Alaska Department of Revenue Increases Investment in AAON, in 2023

March 29, 2023

Trending News 🌥️

In 2023, the Alaska Department of Revenue decided to make a big move and increase its investments in AAON ($NASDAQ:AAON), Inc. The Department acquired an additional number of AAON shares, thus increasing its total holdings of the company’s stock. This decision highlights the Department’s confidence in the company’s future potential and overall financial performance. AAON, Inc. is a leading provider of air-conditioning and heating solutions for commercial and residential buildings that is based in Tulsa, Oklahoma. They specialize in rooftop units, heat pumps, furnaces and chillers, making them an ideal partner for the Alaska Department of Revenue. This investment will provide the company with increased financial stability, allowing them to expand their operations and continue providing excellent products and services. This move is a sign of the Alaska Department of Revenue’s commitment to investing in companies that are poised to experience long-term growth and success.

The additional holdings of AAON, Inc. stock will help ensure the Department’s ability to capitalize on future gains and diversify its portfolio. With this investment, the Department is showing its trust in the company’s strategic management and financial strength. This decision will bring additional financial stability to the company and will help them expand their operations. By investing in AAON, Inc., the Department is also showing confidence in their ability to deliver strong returns over the long-term.

Market Price

The Alaska Department of Revenue recently announced their decision to increase their investment in AAON, Inc. for the year 2023. Media sentiment around the company has mostly been positive, which was further bolstered by Monday’s trading on the stock market. On Monday, AAON opened at $92.3 and closed at $92.8, a jump of 1.7% from the previous closing price of $91.2. This news has been met with enthusiasm from investors and analysts alike, who have been bullish on the company’s prospects moving forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aaon. aaon&utm_title=alaska-department-of-revenue-increases-investment-in-aaon,-in-2023″>More…

| Total Revenues | Net Income | Net Margin |

| 888.79 | 100.38 | 11.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aaon. aaon&utm_title=alaska-department-of-revenue-increases-investment-in-aaon,-in-2023″>More…

| Operations | Investing | Financing |

| 61.32 | -76.21 | 17.36 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aaon. aaon&utm_title=alaska-department-of-revenue-increases-investment-in-aaon,-in-2023″>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 813.9 | 253.19 | 10.5 |

Key Ratios Snapshot

Some of the financial key ratios for Aaon are shown below. aaon&utm_title=alaska-department-of-revenue-increases-investment-in-aaon,-in-2023″>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.7% | 23.1% | 14.4% |

| FCF Margin | ROE | ROA |

| -1.7% | 14.7% | 9.8% |

Analysis

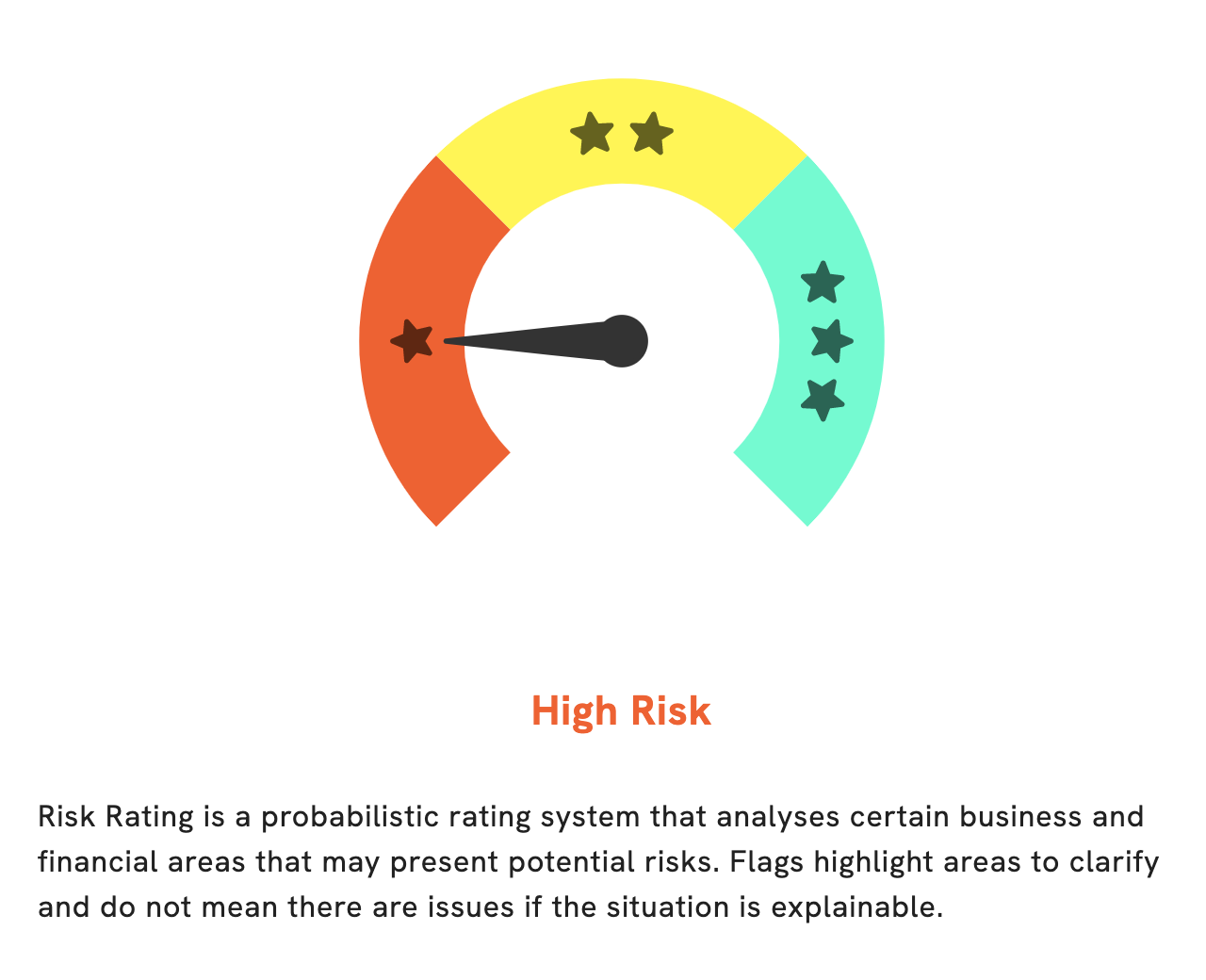

At GoodWhale, we have conducted an analysis of AAON‘s fundamentals. After reviewing all of the data, our Risk Rating shows that this is a high risk investment in terms of both financial and business aspects. More specifically, we have detected two risk warnings in their income sheet, which are classified as non-financial. If you would like to learn more about these risks, please feel free to register on our website at goodwhale.com. We will be more than happy to provide you with a detailed analysis of the risks associated with investing in AAON. More…

Peers

The competition between AAON Inc and its competitors is fierce. Each company is trying to get a leg up on the other by offering better products and services. Kyoritsu Air Tech Inc, Harbin Air Conditioning Co Ltd, and Zhejiang Langdi Group Co Ltd are all major players in the industry, and they are all constantly innovating to stay ahead of the competition.

– Kyoritsu Air Tech Inc ($TSE:5997)

Kyoritsu Air Tech Inc has a market cap of 2.25B as of 2022, a Return on Equity of 4.9%. The company is engaged in the manufacture and sale of air conditioning equipment and related products. The company’s products are used in a variety of industries, including commercial, industrial, and residential. Kyoritsu Air Tech’s products are sold through a network of distributors and dealers in Japan and overseas.

– Harbin Air Conditioning Co Ltd ($SHSE:600202)

Harbin Air Conditioning Co Ltd is a Chinese company that manufactures air conditioners. The company has a market capitalization of 1.97 billion as of 2022 and a return on equity of 4.63%. The company’s products are sold in over 60 countries and regions. Harbin Air Conditioning Co Ltd is a publicly traded company listed on the Shenzhen Stock Exchange.

– Zhejiang Langdi Group Co Ltd ($SHSE:603726)

Zhejiang Langdi Group Co Ltd is a Chinese company that manufactures and sells construction materials. The company has a market cap of 2.88 billion as of 2022 and a return on equity of 7.03%. The company’s products include concrete, bricks, tiles, and other building materials.

Summary

Investing in AAON, Inc. has been increasingly popular among investors in recent years. The Alaska Department of Revenue has announced its decision to strengthen its investment in the company in 2023, which has received mostly positive media sentiment. Analysts predict that the company will continue to grow and provide impressive returns to investors. Several market indicators point to a strong performance for AAON, with a steady rise in stock prices, significant growth in earnings, and a robust balance sheet.

The investment is expected to bring significant profits as the company continues to gain momentum and expand its operations. Investors looking to diversify their portfolios should consider adding AAON as an attractive option.

Recent Posts