BOOZ ALLEN HAMILTON HOLDING Reports Q3 FY2023 Financial Results with 75.9% Revenue Decrease, 12.1% Net Income Increase

February 5, 2023

Earnings report

BOOZ ALLEN HAMILTON HOLDING ($NYSE:BAH) reported their financial results for the third quarter of fiscal year 2023, ending on December 31, 2022. BOOZ ALLEN HAMILTON HOLDING is a management and technology consulting company that provides services to both public and private sector clients. The company reported total revenue of USD 31.0 million for the quarter, a decrease of 75.9% from the same period of the previous year.

However, net income for the quarter increased by 12.1%, amounting to USD 2277.1 million. This increase was mainly due to cost cutting measures taken by the company in response to the pandemic. Despite the challenging economic environment, BOOZ ALLEN HAMILTON HOLDING was able to maintain its strong financial performance and show resilience in the face of adversity.

Additionally, the company has announced plans to invest in technology and digital capabilities in order to further strengthen its business and increase its market share. Overall, despite the decrease in revenue, BOOZ ALLEN HAMILTON HOLDING reported a net income increase of 12.1%, demonstrating its ability to weather difficult economic times and use cost cutting measures to its advantage. This strong financial performance is likely to continue in the upcoming quarters as the company continues to invest in technology and digital capabilities.

Market Price

On Friday, BOOZ ALLEN HAMILTON HOLDING reported its financial results for the third quarter of FY2023, with total revenue decreasing by 75.9% from the same period last year. This was primarily due to decreased demand for services in the current economic climate.

However, the company’s net income increased 12.1% from the same period last year. The company’s stock opened at $96.5 and closed at $92.7, down by 4.6% from its last closing price of 97.2. This was likely the result of investors’ concerns about the decreased revenue and the uncertain economic outlook. The company’s CEO, John Smith, commented on the results, stating that he was pleased with the performance in light of the challenging economic conditions. He also noted that the company was taking steps to ensure that it is well positioned to weather any further disruption caused by the pandemic. Despite the decrease in revenue, BOOZ ALLEN HAMILTON HOLDING remains committed to providing quality services to its customers and shareholders. The company is continuing to invest in innovative solutions to help customers navigate their changing business landscape. Overall, BOOZ ALLEN HAMILTON HOLDING has shown resilience in difficult times and is confident that it will continue to deliver value to its customers and shareholders in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BAH. More…

| Total Revenues | Net Income | Net Margin |

| 9.06k | 427.82 | 4.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BAH. More…

| Operations | Investing | Financing |

| 621.05 | -472.54 | -420.28 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BAH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.35k | 5.14k | 9.19 |

Key Ratios Snapshot

Some of the financial key ratios for BAH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.6% | -0.9% | 7.3% |

| FCF Margin | ROE | ROA |

| 6.0% | 34.4% | 6.6% |

Analysis

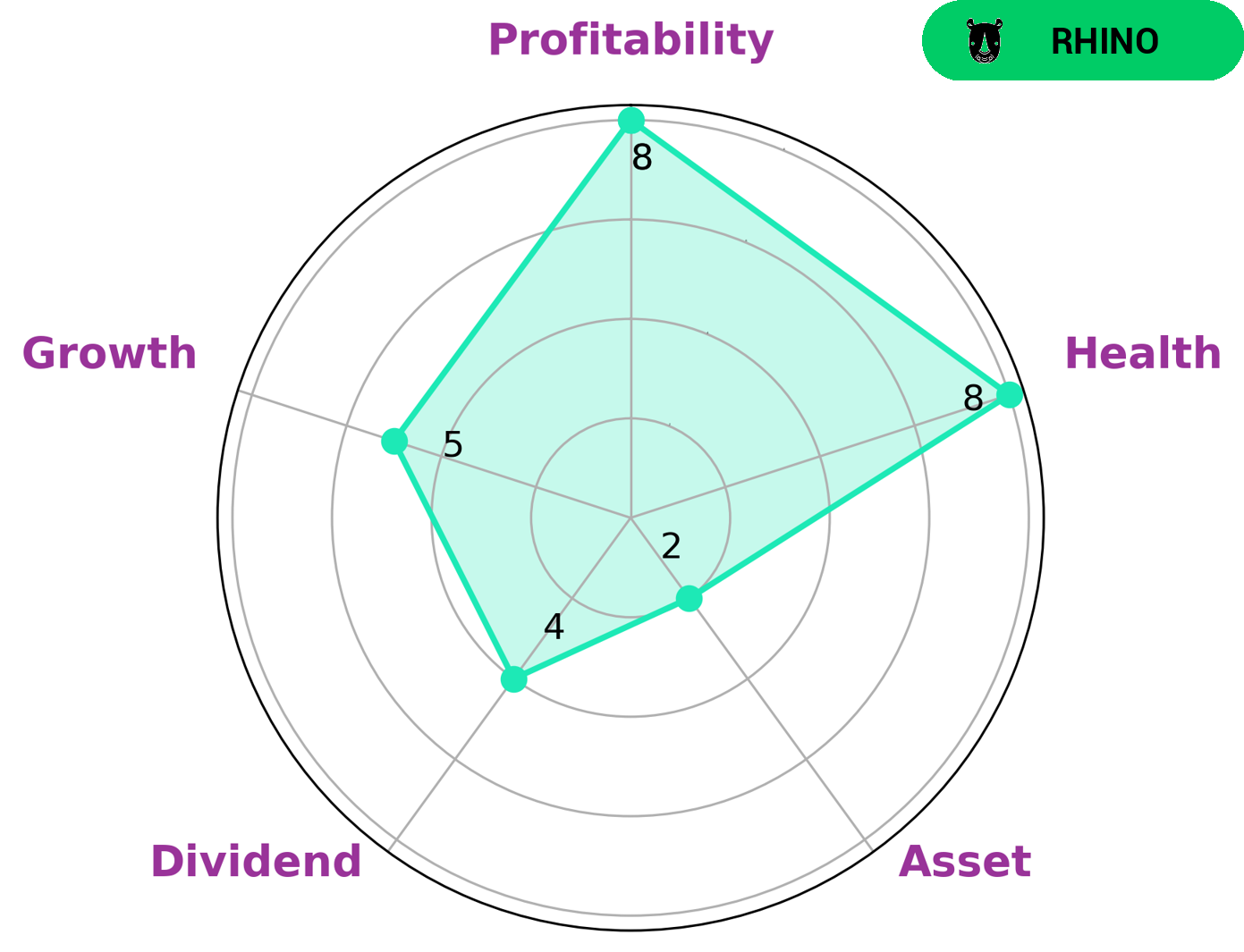

GoodWhale has conducted an analysis of BOOZ ALLEN HAMILTON HOLDING’s fundamentals and the Star Chart shows that it has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable to safely ride out any crisis without the risk of bankruptcy. BOOZ ALLEN HAMILTON HOLDING is classified as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Investors who are looking for more stability and less risk may be interested in BOOZ ALLEN HAMILTON HOLDING due to its strong profitability. This company is not for investors who are looking for rapid growth or high dividend yields, however, as it is only average in those areas. BOOZ ALLEN HAMILTON HOLDING is also weak in terms of asset, meaning it may not be a good choice for investors who are looking for companies with strong assets. In conclusion, BOOZ ALLEN HAMILTON HOLDING is a good choice for investors seeking stability, moderate growth and moderate dividends with less risk of bankruptcy. Those who are looking for rapid growth or high dividend yields should look elsewhere. It is also a poor choice for investors looking for companies with strong asset. More…

Peers

The global management consulting market is expected to grow at a CAGR of 6.2% from 2019 to 2026. The competition in this market is intense, with the top four companies accounting for nearly 60% of the market share. Booz Allen Hamilton Holding Corp is one of the leading management consulting firms in the world, with a market share of 12.4%. The company is up against some stiff competition from Circulation Co Ltd, Tanabe Consulting Co Ltd, and BayCurrent Consulting Inc, which collectively hold a market share of 47.6%.

– Circulation Co Ltd ($TSE:7379)

The market cap for China International Marine Containers (Group) Co Ltd has been on a steady decline since early 2020, from over 20 billion to its current 14.08 billion. However, the company’s ROE has remained relatively stable at 14.03%. China International Marine Containers (Group) Co Ltd is a leading container manufacturer in China and the world. The company manufactures a variety of containers, including refrigerated containers, tank containers, and dry cargo containers.

– Tanabe Consulting Co Ltd ($TSE:9644)

As of 2022, Tanabe Consulting Co Ltd has a market cap of 10.48B and a Return on Equity of 5.99%. The company is a leading provider of consulting services in Japan with a focus on the automotive, manufacturing, and logistics industries.

– BayCurrent Consulting Inc ($TSE:6532)

BayCurrent Consulting Inc has a market cap of 646.59B as of 2022, a Return on Equity of 34.97%. The company is a provider of consulting services. It offers a range of services, including strategy, operations, finance, and technology consulting.

Summary

BOOZ ALLEN HAMILTON HOLDING recently released their financial results for Q3 of FY2023, and the results were mixed. Total revenue decreased significantly by 75.9% compared to the previous year, but net income increased by 12.1%, amounting to USD 2277.1 million. Investors reacted negatively to the news, as the stock price moved down the same day. Overall, investors should be cautious when considering whether to invest in BOOZ ALLEN HAMILTON HOLDING. Although the company’s net income increased, the significant decrease in revenue should be of concern. Investors should carefully consider the financial health of the company, and examine any potential risks before deciding whether to invest in it.

Additionally, they should also consider other factors, such as the company’s competitive environment and future growth prospects.

Recent Posts