RCM Technologies Reports Record Q1 Revenue of $67.1M

April 29, 2023

Trending News 🌥️

The growth in revenue was driven largely by strong demand for their products and services, along with a more efficient pricing structure. The exceptional financial performance has resulted in RCM ($NASDAQ:RCMT) Technologies being one of the most profitable businesses in the industry and is a clear indication of the company’s ability to deliver innovative solutions to its customers and maintain a competitive edge in the market. The impressive results demonstrate RCM Technologies’ commitment to delivering value to its shareholders and stakeholders through robust growth, operational excellence, and customer satisfaction. The success of RCM Technologies has been attributed to its comprehensive product portfolio, which includes software, hardware, and cloud-based solutions. The company has also invested heavily in research and development to ensure its offerings are up-to-date and meet customer demands.

Additionally, RCM Technologies has a strong presence in the market given its partnerships with a range of major players such as Microsoft and Amazon. This impressive performance reflects investors’ confidence in the potential of RCM Technologies as well as its ability to continue to deliver strong financial results.

Price History

The company’s stock opened at $11.5, however, it closed the day at $11.2, down by 2.7% from previous closing price of 11.6. This dip in stock price could be attributed to an overall sluggish trend in the market, which has had an impact on many companies. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rcm Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 284.68 | 20.89 | 7.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rcm Technologies. More…

| Operations | Investing | Financing |

| 28.44 | -4.98 | -23.13 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rcm Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 87.96 | 56 | 3.73 |

Key Ratios Snapshot

Some of the financial key ratios for Rcm Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.2% | 63.1% | 10.0% |

| FCF Margin | ROE | ROA |

| 10.0% | 48.5% | 20.2% |

Analysis

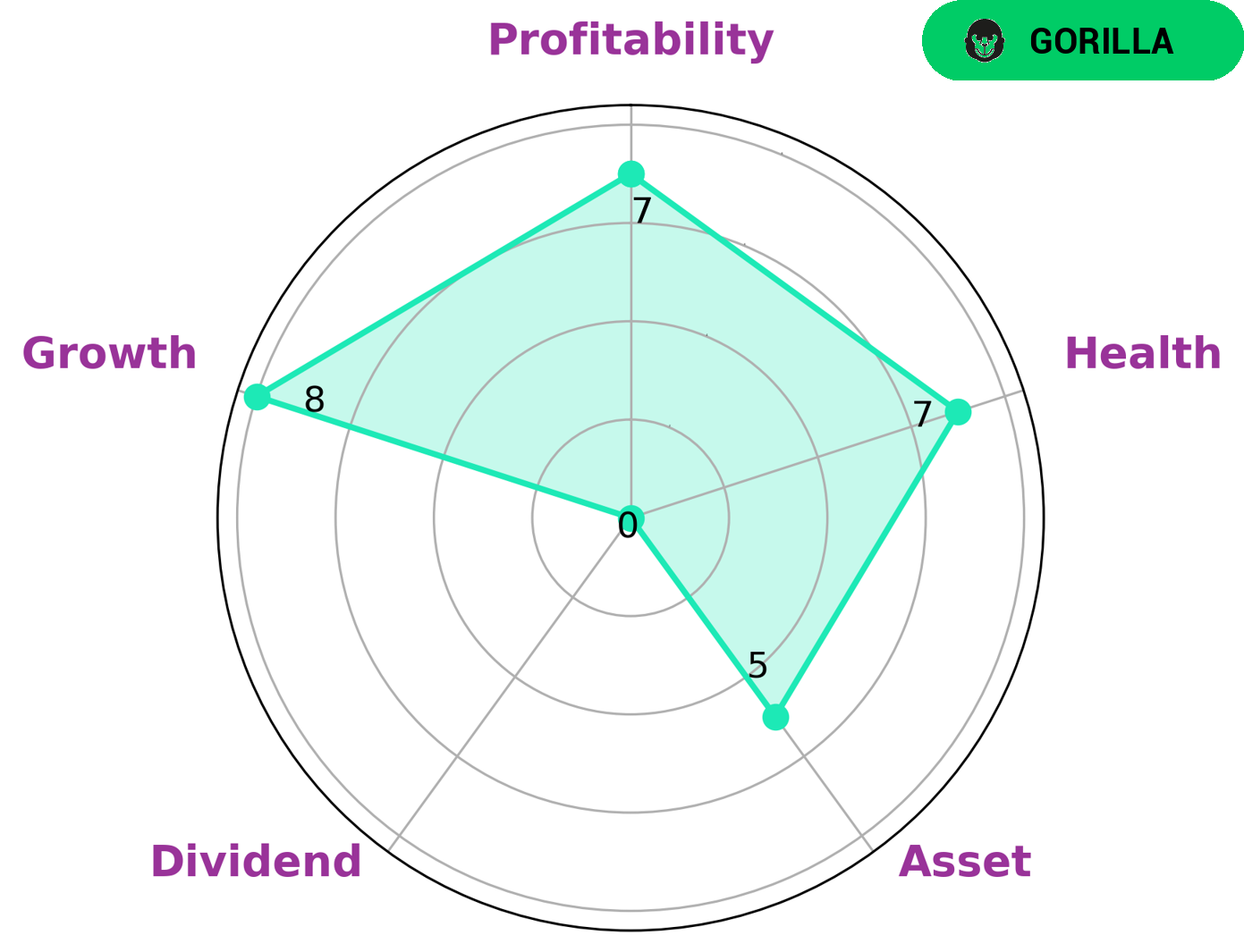

GoodWhale was used to analyze RCM TECHNOLOGIES‘s financials. Upon analysis of the Star Chart, RCM TECHNOLOGIES has strong growth, profitability, and medium asset. Moreover, it has a weak dividend rate. Additionally, its Health Score of 7/10 indicates that it is capable to sustain future operations in times of crisis. Furthermore, based on its strong competitive advantage, RCM TECHNOLOGIES is classified as a “gorilla”. In conclusion, RCM TECHNOLOGIES is an attractive option for investors. It has the potential to provide not only stable and high return on investments but also to remain competitive in times of crisis. Investors that are looking for stable and growing returns should consider RCM TECHNOLOGIES as a viable option. More…

Peers

The company has a strong presence in North America, Europe, and Asia. RCM Technologies Inc’s competitors include Jangho Group Co Ltd, Calian Group Ltd, and Peoplein Ltd.

– Jangho Group Co Ltd ($SHSE:601886)

JHG is a leading investment company with a focus on the healthcare sector. The company has a market capitalization of 8.92 billion as of 2022 and a return on equity of -9.2%. JHG has a diversified portfolio of healthcare investments, including hospitals, clinics, and nursing homes. The company also has a significant presence in the pharmaceutical and biotechnology industries.

– Calian Group Ltd ($TSX:CGY)

Calian Group Ltd is a Canadian professional services company with over 30 years of experience in the provision of health, training, and technology solutions. The company has a market cap of 648.65M as of 2022 and a Return on Equity of 4.41%. Calian employs over 2,600 people in Canada, the United States, and the United Kingdom. The company’s health solutions include primary care, health promotion, and disease prevention services. Calian’s training solutions include online and classroom training, as well as simulation-based training. The company’s technology solutions include systems engineering, software development, and network integration services.

– Peoplein Ltd ($ASX:PPE)

As of 2022, Peoplein Ltd has a market cap of 310.55M and a Return on Equity of 13.79%. The company is a provider of human resources solutions and services.

Summary

Investors should consider that this growth in revenue can be attributed to a number of factors, namely the company’s focus on innovative technology and its ability to capitalize on market trends. Going forward, it is likely that RCM Technologies will continue to deliver strong returns as long as it maintains its competitive advantage. With a diverse customer base and healthy cash reserves, there is much potential for further growth in the coming quarters.

Recent Posts