procurement, and construction services to the petrochemical industry. The company has a market capitalization of 2.09 billion as of 2022 and a return on equity of 5.9%. Zhenhai Petrochemical Engineering Co Ltd is a publicly traded company listed on the Shanghai Stock Exchange.

– Sino Daan Co Ltd ($SZSE:300635)

Sino Daan Co Ltd is a company that manufactures and sells electronic products. The company has a market cap of 1.92B as of 2022 and a return on equity of 3.86%. The company’s products include mobile phones, tablets, laptops, and other electronic devices.

– Wison Engineering Services Co Ltd ($SEHK:02236)

Wison Engineering Services Co Ltd has a market cap of 1.12B as of 2022. The company provides engineering, procurement, and construction services in China. It has a Return on Equity of -2.43%.

Summary

EXPONENT‘s fourth quarter results for the fiscal year ending December 31, 2022, show impressive growth in both total revenue and net income. Total revenue was USD 22.5 million, a 10.5% increase compared to the same period in the previous year, while net income reported was USD 127.4 million, representing a 12.2% year-over-year growth. This shows that EXPONENT is continuing to experience strong financial performance and is a good investment option for investors. EXPONENT’s future financial prospects look promising and the company is likely to continue to perform well in the future.

Recent Posts