Juniper Networks Reports Q4 Revenue of $1 and Non-GAAP EPS of $0.65 In-Line.

February 7, 2023

Trending News 🌥️

Juniper Networks ($NYSE:JNPR) is a leading provider of networking, security, and automation technologies for service providers, enterprise customers and public sector customers. Its high-performance platform helps organizations to securely connect users, devices, and things across distributed networks. The company reported fourth-quarter non-GAAP earnings per share of $0.65, in line with expectations, while revenue of $1.3 billion exceeded estimates.

Stock Price

Juniper Networks reported its fourth-quarter revenue of $1 billion, in line with analysts’ expectations, and non-GAAP earnings per share of $0.65, also in line with estimates. The news was mostly negative, as the company saw a decline in revenue year-over-year. Despite the largely negative news, investors were not overly concerned and the stock opened at $32.0 on Tuesday and closed up 0.5% at $32.3 from the previous day’s closing price of $32.1.

We remain focused on delivering long-term value to our customers and shareholders through our differentiated portfolio of networking, security and cloud products and services.” Overall, investors were not overly concerned with the news and the stock closed at $32.3, up 0.5% from last closing price of 32.1. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Juniper Networks. More…

| Total Revenues | Net Income | Net Margin |

| 5.3k | 471 | 8.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Juniper Networks. More…

| Operations | Investing | Financing |

| 97.6 | 407.5 | -528.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Juniper Networks. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.33k | 4.85k | 13.37 |

Key Ratios Snapshot

Some of the financial key ratios for Juniper Networks are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.0% | 4.1% | 10.2% |

| FCF Margin | ROE | ROA |

| -0.1% | 7.8% | 3.6% |

VI Analysis

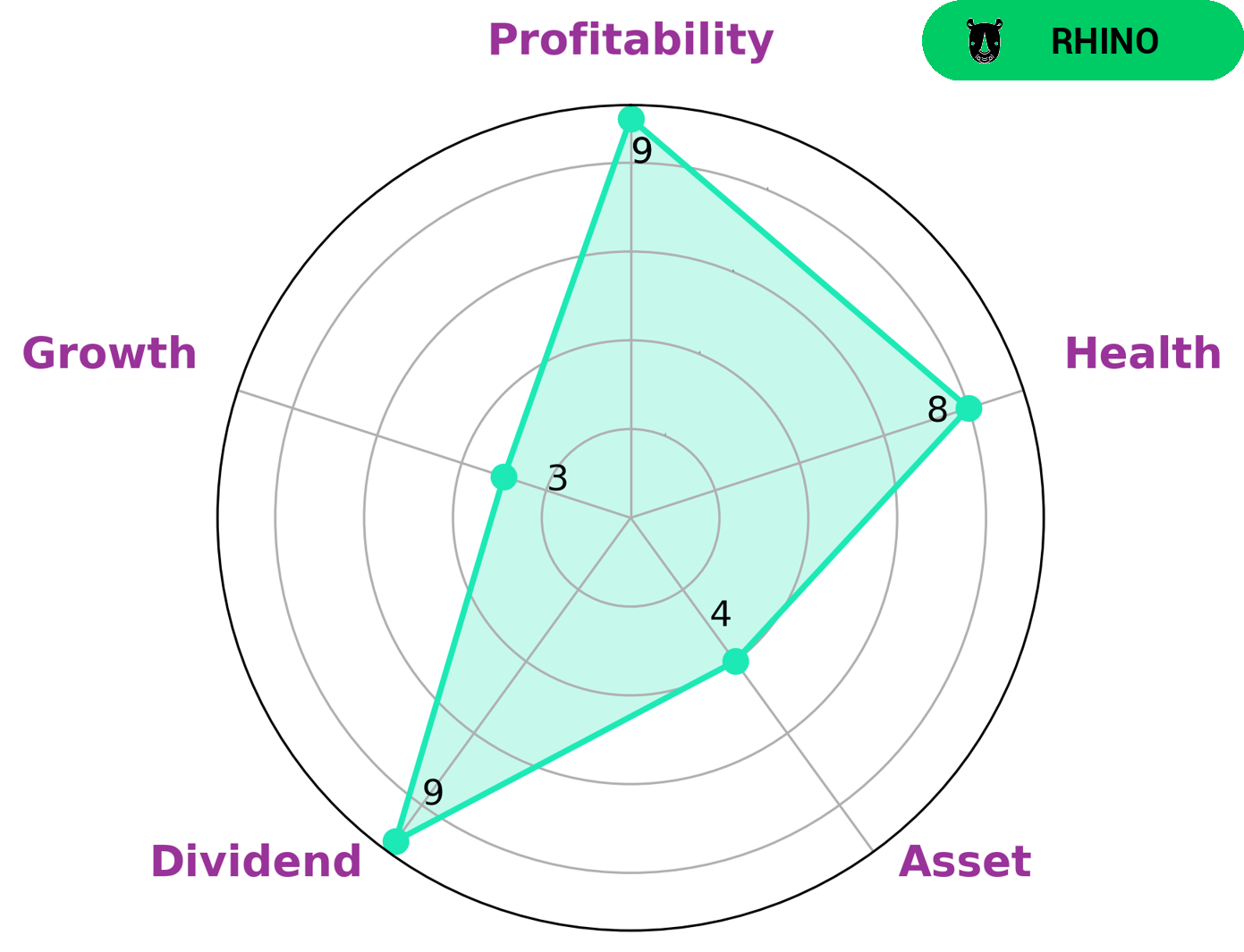

VI Star Chart’s analysis of JUNIPER NETWORKS‘ fundamentals reveals that the company is in good health, with a score of 8/10 for its cashflows and debt. This indicates that it has the capability to safely ride out any crisis without the risk of bankruptcy. JUNIPER NETWORKS is classified as a ‘rhino’ company, which means it has achieved moderate revenue and earnings growth. JUNIPER NETWORKS may be attractive to value investors, who seek to purchase stocks at a price lower than their intrinsic value or potential future value. The company is strong in dividend and profitability and medium in asset, but weak in growth. This makes it an ideal stock for value investors, who are looking for good dividend yields and stable investments.

Long term investors may also be interested in JUNIPER NETWORKS, as from a fundamental perspective, it appears to have good prospects for long term growth. The company’s cashflows and debt score of 8/10 suggest that it is in good financial health and is capable of riding out any market downturns. It is also strong in dividend and profitability, making it an attractive stock for value investors. Furthermore, its moderate revenue and earnings growth make it a good option for long term investors.

Peers

It’s main competitors are TPT Global Tech Inc, Unizyx Holdings, and Sangfor Technologies Inc. All three companies offer networking products and services, but Juniper Networks Inc is the clear leader in the industry. It has the most market share and the most innovative products.

– TPT Global Tech Inc ($OTCPK:TPTW)

TPT Global Tech Inc is a publicly traded company with a market capitalization of $1.75 million as of 2022. The company has a Return on Equity of 6.63%. TPT Global Tech Inc is a provider of global telecommunications solutions and services. The company offers a range of services, including voice, data, and video, to residential and business customers in the United States and internationally.

– Unizyx Holdings ($TWSE:3704)

Unizyx Holdings is a publicly traded company with a market capitalization of 12.59 billion as of 2022. The company has a return on equity of 12.15%. Unizyx Holdings is a holding company that operates businesses in the financial services, insurance, and investment industries. The company’s subsidiaries include Union Bank of Taiwan, Taiwan Insurance, and Uni-Investment.

– Sangfor Technologies Inc ($SZSE:300454)

Sangfor Technologies Inc is a global provider of information technology solutions. Its products and services include network security, cloud computing, and big data. The company has a market cap of 50.71B as of 2022 and a return on equity of -1.21%. It has operations in China, North America, Europe, Asia Pacific, and the Middle East.

Summary

Juniper Networks recently reported their fourth quarter financial results with revenue of $1 billion and non-GAAP earnings per share (EPS) of $0.65, which is in line with analysts’ expectations. The news has largely been negative as investors are concerned about the company’s prospects going forward. Juniper Networks is a market leader in networking technology and its products are used in data centers, telecommunications, security and other areas. However, the company faces stiff competition from other networking equipment providers and must continue to innovate to remain competitive.

Recent Posts