3m Company Stock Fair Value – 3M CEO Ordered to Mediate Over Earplug Litigation

May 24, 2023

Trending News 🌧️

The 3M ($NYSE:MMM) Company, commonly referred to as 3M, is a diversified technology company with a global presence. In response to the litigation, a federal judge has ordered the CEO of 3M to mediate. The lawsuit alleges that the earplugs were defectively designed and that 3M knowingly sold them to the military despite knowing of their design flaws. As a result, many U.S. soldiers are now suffering from hearing loss and related conditions. The mediation has been mandated in order to see if the parties can reach a resolution prior to the case going to trial.

This could be beneficial for both sides as it would prevent additional costs and delays associated with a lengthy court process. 3M has yet to comment on the judge’s order, but its lawyers have stated they are open to finding an amicable solution. The 3M Company is now at an important juncture in its history, as the outcome of this lawsuit could have significant implications for its reputation and financial standing. It remains to be seen if the CEO will be able to reach a suitable agreement with those pursuing litigation over the earplugs.

Stock Price

On Tuesday, 3M COMPANY stock opened at $101.7 and closed at $100.7, a dip of 1.0% from the previous closing price of 101.7. This was in response to the news that the CEO of 3M had been ordered by a judge to personally mediate with lawyers who are suing the company over defective earplugs that were used by U.S. military personnel. The plaintiffs allege that the earplugs were too short, which caused them to enter too deeply into the ear canal thus failing to provide adequate protection from the sound of explosions and gunfire.

As a result, many service members have suffered hearing damage and tinnitus. 3M is currently facing a number of lawsuits related to the earplug issue and the outcome of these proceedings could significantly affect the company’s financial performance in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 3m Company. More…

| Total Revenues | Net Income | Net Margin |

| 33.43k | 5.45k | 9.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 3m Company. More…

| Operations | Investing | Financing |

| 5.86k | -1.17k | -4.01k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 3m Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 46.89k | 31.54k | 27.73 |

Key Ratios Snapshot

Some of the financial key ratios for 3m Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.1% | -16.3% | 19.3% |

| FCF Margin | ROE | ROA |

| 12.1% | 26.9% | 8.6% |

Analysis – 3m Company Stock Fair Value

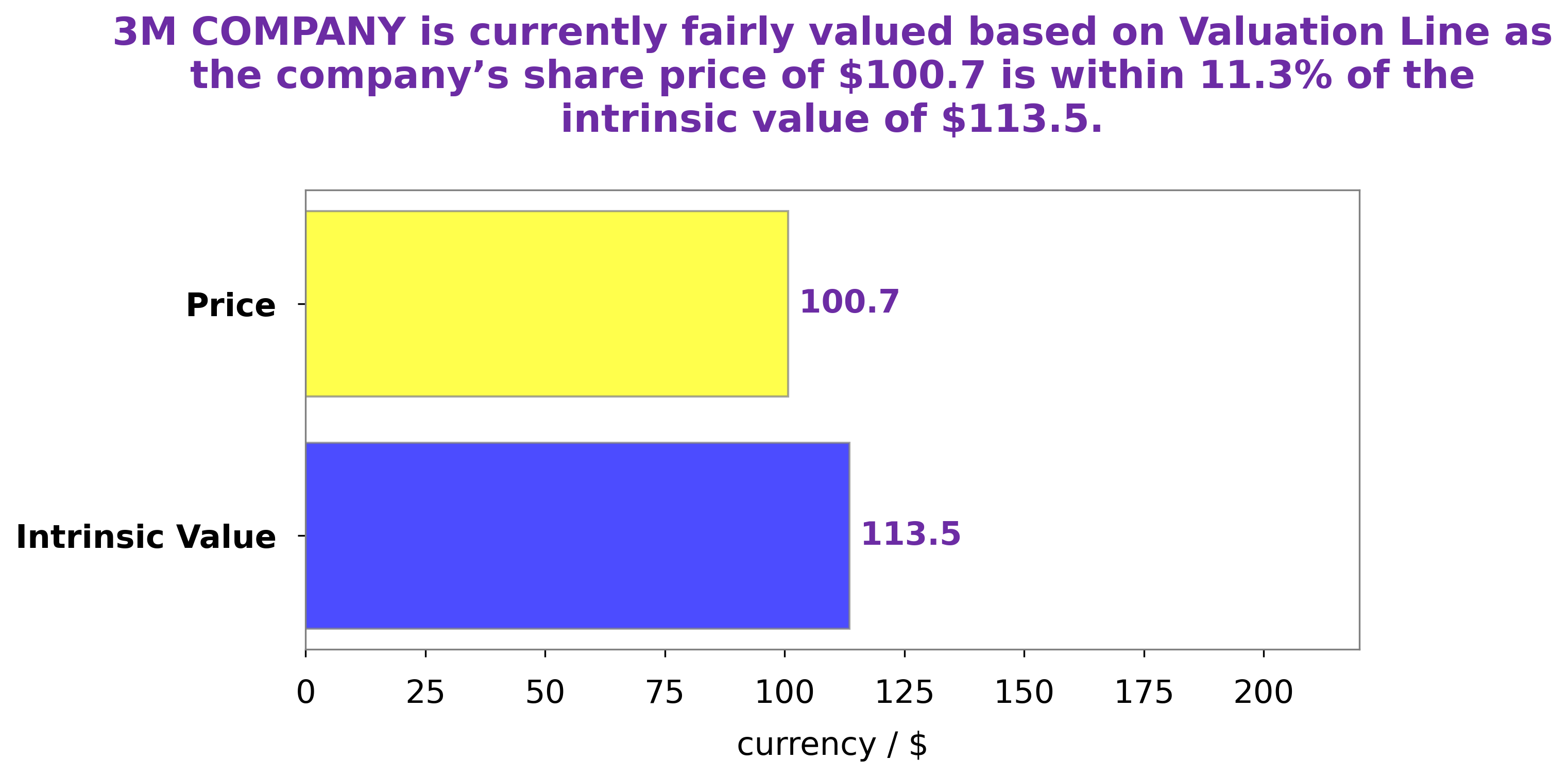

At GoodWhale, we have conducted an analysis of 3M COMPANY‘s fundamentals in order to make our assessment. After thorough review of the company’s financials, we have concluded that the fair value of 3M COMPANY shares is around $113.5. This calculation was made using our proprietary Valuation Line, which takes into account a range of factors including balance sheet metrics, financial ratios, and industry trends. Currently, 3M COMPANY stock is being traded at $100.7, which is a fair price that is undervalued by 11.3%. We believe that investors could potentially benefit from purchasing shares at this price as the stock may be poised to rise in value over time. More…

Peers

3M’s position as a market leader is under threat from a number of competitors. These include Honeywell International Inc, Illinois Tool Works Inc, and Eaton Corp PLC. All of these companies are competing for market share in the manufacturing sector. 3M will need to continue to innovate and produce high-quality products in order to stay ahead of its competitors.

– Honeywell International Inc ($NASDAQ:HON)

Honeywell International Inc. is an American multinational conglomerate company that produces commercial and consumer products, engineering services and aerospace systems. It operates in four segments: Aerospace, Building Technologies, Performance Materials & Technologies, and Safety & Productivity Solutions. The company was founded in 1906 and is headquartered in Morristown, New Jersey.

Honeywell’s market cap is $121.18 billion as of 2022 and its return on equity is 24.52%. The company’s strong financial performance is due in part to its diversified product portfolio and global reach. Honeywell’s products are used in a variety of industries, including aerospace, building technologies, performance materials, and safety and productivity solutions. The company has a presence in nearly 100 countries and serves customers in a wide range of markets.

– Illinois Tool Works Inc ($NYSE:ITW)

Illinois Tool Works Inc. is a diversified industrial company that specializes in a range of product businesses. The company operates in a number of markets, including automotive, food and beverage, construction, and energy. Illinois Tool Works has a market capitalization of $59.87 billion as of 2022 and a return on equity of 63.86%. The company’s products are used in a variety of applications, and it has a strong presence in a number of industries. Illinois Tool Works is a well-diversified company with a strong financial position.

– Eaton Corp PLC ($NYSE:ETN)

Eaton Corp PLC is a power management company with a market cap of 56.02B as of 2022. The company has a Return on Equity of 12.16%. Eaton Corp PLC provides power management solutions that help customers effectively manage electrical, hydraulic, and mechanical power. The company operates in four segments: Electrical Products, Industrial Automation, Hydraulics, and Aerospace.

Summary

Investors interested in 3M Company should be aware of the company’s recent involvement in a legal dispute. The company’s CEO was recently ordered to attend mandatory mediation for a litigation case over 3M’s alleged negligence and failure to warn consumers about the risks of using their own earplugs. The case is still ongoing and the outcome for 3M is uncertain.

In the short-term, investors can expect increased volatility in the share price as the case progresses. In the long-term, investors should consider 3M’s track record of financial performance, research & development, innovation, and successes in overseas markets when deciding whether or not to invest in the company.

Recent Posts