Iheartmedia Stock Fair Value – IHeartMedia Hopes for Profitability by 2023 Despite 6% Dip

May 4, 2023

Trending News ☀️

IHEARTMEDIA ($NASDAQ:IHRT): IHeartMedia, one of the world’s largest media and entertainment companies, is hoping to regain its profitability by 2023. This goal comes despite a 6% drop in its shares, as the company works to reduce its debt burden and increase its operating efficiency. IHeartMedia is the parent company of iHeartRadio, and operates a portfolio of radio stations, digital streaming services, and live events. Despite this, IHeartMedia is continuing to invest in its streaming services and original content.

IHeartMedia’s future success depends on reducing its debt, increasing revenues, and continuing to invest in new services and content. The company is clearly optimistic that it can turn itself around and become profitable by 2023.

Analysis – Iheartmedia Stock Fair Value

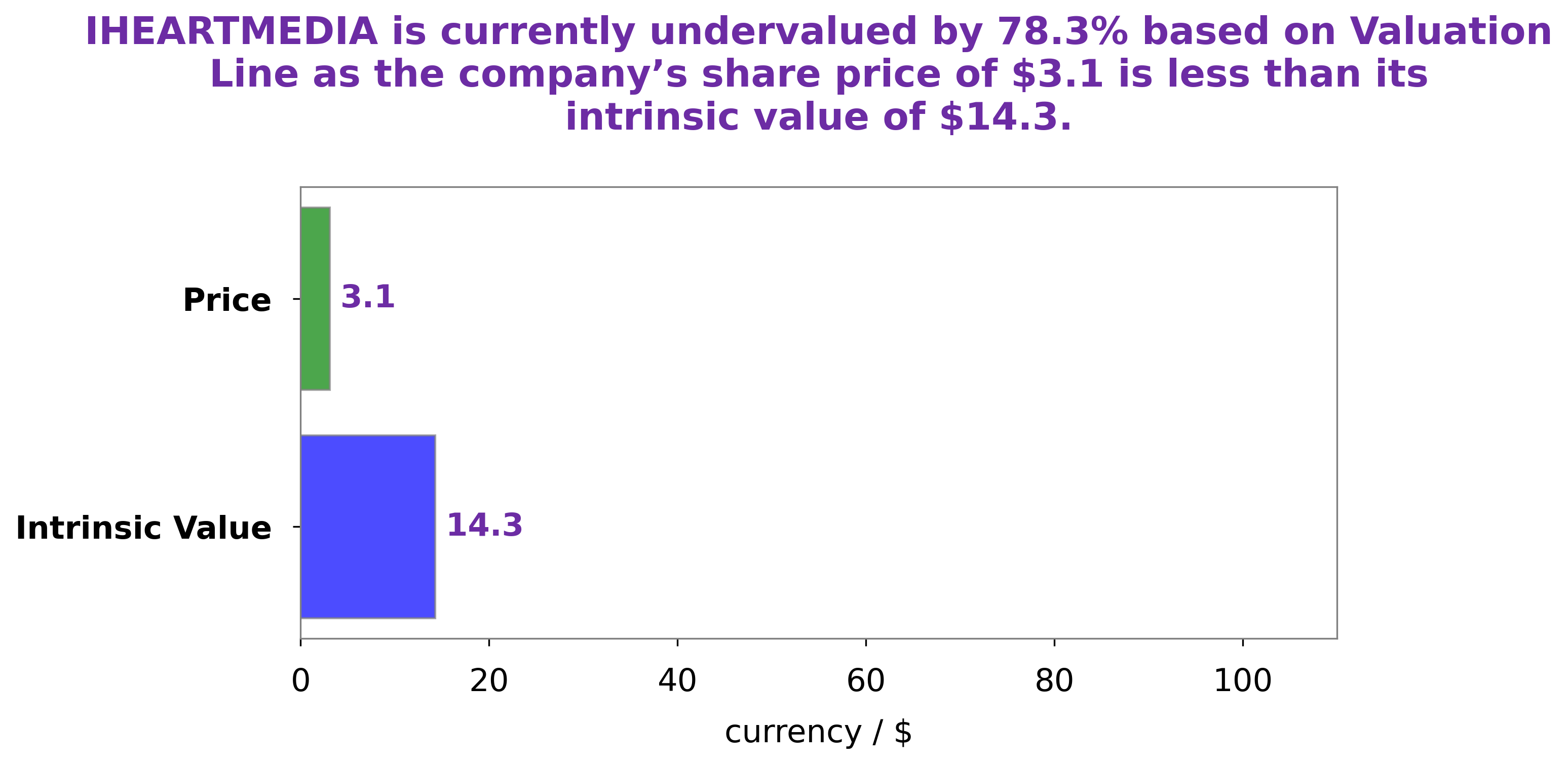

GoodWhale has conducted an analysis of IHEARTMEDIA’s wellbeing and we have determined the intrinsic value of their stock to be around $14.3, which we calculated using our proprietary Valuation Line. Currently, IHEARTMEDIA shares are being traded at just $3.1, which means they are undervalued by 78.3%. This presents a great opportunity for investors to pick up a bargain and benefit from the expected appreciation of IHEARTMEDIA’s stock price in the future. IHeartMedia_Hopes_for_Profitability_by_2023_Despite_6_Dip”>More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Iheartmedia. IHeartMedia_Hopes_for_Profitability_by_2023_Despite_6_Dip”>More…

| Total Revenues | Net Income | Net Margin |

| 3.91k | -264.66 | -2.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Iheartmedia. IHeartMedia_Hopes_for_Profitability_by_2023_Despite_6_Dip”>More…

| Operations | Investing | Financing |

| 420.07 | -129.23 | -306.11 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Iheartmedia. IHeartMedia_Hopes_for_Profitability_by_2023_Despite_6_Dip”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.34k | 7.65k | 4.71 |

Key Ratios Snapshot

Some of the financial key ratios for Iheartmedia are shown below. IHeartMedia_Hopes_for_Profitability_by_2023_Despite_6_Dip”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -17.5% | -40.9% | 9.4% |

| FCF Margin | ROE | ROA |

| 6.6% | 36.6% | 2.8% |

Peers

The media industry is highly competitive, and iHeartMedia Inc is no exception. As one of the world’s leading radio broadcasting and digital media companies, iHeartMedia Inc faces fierce competition from other industry giants such as Salem Media Group Inc, ProSiebenSat 1 Media SE, and IMPRESA SGPS SA. Each company is vying for a greater share of the market, which has resulted in an intense battle for the hearts and minds of consumers.

– Salem Media Group Inc ($NASDAQ:SALM)

Salem Media Group Inc is a media company that provides radio and digital content, as well as other services, to Christian and family-themed audiences in the United States. As of 2023, the company has a market cap of 32.39M and a Return on Equity of 9.26%. The market cap is the total market value of the company, which is determined by multiplying the current share price by the total number of outstanding shares. The Return on Equity measures the company’s ability to generate profit from its shareholders’ equity. It is calculated by dividing net income by shareholders’ equity. Salem Media Group Inc’s market cap and ROE indicate that it is a relatively small company, with a relatively low rate of return.

– ProSiebenSat 1 Media SE ($OTCPK:PBSFF)

ProSiebenSat 1 Media SE is a leading German media company, operating across television, radio, digital, and commerce. The company has a market cap of 1.89 billion euros as of 2023, making it one of the largest media companies in the country. The Return on Equity (ROE) for ProSiebenSat 1 Media SE is 6.31%, indicating that the company is efficiently utilizing its assets to generate profits. This is well above the industry average and showcases the company’s commitment to delivering value to shareholders.

– IMPRESA SGPS SA ($LTS:0M5U)

IMPRESA SGPS SA is a Portuguese media, telecommunications, and energy conglomerate founded in 1924. The company is headquartered in Lisbon and is one of the leading companies in the Portuguese market. IMPRESA has a market capitalization of 27.72M as of 2023, making it an attractive investment opportunity for investors. The company also has a Return on Equity of 6.45%, indicating that it has been able to generate a satisfactory return on the funds that have been invested in it. IMPRESA SGPS SA provides a variety of services ranging from media and entertainment, telecommunications, energy, and others, making it a well-diversified company that offers a variety of products and services.

Summary

IHeartMedia recently had a 6% dip in stock price on the same day. This can be attributed to a desire to turn a corner towards profitability by 2023. Investors are somewhat skeptical of the plan, and are expecting further financial results to be released in order to better understand the current state of the company.

Analysts are also looking at the company’s ability to manage its debt, as well as its operations and marketing strategies. It is important to note that IHeartMedia is currently undergoing certain restructuring initiatives, which could help the company improve its financials and rebuild investor confidence in the long term.

Recent Posts