Sembcorp Industries Stock Fair Value – Sembcorp Acquires 428 MW of Wind Projects in China and India

December 17, 2023

🌥️Trending News

Sembcorp Industries ($SGX:U96) is a global energy, marine, and urban development group, based in Singapore. It is one of the leading conglomerates in the Asia-Pacific region and is active across multiple industries, including energy, water, and industrial park development. Recently, Sembcorp has announced the acquisition of 428 megawatts of wind power projects in both China and India. This move marks a significant development in Sembcorp’s renewable energy portfolio. These acquisitions will bring Sembcorp’s total renewable energy portfolio to more than 2 gigawatts and will diversify its global energy portfolio.

It also demonstrates Sembcorp’s commitment to transitioning towards clean energy sources and reducing its carbon footprint. The company is also expanding its renewable energy portfolio with investments in other sources, such as solar energy. It will also help the company to reach its goals of developing a cleaner and more efficient energy future.

Market Price

On Monday, SEMBCORP INDUSTRIES saw their stock open at SG$5.2 and close at SG$4.9, a 6.2% dip from the prior closing price of 5.2. This news comes shortly after the international utilities and marine group announced their acquisition of 428 megawatts worth of wind projects in both China and India. The acquisition also bolsters their existing portfolio of renewable energy assets across South and South East Asia. It is likely that this news will improve Sembcorp’s stock price and performance in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sembcorp Industries. More…

| Total Revenues | Net Income | Net Margin |

| 7.58k | 888 | 12.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sembcorp Industries. More…

| Operations | Investing | Financing |

| 1.83k | -1.32k | -838 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sembcorp Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.46k | 10.7k | 2.52 |

Key Ratios Snapshot

Some of the financial key ratios for Sembcorp Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.9% | 51.5% | 19.9% |

| FCF Margin | ROE | ROA |

| 13.4% | 22.3% | 6.1% |

Analysis – Sembcorp Industries Stock Fair Value

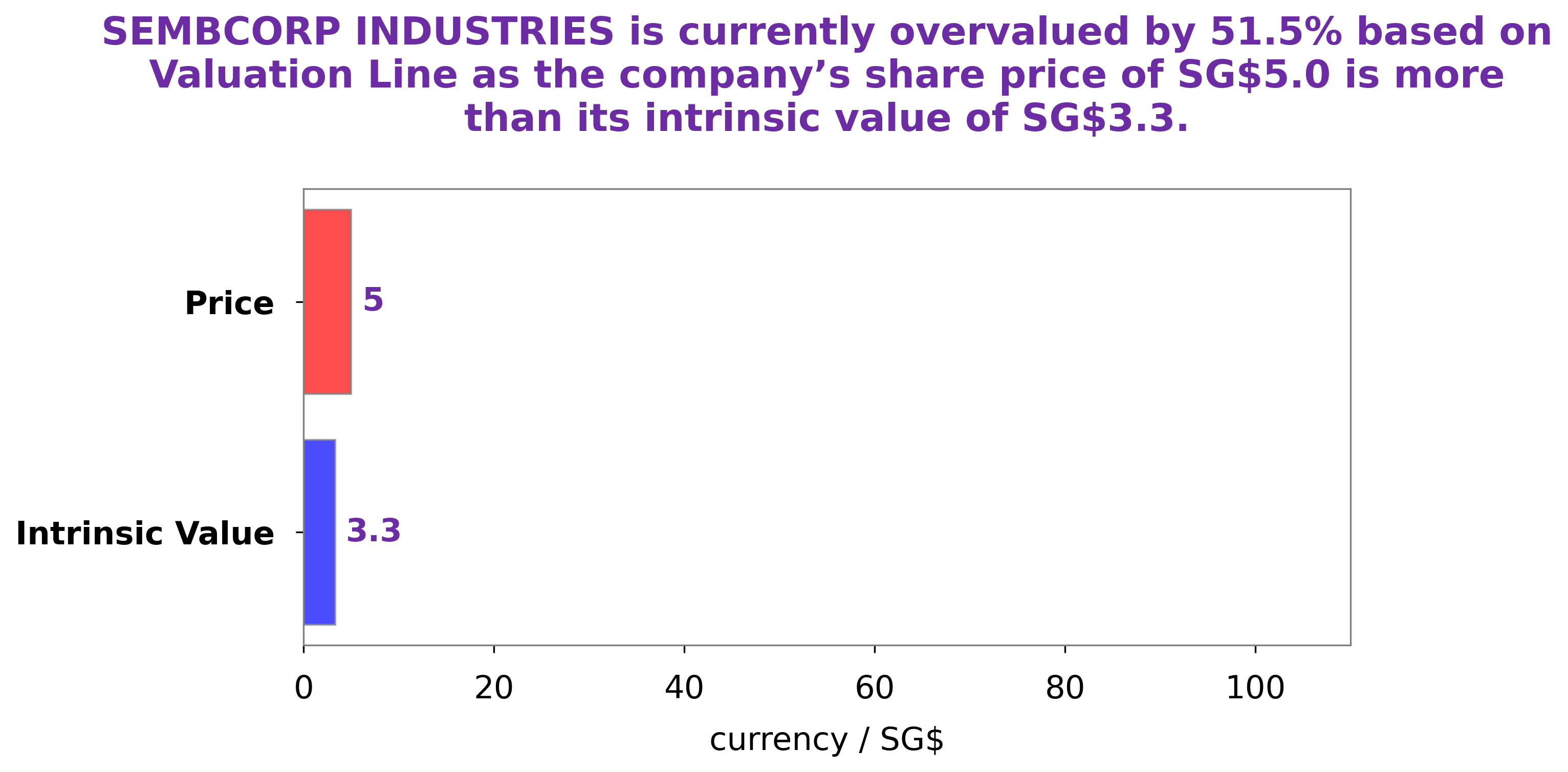

At GoodWhale, we have conducted an extensive analysis of SEMBCORP INDUSTRIES‘s wellbeing. Using our proprietary Valuation Line, we have calculated the fair value of SEMBCORP INDUSTRIES share to be around SG$3.1. However, the current market value of SEMBCORP INDUSTRIES stock stands at SG$4.9, which is significantly overvalued by 58.5%. We believe that investors should be aware of the significant discrepancy between the fair value and current market price of SEMBCORP INDUSTRIES stock. More…

Peers

Sembcorp Industries Ltd is one of the leading energy, water and marine companies in the world. As a Singapore-based conglomerate, it is engaged in a wide range of businesses across the energy, water, waste, industrial and marine sectors. Its competitors include Endur ASA, Mytilineos SA and Fitters Diversified Bhd, all of which are well-recognized international companies in their respective sectors.

– Endur ASA ($LTS:0JGO)

Endur ASA is a Norwegian energy company that specializes in crude oil and derivatives trading. The company has a market capitalization of 962.36M as of 2022 and a Return on Equity (ROE) of 5.71%. Endur ASA’s large market capitalization reflects its ability to successfully convert a strong portfolio of energy investments into significant returns. The company’s ROE of 5.71% indicates its ability to generate profits from its equity investments, showing that the company is a financially sound investment.

– Mytilineos SA ($OTCPK:MYTHY)

Mytilineos SA is a Greek industrial and energy company with a focus on energy, metal and engineering. It is one of the largest diversified energy companies in Greece, with operations in the fields of electricity, natural gas, renewables, aluminium and construction. With a market cap of 2.91B as of 2022, Mytilineos SA is one of the top companies in Greece. Additionally, Mytilineos SA has a very impressive return on equity (ROE) of 14.63%, which is significantly higher than the industry average. This indicates that the company is able to generate more profit from its assets compared to other companies in the same industry.

– Fitters Diversified Bhd ($KLSE:9318)

Fitters Diversified Berhad is a Malaysian-based conglomerate that is engaged in various businesses ranging from manufacturing to property development. The company has a market capitalization of 66.88 million as of 2022 and a Return on Equity of -2.15%. Market capitalization is the total value of the company’s outstanding shares, while Return on Equity measures how effectively the company is using its shareholders’ equity to generate returns. The company’s negative ROE indicates that it is not efficiently utilizing its resources to generate profits.

Summary

SEMBCORP Industries is a Singapore-based energy, marine, and urban solutions provider with operations in Asia, Middle East, and Africa. Recently, the company announced that it will acquire two wind power projects in China and India, totaling 428 MW in capacity. This will diversify the company’s energy portfolio and provide a stable source of renewable energy. In response to this news, the stock price dropped on the same day, suggesting that investors may not be convinced by the move.

Nevertheless, with the Singapore government’s commitment to reducing carbon emissions, SEMBCORP Industries may see long-term returns from its investments in renewable energy. Investors should consider the potential risks and rewards of investing in the company before making a decision.

Recent Posts