Warrior Met Coal Sees Increased Sales Volumes of 8% in Full Year

June 14, 2023

☀️Trending News

Warrior Met Coal ($NYSE:HCC) Inc. is a leading producer and exporter of high-quality metallurgical coal for the global steel industry. Based in Alabama, USA, the company primarily operates underground coal mines in Alabama’s Warrior Basin. This anticipated increase in sales volumes is a result of their robust production levels and strong customer demand. The company has reported that they have seen an increase in international orders and their coal shipments are expected to remain strong throughout the year. As the global steel industry continues to grow, Warrior Met Coal is confident that their demand will remain steady and consistent.

The company is also expecting to set new records for their production volumes in the coming year, which will help to further increase their sales volumes. With the anticipated 8% increase in sales volume, Warrior Met Coal is well positioned to remain one of the world’s leading producers and exporters of high-quality metallurgical coal. With a strong customer base, a diverse product portfolio, and an experienced management team, Warrior Met Coal is confident that they will continue to be a major player in the global steel industry for years to come.

Analysis

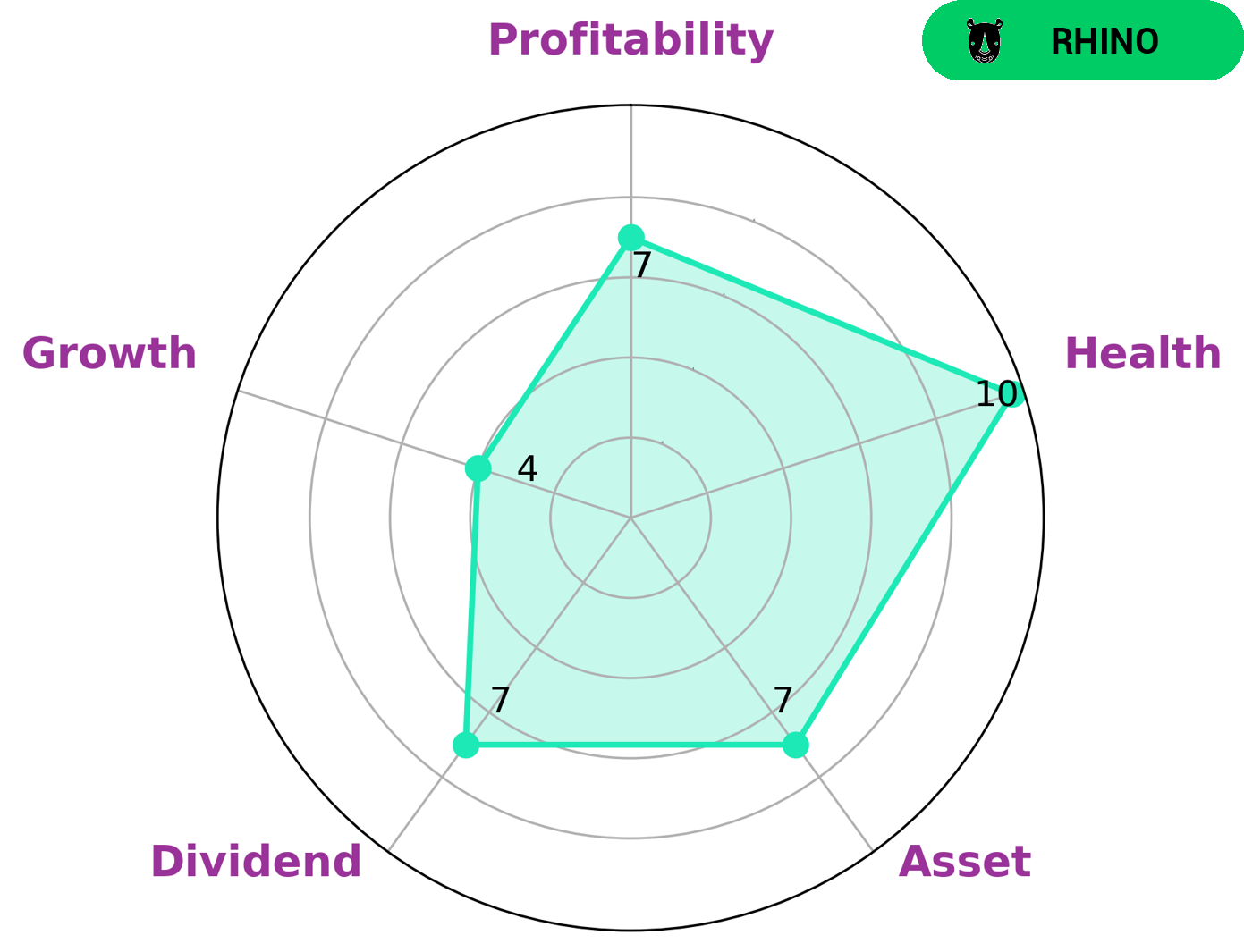

This type of company is sure to be of interest to investors seeking long-term growth opportunities. Furthermore, GoodWhale has also determined that WARRIOR MET COAL has an impressive health score of 10/10 with regards to its cashflows and debt, indicating that it is in a strong financial position and capable of sustaining future operations in times of crisis. On top of that, WARRIOR MET COAL also shows strong performance in areas such as asset, dividend, growth, and profitability. All these factors make WARRIOR MET COAL an attractive investment opportunity. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HCC. More…

| Total Revenues | Net Income | Net Margin |

| 1.87k | 677.33 | 37.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HCC. More…

| Operations | Investing | Financing |

| 964.7 | -322.27 | -213.92 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HCC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.15k | 572.7 | 30.36 |

Key Ratios Snapshot

Some of the financial key ratios for HCC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.7% | 49.2% | 43.8% |

| FCF Margin | ROE | ROA |

| 37.3% | 33.9% | 23.8% |

Peers

In the coal industry, Warrior Met Coal Inc faces competition from Tigers Realm Coal Ltd, Mongolian Mining Corp, and Shougang Fushan Resources Group Ltd. These companies are all major players in the industry, and each has its own strengths and weaknesses. Warrior Met Coal Inc must constantly evaluate its competitors in order to stay ahead in the market.

– Tigers Realm Coal Ltd ($ASX:TIG)

Tigers Realm Coal Ltd is a coal company with a market cap of 196M as of 2022. The company has a return on equity of 12.25%. Tigers Realm Coal Ltd is involved in the exploration, development, and production of thermal and coking coal in Russia.

– Mongolian Mining Corp ($SEHK:00975)

Mongolian Mining Corporation is a coal mining and exploration company operating in Mongolia. The company has a market cap of 1.89B as of 2022 and a Return on Equity of -3.82%. Mongolian Mining Corporation is engaged in the business of mining, processing and selling coal products in Mongolia. The company’s principal products are coking coal and thermal coal. Coking coal is used in the production of steel and is a key ingredient in the manufacturing of coke, a fuel used in blast furnaces. Thermal coal is used for power generation.

– Shougang Fushan Resources Group Ltd ($SEHK:00639)

Shougang Fushan Resources Group Ltd is a Chinese state-owned enterprise and one of the largest iron ore producers in the country. The company has a market cap of 11.97B as of 2022 and a return on equity of 21.21%. The company’s main business is the mining, beneficiation, and smelting of iron ore, as well as the production of downstream products such as steel.

Summary

WARRIOR MET COAL is an established coal producer with a reputation for producing high-quality metallurgical coal. The company has recently reported that its full-year sales volumes are expected to increase by 8%. This suggests that the company is well-positioned to capitalize on a favorable demand environment. WARRIOR MET COAL is a solid investment opportunity for those seeking exposure to the coal industry.

Its diverse portfolio of production assets ensures strong market positioning and reliable cash flows. The company has a long history of operational excellence and financial stability, making it an attractive option for those looking for a steady, reliable return on their investment.

Recent Posts