VERACYTE Reports Fourth Quarter Total Revenue of -$3.8 Million for FY2022

March 2, 2023

Earnings report

VERACYTE ($NASDAQ:VCYT) recently reported their fourth quarter results for the Fiscal Year 2022, ending on December 31 2022. The total revenue figure came to USD -3.8 million, an increase of 63.5% from the same quarter the previous year. Net income rose by 19.2%, totaling USD 80.3 million compared to the same period in FY2021. The results were published on February 22 2023.

These figures indicate continued growth and success for VERACYTE, despite the challenging business climate. This is likely a result of their focus on providing innovative products and services to their customers, as well as continuing to maintain strong relationships with clients and partners. As their financial performance continues to improve, VERACYTE is well positioned to take advantage of the opportunities that await them in the coming year.

Share Price

On Wednesday, VERACYTE reported fourth quarter total revenue of -$3.8 million for FY2022. At the same time, the company’s stock opened at $22.8 and closed at $23.9, a 5.2% increase from last closing price of 22.7. These results demonstrate the resilience of the firm despite the current economic environment, likely due to its dedication to providing innovative and clinically proven diagnostic solutions. However, the decrease in revenue, compared to the same period last year, demonstrates the current challenges in the industry and the need for the company to continue to work hard in order to further improve its position in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Veracyte. More…

| Total Revenues | Net Income | Net Margin |

| 296.54 | -36.56 | -12.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Veracyte. More…

| Operations | Investing | Financing |

| 7.54 | -29.39 | 3.49 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Veracyte. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.16k | 81.22 | 14.61 |

Key Ratios Snapshot

Some of the financial key ratios for Veracyte are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 35.1% | – | -13.9% |

| FCF Margin | ROE | ROA |

| -0.3% | -2.4% | -2.2% |

Analysis

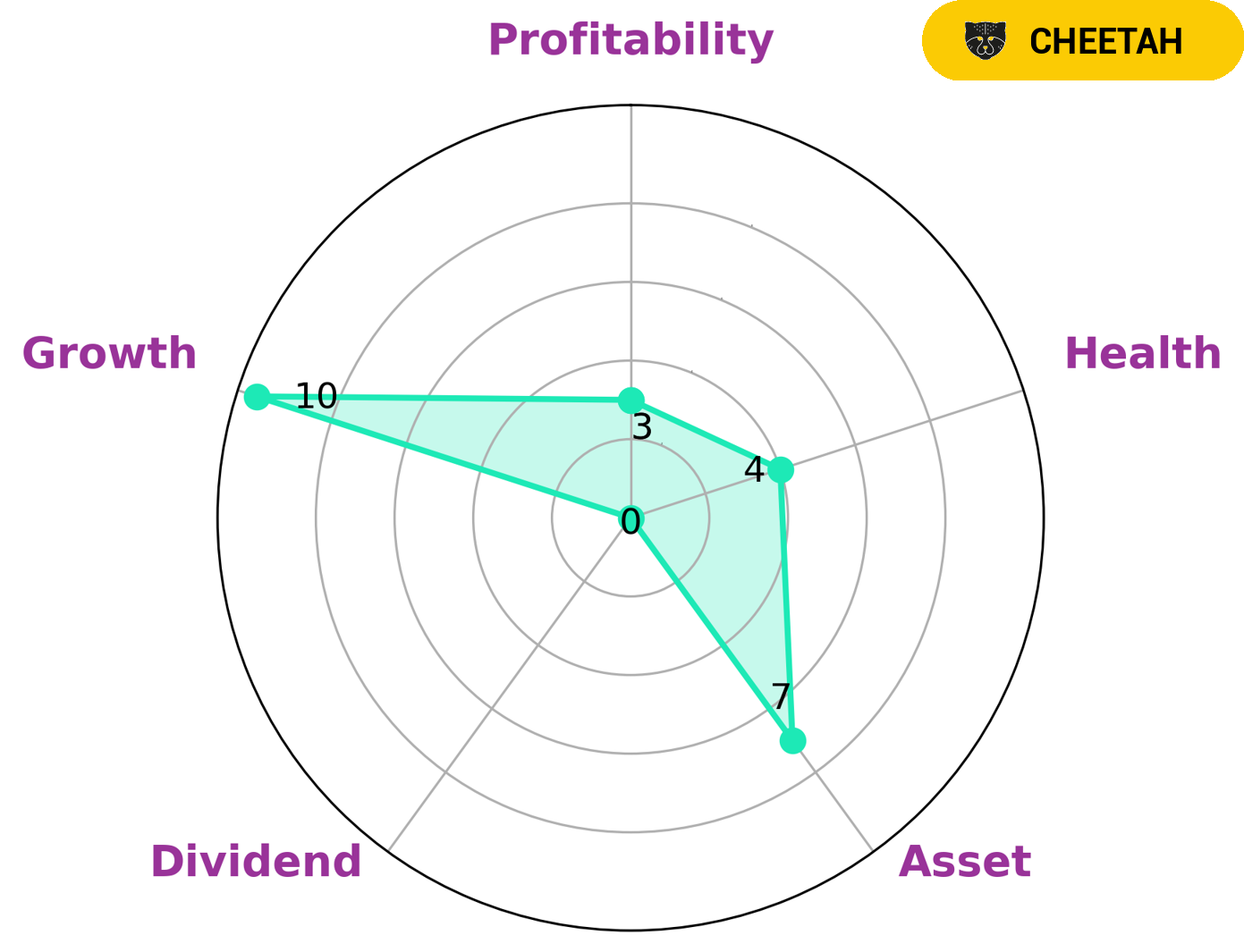

GoodWhale recently conducted an analysis of VERACYTE‘s wellbeing, and our findings suggest that they are in an intermediate state. On the Star Chart, the company has a health score of 4/10 with regard to cashflows and debt. This suggests that they are likely to sustain future operations in times of crisis. Furthermore, we classified VERACYTE as a ‘cheetah’ – a type of company that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Such companies may be interesting to investors looking for higher risk, higher return investments. VERACYTE is strong in asset and growth, and weak in dividend and profitability when compared to industry competitors. As such, the company may need to focus on these areas in order to improve their overall wellbeing and attract more investors. More…

Peers

The company’s competitors include Exact Sciences Corp, Invitae Corp, and NanoString Technologies Inc.

– Exact Sciences Corp ($NASDAQ:EXAS)

Exact Sciences Corp has a market cap of 7.56B as of 2022. The company’s ROE for the same year is -14.13%.

Exact Sciences Corp is a biotechnology company that focuses on the development of cancer detection tests. The company’s flagship product is Cologuard, a stool-based DNA test that can detect the presence of colorectal cancer.

– Invitae Corp ($NYSE:NVTA)

Invitae Corp is a biotechnology company that uses genetic information to help healthcare providers diagnose, treat and prevent disease. The company has a market cap of 689.82M as of 2022 and a Return on Equity of -120.15%.

– NanoString Technologies Inc ($NASDAQ:NSTG)

NanoString Technologies Inc is a molecular diagnostics company that develops and sells proprietary technologies and instruments for digital molecular profiling. The company has a market capitalization of 313.93 million as of 2022 and a return on equity of -87.4%. NanoString’s technology is based on a unique digital detection platform that can measure the expression of hundreds of genes simultaneously with high accuracy and precision. The company’s products are used in a variety of applications, including gene expression profiling, copy number variation analysis, single-nucleotide polymorphism genotyping, and mRNA quantification. NanoString’s products are sold to a diverse customer base, including academic research institutions, government laboratories, pharmaceutical and biotechnology companies, and diagnostic laboratories.

Summary

Veracyte Inc. released its financial results for the fourth quarter of FY2022 on February 22, 2023. Net income rose 19.2% year over year to USD 80.3 million, compared to the same period in FY2021. This marked a healthy increase in earnings for the company, and investors reacted positively, with the stock price rising the same day. Overall, this financial report reflects positively for Veracyte Inc., and investors should look favorably on the company’s prospects in the future.

Recent Posts