Tecnoglass and Wells Fargo Forge Financing Partnership to Boost Revenue

April 22, 2023

Trending News ☀️

Tecnoglass Inc ($NYSE:TGLS)., a leading manufacturer of architectural glass, aluminum, and windows in Latin America, recently announced a financing partnership with Wells Fargo to boost sales and increase revenue. The two companies have come together to create flexible financing solutions that will help Tecnoglass reach new markets, allowing them to expand their operations and increase their reach. By partnering with Wells Fargo, Tecnoglass is able to find the most beneficial and cost-effective solutions for their customers, giving them an edge in the industry. This strategic partnership with Wells Fargo has already helped Tecnoglass expand their global footprint and increase their client base in the U.S. and Latin America.

The company’s stock has seen a steady increase in value since the announcement of the partnership, indicating a strong future for Tecnoglass and its new financing solutions. The financial stability provided by Wells Fargo has opened up new opportunities for Tecnoglass, allowing them to invest in research and development, hire more staff, and provide better services to their existing customers. With the help of this partnership, Tecnoglass aims to become a leader in the manufacturing industry and continue to be a reliable and trusted provider of quality products.

Market Price

On Thursday, TECNOGLASS INC announced an agreement with Wells Fargo to increase its financial resources and strengthen the company’s revenue growth. Following the announcement, TECNOGLASS INC’s stock opened at $44.6 and closed at $46.4, up 4.1% from the prior closing price. This marks a significant development as the company looks to expand its operations and capitalize on new opportunities. The new financing agreement will allow TECNOGLASS INC to leverage Wells Fargo’s range of products, services, and financing capabilities that can help accelerate growth in the near-term and beyond.

It will also provide the company with financial stability and flexibility to pursue more strategic investments. The agreement is expected to boost the company’s revenue, productivity, and profitability over the coming years. This agreement also signals the company’s confidence in its ability to create value for shareholders through increased revenue, sustained profitability, and long-term growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tecnoglass Inc. More…

| Total Revenues | Net Income | Net Margin |

| 716.57 | 155.74 | 22.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tecnoglass Inc. More…

| Operations | Investing | Financing |

| 141.92 | -72.58 | -44.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tecnoglass Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 734.31 | 383.98 | 7.32 |

Key Ratios Snapshot

Some of the financial key ratios for Tecnoglass Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.5% | 58.1% | 33.4% |

| FCF Margin | ROE | ROA |

| 9.9% | 45.3% | 20.4% |

Analysis

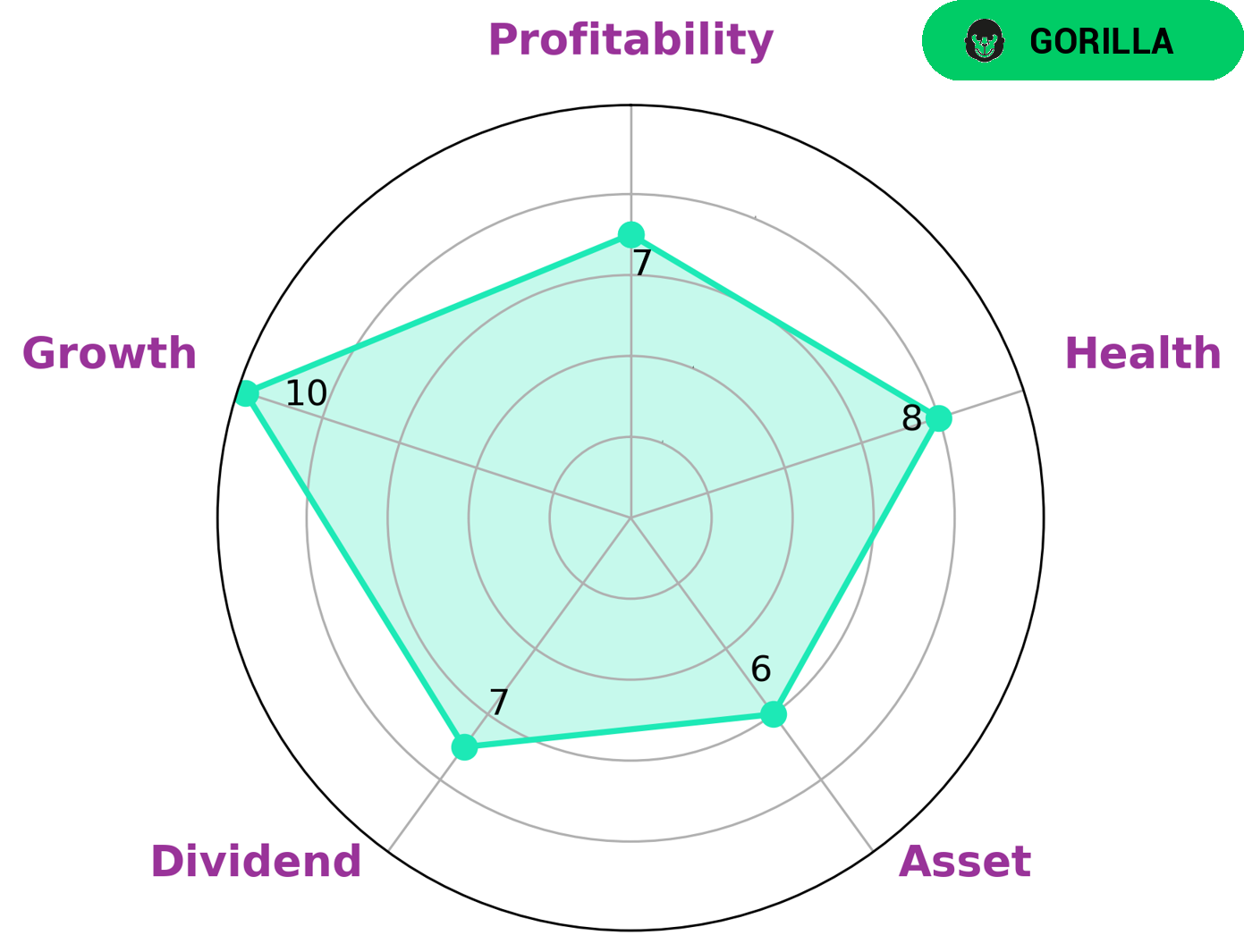

As an analyst with GoodWhale, I recently had the opportunity to study the financials of TECNOGLASS INC. After running the numbers through our algorithms, I was able to classify this company as a ‘gorilla’- a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. When it comes to investors, this type of company is usually attractive for those who value dividend, growth, and profitability. Furthermore, TECNOGLASS INC scored a healthy 8/10 on our health score, showing that it is capable enough to pay off debt and fund future operations. Additionally, its asset score is medium, giving potential investors an added layer of security. All in all, TECNOGLASS INC is an attractive investment opportunity that should be considered by those investors who are looking for steady dividend payments, strong growth potential, and a healthy financial record. More…

Peers

They are one of the top competitors in the market, competing with CSG Holding Co Ltd, Xinyi Glass Holdings Ltd, and Shanghai Yaohua Pilkington Glass Group Co Ltd. All four of these companies produce high-quality architectural glass products, offering a wide range of services and solutions to meet the needs of their customers.

– CSG Holding Co Ltd ($SZSE:000012)

CSG Holding Co Ltd is a Chinese company that specializes in the development and sale of construction materials, real estate and engineering services. With a market cap of 16.56B as of 2023, the company has seen impressive growth in the last few years. Its Return on Equity (ROE) of 11.21% reflects its strong performance, as it has been able to effectively use its resources to generate returns for its shareholders. The company continues to strategically invest in its products, services, and real estate to maintain its competitive edge in the market.

– Xinyi Glass Holdings Ltd ($SEHK:00868)

Xinyi Glass Holdings Ltd is a leading manufacturer of glass products in the world. The company’s market capitalization of 66.84B as of 2023 reflects its strong performance and significant growth over the years. Xinyi Glass Holdings Ltd has achieved a Return on Equity of 20.97%, which speaks to the company’s success in creating value for its shareholders. The company specializes in producing glass solutions for residential and commercial buildings, automobiles, photovoltaic modules, and other uses. Their products are exported to numerous countries in Asia, Europe, and North America, making them a reliable partner in the glass industry.

– Shanghai Yaohua Pilkington Glass Group Co Ltd ($SHSE:600819)

Shanghai Yaohua Pilkington Glass Group Co Ltd is a Chinese multinational glass manufacturer, specializing in the production of automobile glass, building glass, and decorative glass. As of 2023, the company has a market capitalization of 5.5B. The company’s Return on Equity stands at 0.18%, indicating that it is a relatively stable company. Shanghai Yaohua holds a global presence, and its products are used in a wide range of applications such as automotive windows and architectural glass for buildings and skyscrapers. The company is a major player in the glass and glazing industry, and its products are known for their quality and durability.

Summary

Tecnoglass Inc. is a leading manufacturer of architectural glass, windows, and associated products for the global construction industry. Recently, the company announced a collaboration with Wells Fargo to provide financing solutions and incremental sales. Following the news, the stock price of Tecnoglass Inc. moved up significantly on the same day.

Analysts suggest that the company’s strategic collaborations and focus on innovation and expansion would help it maintain its growth trajectory in the long run. Furthermore, its healthy financials and robust balance sheet provide investors with an attractive opportunity to invest in the stock.

Recent Posts