Liberty Siriusxm Stock Fair Value Calculator – U.S. Capital Wealth Advisors LLC Acquires New Stake in The Liberty SiriusXM Group

May 3, 2023

Trending News ☀️

U.S. Capital Wealth Advisors LLC recently acquired a stake in The Liberty ($NASDAQ:LSXMA) SiriusXM Group’s shares during the fourth quarter. The Liberty SiriusXM Group is a media and entertainment holding company, which holds a controlling stake in SiriusXM Holdings Inc., the world’s largest audio entertainment company. SiriusXM’s platform is available in vehicles from every major car company in the United States and Canada, as well as on mobile devices, smart TVs, streaming players, game consoles and other connected devices.

Additionally, SiriusXM provides enhanced audio experiences for its subscribers with exclusive content from its partner labels. The Liberty SiriusXM Group’s investments allow it to benefit from the growth of the audio entertainment industry, while also providing exposure to new technologies and business opportunities.

Price History

The reported purchase came as LIBERTY SIRIUSXM stock opened at $28.0 and closed at $28.7, up by 2.0% from its previous closing price of 28.1. This acquisition signal from U.S. Capital Wealth Advisors is seen as a vote of confidence in the company’s potential for growth and value. It also increases the institutional ownership of the company, which can provide a base of stability in the long-term. Overall, the move is seen as a positive sign for the future of LIBERTY SIRIUSXM and its investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Liberty Siriusxm. More…

| Total Revenues | Net Income | Net Margin |

| 12.16k | 1.29k | 10.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Liberty Siriusxm. More…

| Operations | Investing | Financing |

| 2.55k | -46 | -3.15k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Liberty Siriusxm. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 30.48k | 18.58k | 25.91 |

Key Ratios Snapshot

Some of the financial key ratios for Liberty Siriusxm are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.0% | 9.5% | 23.7% |

| FCF Margin | ROE | ROA |

| 14.9% | 20.9% | 5.9% |

Analysis – Liberty Siriusxm Stock Fair Value Calculator

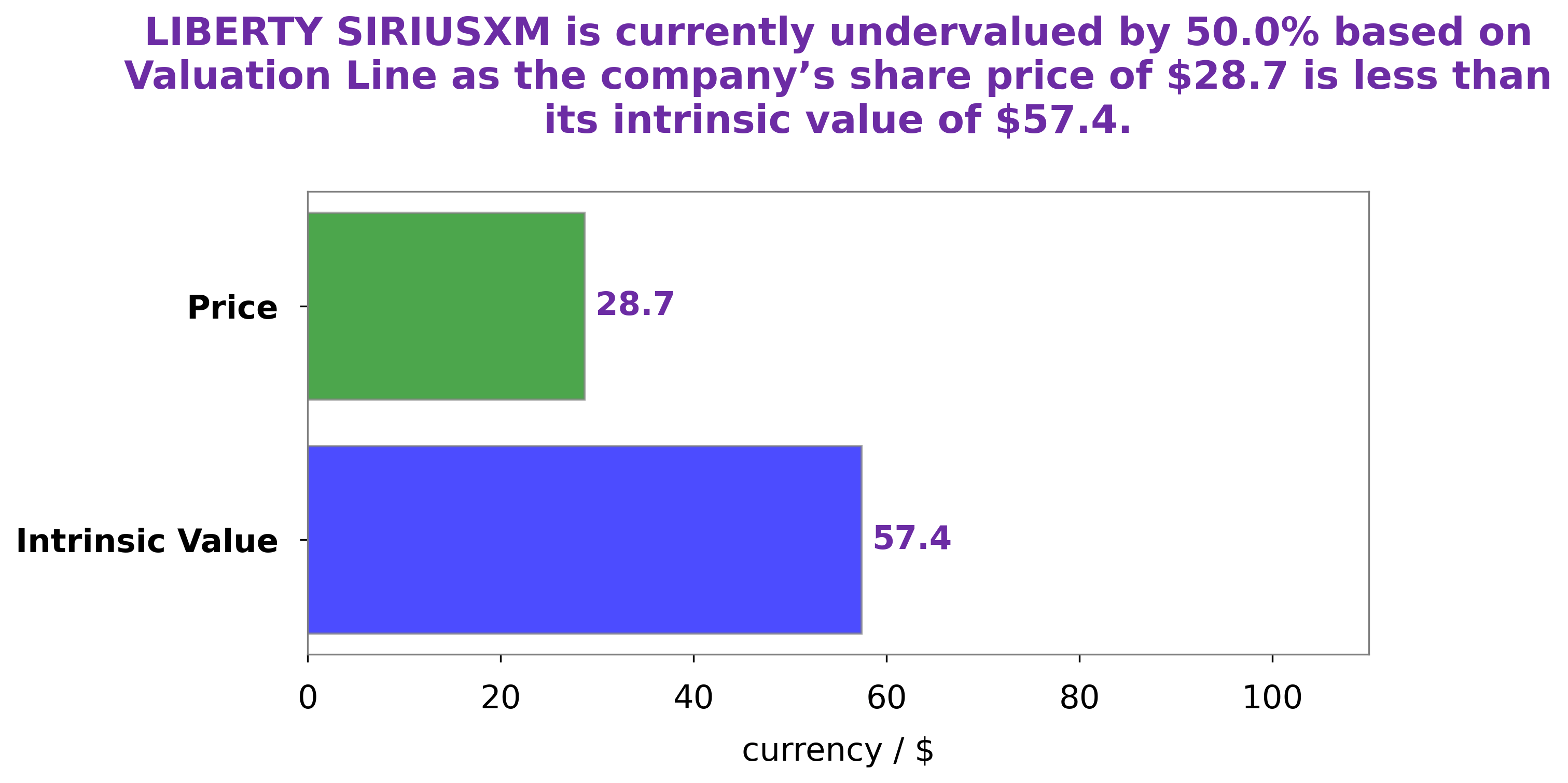

At GoodWhale, we have conducted an analysis of LIBERTY SIRIUSXM‘s wellbeing. Through our proprietary Valuation Line, we have calculated the fair value of LIBERTY SIRIUSXM share to be around $57.4. Yet currently the share is being traded at only $28.7, which means the equity is undervalued by 50.0%. This presents a good opportunity for investors to purchase LIBERTY SIRIUSXM stock at a lower price than its fair value. More…

Peers

The competition between Liberty SiriusXM Group and its competitors, Corporacion Interamericana de Entretenimiento SAB de CV, Inmyshow Digital Technology (Group) Co Ltd, and PT Intermedia Capital Tbk, is fierce. All of these companies are vying for a bigger share of the market in the digital entertainment and media industry, fighting to provide their customers with the most innovative and cost-effective solutions. This competition is driving each company to push the boundaries of innovation, creating a competitive environment that will benefit customers in the long run.

– Corporacion Interamericana de Entretenimiento SAB de CV ($OTCPK:CIEZF)

Corporacion Interamericana de Entretenimiento SAB de CV is a Mexican entertainment company that provides film, television and radio services. As of 2022, the company has a market cap of 327.67M and a Return on Equity of 10.9%. This market capitalization indicates that the company is a mid-sized organization and that it is performing well in terms of generating returns for its shareholders. The return on equity of 10.9% further suggests that the company is managing its investments and resources efficiently and is creating value for its shareholders.

– Inmyshow Digital Technology (Group) Co Ltd ($SHSE:600556)

MyShow Digital Technology (Group) Co Ltd is a Chinese digital media and entertainment company that specializes in providing online entertainment and media services. The company’s market cap as of 2022 is 12.46B, which demonstrates its strong presence in the industry. Additionally, the company has a Return on Equity of 3.77%, indicating that it is able to generate profits from its investments. This is a testament to the company’s ability to create value for its shareholders and provide a good return on their investments. MyShow Digital Technology (Group) Co Ltd is an example of how digital media and entertainment companies can be successful in the current digital landscape.

– PT Intermedia Capital Tbk ($IDX:MDIA)

Intermedia Capital Tbk (ICAP) is a leading Indonesian media conglomerate with a market capitalization of 2.16T as of 2022. The company operates in various sectors including television broadcasting, radio, digital media, and advertising. ICAP’s success can be attributed to its strong financial performance, as evidenced by its Return on Equity (ROE) of 8.11%. This impressive return reflects the company’s ability to effectively manage and reinvest its profits to increase shareholder value. ICAP’s diversified portfolio of businesses and its strong financial performance have allowed it to become one of the leading media companies in Indonesia.

Summary

Investors appear to be bullish on The Liberty SiriusXM Group, with U.S. Capital Wealth Advisors LLC acquiring a new stake during the fourth quarter. Analysts have praised the company’s high-quality content and programming, as well as its strong cash flow, which has created a stable earnings base. The company’s recent acquisitions have added to its pool of high-growth assets and supported share price appreciation. Liberty SiriusXM’s margin expansion has also been driven by its focus on cost and efficiency management, allowing it to remain competitive in the streaming audio space.

Additionally, its diverse portfolio of partners and clients has enabled the company to continue to increase its subscription base, further driving shareholder value.

Recent Posts