3m Company Stock Fair Value Calculator – 3M Company [MMM] Revenue Drops 15.96% YTD, Closing at $100.78 on 05/11/23: What’s Next?

May 16, 2023

Trending News 🌥️

The 3M ($NYSE:MMM) Company NYSE: MMM closed the 5/11/23 trading session at $100.78, after a day of trading with a low of $99.80 and high of $101.20. The YTD revenue for the company has dropped 15.96% to $33.43 billion. This has raised the question of what is the next step for 3M Company. The company operates in various industries, such as consumer goods, healthcare, and industrial products. The company has seen its share of successes in recent years, but its current financial troubles have brought the stock price down to levels not seen in years.

Investors will be watching to see what strategies the company will employ to turn around its business and improve its performance. Since 3M operates in multiple industries, it could look to focus on its core business and streamline operations while finding new avenues of growth such as expanding into new markets or launching innovative products to bolster its revenue. Furthermore, the company could implement cost-cutting measures or increase its dividend payments to shareholders in order to boost investor confidence. Ultimately, investors should monitor the decisions and actions taken by 3M’s management to see if the company can overcome its current challenges and make a strong comeback in the near future.

Earnings

In the report, it was revealed that the company earned 8.03 billion USD in total revenue and 0.98 billion USD in net income. This marks a 9.1% decrease in total revenue and 24.6% decrease in net income compared to the previous year. Over the past three years, 3M COMPANY’s total revenue has dropped from 8.85 billion USD to 8.03 billion USD. Given this decrease in overall numbers, investors may be wondering what the future holds for 3M COMPANY.

While past performance can be informative, future predictions are difficult to make. It is certain, however, that continued growth and market success will depend on the company’s ability to adjust to changing market conditions and emerging trends.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 3m Company. More…

| Total Revenues | Net Income | Net Margin |

| 33.43k | 5.45k | 9.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 3m Company. More…

| Operations | Investing | Financing |

| 5.86k | -1.17k | -4.01k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 3m Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 46.89k | 31.54k | 27.73 |

Key Ratios Snapshot

Some of the financial key ratios for 3m Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.1% | -16.3% | 19.3% |

| FCF Margin | ROE | ROA |

| 12.1% | 26.9% | 8.6% |

Analysis – 3m Company Stock Fair Value Calculator

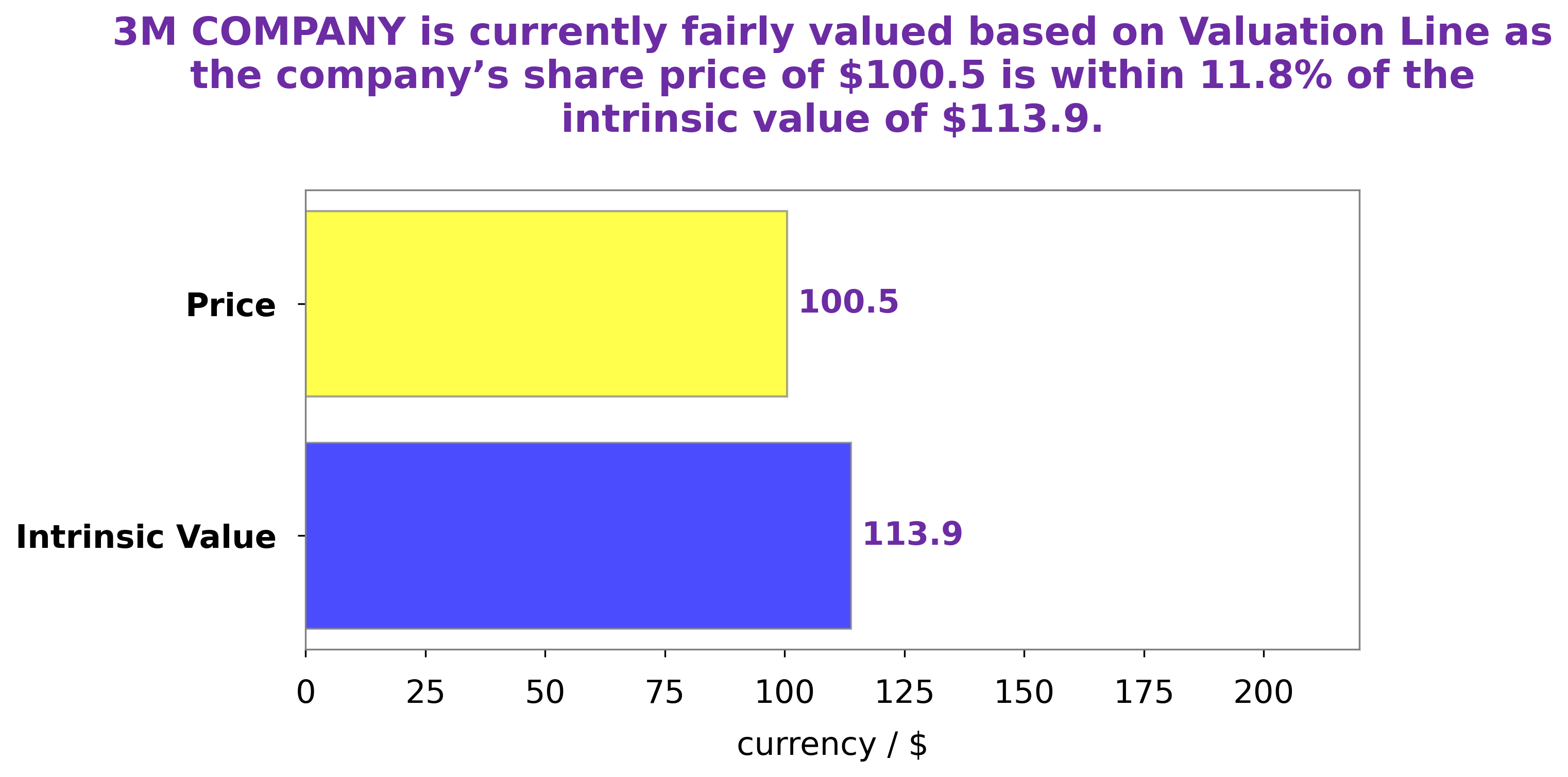

After conducting a comprehensive analysis of 3M COMPANY‘s fundamentals, our team at GoodWhale has determined that the fair value of its share is around $113.9. This figure was calculated using our proprietary Valuation Line. At the moment, 3M COMPANY stock is traded at $100.5, which is a fair price but undervalued by 11.8%. This makes it a great opportunity for investors looking to capitalize on a discounted investment. We recommend that investors take advantage of this golden opportunity and purchase the stock while it is undervalued. It is important to note, however, that 3M COMPANY might not remain undervalued for long and prices could eventually return to their fair value of $113.9. As such, it would be wise to keep an eye on the stock and act accordingly. More…

Peers

3M’s position as a market leader is under threat from a number of competitors. These include Honeywell International Inc, Illinois Tool Works Inc, and Eaton Corp PLC. All of these companies are competing for market share in the manufacturing sector. 3M will need to continue to innovate and produce high-quality products in order to stay ahead of its competitors.

– Honeywell International Inc ($NASDAQ:HON)

Honeywell International Inc. is an American multinational conglomerate company that produces commercial and consumer products, engineering services and aerospace systems. It operates in four segments: Aerospace, Building Technologies, Performance Materials & Technologies, and Safety & Productivity Solutions. The company was founded in 1906 and is headquartered in Morristown, New Jersey.

Honeywell’s market cap is $121.18 billion as of 2022 and its return on equity is 24.52%. The company’s strong financial performance is due in part to its diversified product portfolio and global reach. Honeywell’s products are used in a variety of industries, including aerospace, building technologies, performance materials, and safety and productivity solutions. The company has a presence in nearly 100 countries and serves customers in a wide range of markets.

– Illinois Tool Works Inc ($NYSE:ITW)

Illinois Tool Works Inc. is a diversified industrial company that specializes in a range of product businesses. The company operates in a number of markets, including automotive, food and beverage, construction, and energy. Illinois Tool Works has a market capitalization of $59.87 billion as of 2022 and a return on equity of 63.86%. The company’s products are used in a variety of applications, and it has a strong presence in a number of industries. Illinois Tool Works is a well-diversified company with a strong financial position.

– Eaton Corp PLC ($NYSE:ETN)

Eaton Corp PLC is a power management company with a market cap of 56.02B as of 2022. The company has a Return on Equity of 12.16%. Eaton Corp PLC provides power management solutions that help customers effectively manage electrical, hydraulic, and mechanical power. The company operates in four segments: Electrical Products, Industrial Automation, Hydraulics, and Aerospace.

Summary

3M Company (MMM) is a diversified technology company with a wide range of products and services. The company’s revenue for the year has seen a decrease of 15.96% to $33.43 billion. Investors should take note that 3M Company is actively engaged in cost-cutting and restructuring measures to improve profitability.

They should consider the company’s performance in light of its long-term strategic goals, technological innovations and overall financials. A further analysis of 3M Company’s competitors, and their respective products and services, can help provide investors with a realistic expectation of the company’s future prospects.

Recent Posts