Aspen Aerogels Is a High-Growth Stock with a Beta of 2.17 and Over 1 Million Shares Traded in 2023

March 10, 2023

Trending News ☀️

Aspen Aerogels ($NYSE:ASPN) Inc. has been gaining significant attention from investors, with its beta value of 2.17 and over 1 million shares traded in the latest trading session. It has become one of the most talked about stocks, with its high-growth potential and impressive stock performance in recent years. This could prove to be a great bargain stock for investors, both for its solid long-term returns and its reliable dividend yield. The company has managed to consistently beat expectations on revenue and earnings in the last few quarters, pushing its stock higher despite a volatile overall market environment.

What’s more, Aspen Aerogels Inc. has been investing heavily in research and development, making it well-positioned to benefit from any potential new innovations or technological breakthroughs in the field. The company is also planning to expand its product portfolio, giving it more opportunities to grow its market share and drive higher revenues. This could prove to be an attractive option for investors who are looking for long-term returns or short-term gains.

Share Price

On Wednesday, the company’s stock opened at $9.8 and closed at $9.9, indicating a growth of 0.7% from its last closing price of $9.8. This success is indicative of the company’s potential for continuing growth, suggesting that now may be a good time to invest in ASPEN AEROGELS stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aspen Aerogels. More…

| Total Revenues | Net Income | Net Margin |

| 180.36 | -82.74 | -45.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aspen Aerogels. More…

| Operations | Investing | Financing |

| -82.37 | -13.78 | 92.47 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aspen Aerogels. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 646.57 | 203.23 | 0 |

Key Ratios Snapshot

Some of the financial key ratios for Aspen Aerogels are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.0% | – | -43.0% |

| FCF Margin | ROE | ROA |

| -116.1% | -53.2% | -7.5% |

Analysis

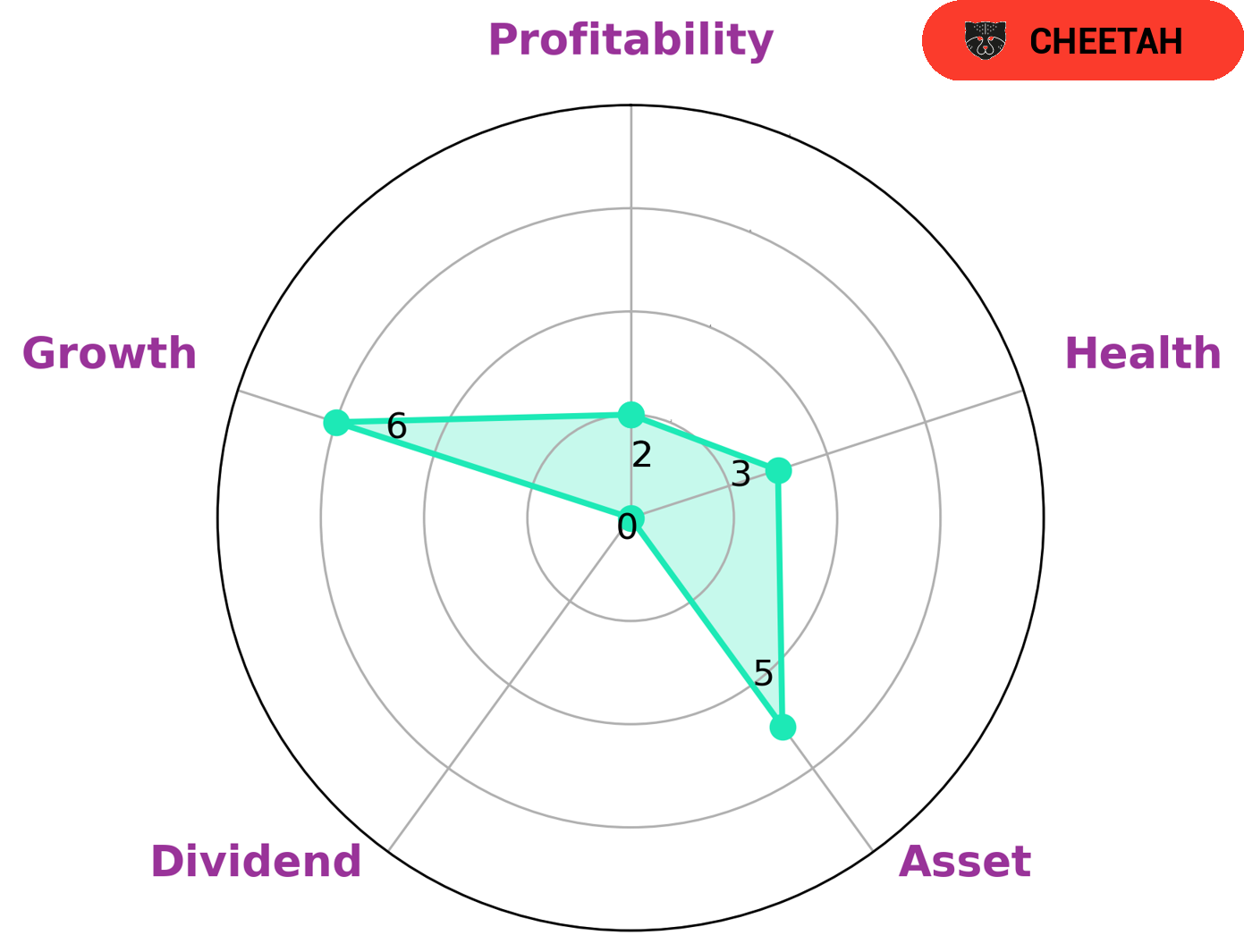

As GoodWhale has analyzed ASPEN AEROGELS‘s financials, it is classified as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. This may be of particular interest to investors looking for higher growth potential with more risk. The company is strong in terms of asset and growth, but weak in dividend and profitability. It has a low health score of 3/10, considering its cashflows and debt, and is less likely to sustain future operations in times of crisis. Therefore, ASPEN AEROGELS may not be the best choice for investors who are looking for more security and stability. More…

Peers

Its main competitors are Goodtech ASA, LifeSafe Holdings PLC, and Jiangsu Jingxue Insulation Technology Co Ltd.

– Goodtech ASA ($LTS:0ELH)

Goodtech ASA is a Norwegian engineering and technology company. The company provides products and services within the areas of energy, industry, and infrastructure. Goodtech ASA has a market cap of 211.8M as of 2022 and a Return on Equity of -3.23%.

– LifeSafe Holdings PLC ($LSE:LIFS)

LifeSafe Holdings PLC is a provider of health and safety products and services. The company has a market cap of 8.62M as of 2022 and a return on equity of 252.02%. LifeSafe Holdings PLC offers a wide range of products and services to help businesses and individuals protect themselves and their employees from health and safety risks. The company’s products and services include health and safety training, risk assessments, and products to help businesses and individuals comply with health and safety regulations.

– Jiangsu Jingxue Insulation Technology Co Ltd ($SZSE:301010)

Jiangsu Jingxue Insulation Technology Co Ltd is a Chinese company that manufactures insulation products. The company has a market cap of 2.23B as of 2022 and a Return on Equity of 5.98%. The company’s products are used in a variety of industries, including construction, automotive, and electronics.

Summary

Aspen Aerogels Inc. is a high-growth stock that has seen significant growth over the past year. The company has garnered significant media attention, which is mostly positive. Analysts agree that the company has significant potential for growth with an emphasis on environmental sustainability.

Investors should consider the potential long-term returns of such an investment, as well as the risk associated with such a high-growth stock. There is potential for significant returns, but also for significant losses.

Recent Posts