Sarepta Therapeutics Intrinsic Value Calculation – Sarepta Therapeutics Positioned to Lead Accelerated Growth of Duchenne Muscular Dystrophy Treatment Market

December 9, 2023

☀️Trending News

Sarepta Therapeutics ($NASDAQ:SRPT) is a biopharmaceutical company dedicated to developing treatments for rare and serious diseases. The company focuses on post-transcriptional gene regulation and exon-skipping therapies for Duchenne muscular dystrophy (DMD) and other genetic diseases. With its pioneering exon-skipping technology and specialization in treating rare diseases, Sarepta Therapeutics is positioned to become one of the leading companies in the Duchenne muscular dystrophy treatment market. The market for DMD treatments is expected to experience an increase in growth, becoming increasingly competitive as more companies enter the field.

Sarepta Therapeutics has developed a portfolio of potential treatments that offer the possibility of significant clinical benefit for DMD patients. These therapies offer the potential to treat a wider range of DMD patients and have been accepted for review by the U.S. Food and Drug Administration (FDA). With its broad array of potential treatments and its focus on developing revolutionary new therapies, Sarepta Therapeutics is well-positioned to take the lead in the rapidly growing DMD treatment market.

Price History

On Thursday, Sarepta Therapeutics made an impressive showing in the stock market, opening at $87.9 and closing at $88.4, up 1.2% from last closing price of 87.4. Sarepta is making great strides in the field of genetic medicine with its groundbreaking therapies that have already been approved by the US Food and Drug Administration. The company is focused on continuing to develop advanced treatments for this rare disorder and has made it a priority to bring them to market as quickly as possible. This dedication to excellence has helped Sarepta Therapeutics position itself as one of the most promising players in the field of Duchenne muscular dystrophy treatment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sarepta Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 1.1k | -690.88 | -32.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sarepta Therapeutics. More…

| Operations | Investing | Financing |

| -538.73 | -91.65 | 133.81 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sarepta Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.11k | 2.35k | 8.17 |

Key Ratios Snapshot

Some of the financial key ratios for Sarepta Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 30.7% | – | -57.8% |

| FCF Margin | ROE | ROA |

| -55.5% | -53.0% | -12.8% |

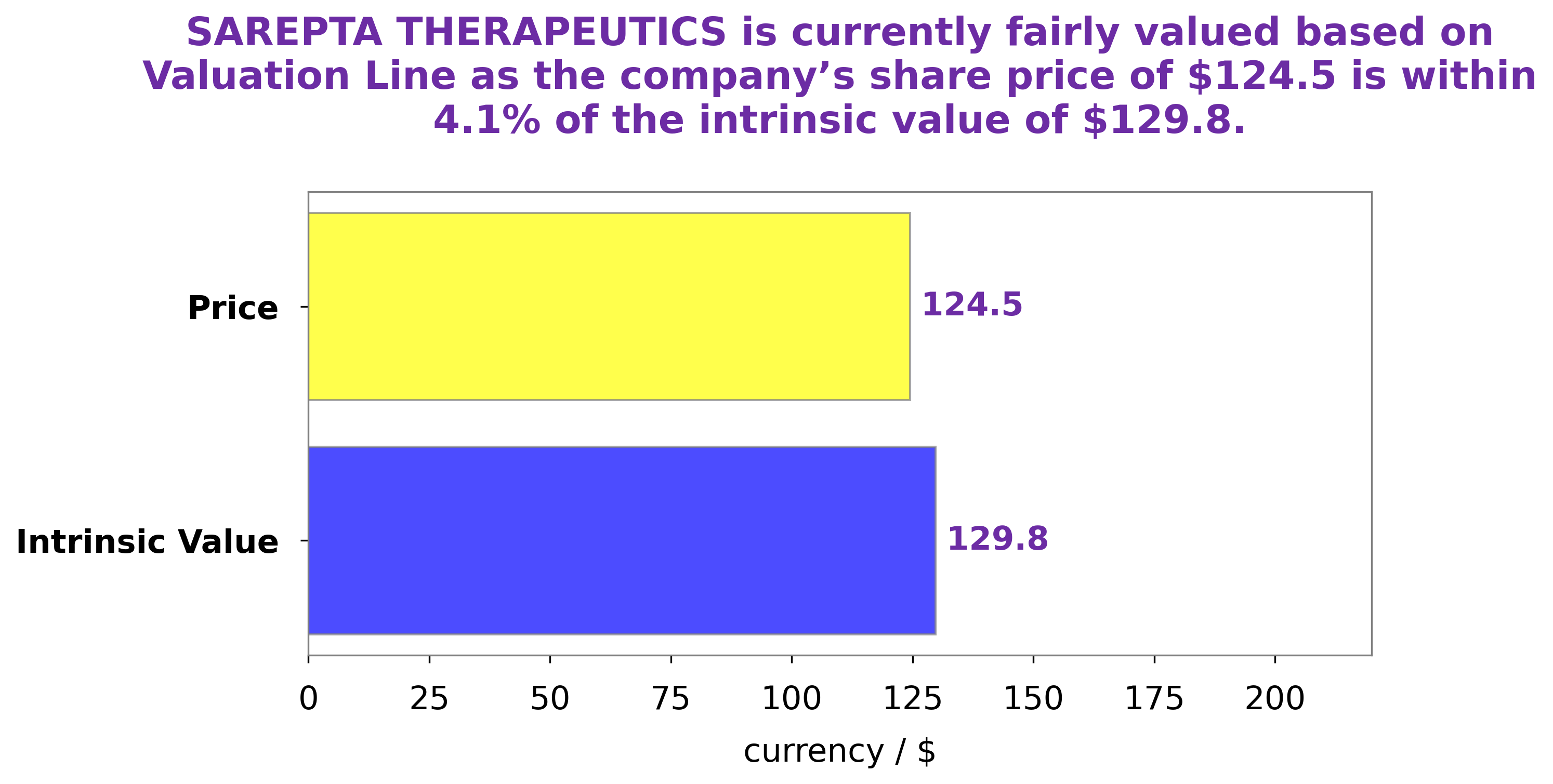

Analysis – Sarepta Therapeutics Intrinsic Value Calculation

At GoodWhale, we performed an analysis of SAREPTA THERAPEUTICS‘ fundamentals and determined that their intrinsic value is approximately $119.6 per share. Our proprietary Valuation Line was used to reach this conclusion, and we believe that the stock is currently being traded at $88.4 – which is 26.1% undervalued. As such, we recommend investors take a closer look at SAREPTA THERAPEUTICS at this time and consider whether investing in the stock may be a good move. More…

Peers

The company is headquartered in Cambridge, Massachusetts and was founded in 1980. Sarepta Therapeutics Inc has four main competitors: Genor Biopharma Holdings Ltd, Impel Pharmaceuticals Inc, Entera Bio Ltd, and PTC Therapeutics Inc. These companies are all focused on the development of treatments for DMD and other rare diseases.

– Genor Biopharma Holdings Ltd ($SEHK:06998)

Genor Biopharma Holdings Ltd is a pharmaceutical company that focuses on the development and commercialization of innovative drugs for the treatment of cancer. The company has a market cap of 949.11M as of 2022 and a ROE of -23.99%. The company’s products are designed to target specific genetic mutations that are known to drive the growth and progression of cancer.

– Impel Pharmaceuticals Inc ($NASDAQ:IMPL)

Impel Pharmaceuticals Inc is a pharmaceutical company with a market cap of 94.72M as of 2022. The company has a Return on Equity of -359.89%. Impel Pharmaceuticals Inc is a company that focuses on the development and commercialization of drugs for the treatment of central nervous system disorders.

– Entera Bio Ltd ($NASDAQ:ENTX)

Entera Bio Ltd is a clinical-stage biopharmaceutical company focused on the development and commercialization of oral therapeutics for serious unmet medical needs. The company’s lead product candidate is EB614, an oral biologic that is in clinical development for the treatment of osteoporosis, inflammatory bowel disease, and other immune-mediated diseases. Entera Bio Ltd has a market cap of 24.06M as of 2022, a Return on Equity of -48.6%. The company’s focus on the development and commercialization of oral therapeutics makes it a unique player in the biopharmaceutical market. However, its negative ROE indicates that it is not a profitable company at this time.

Summary

Sarepta Therapeutics, Inc., is an American biopharmaceutical company focused on the discovery and development of precision genetic medicines to treat rare neuromuscular diseases. Investing analysts have a favorable outlook for Sarepta based on the company’s progress in the research and development of treatments for Duchenne Muscular Dystrophy and other rare neuromuscular diseases. Analysts are particularly interested in Sarepta’s gene therapy program, which is now in Phase 1 clinical trials.

They also view the company’s expanding partnerships with academic centers, government agencies, and biotechnology companies as encouraging signs for its future growth. Overall, analysts believe that there is great potential for Sarepta Therapeutics to increase its market share in the Duchenne Muscular Dystrophy treatment market.

Recent Posts