HALOZYME THERAPEUTICS Reports 77.9% Increase in Net Income Despite 13.6% Revenue Drop in Q4 FY2022.

March 2, 2023

Earnings report

HALOZYME THERAPEUTICS ($NASDAQ:HALO) reported their financial results for the fourth quarter of Fiscal Year 2022 on February 21, 2023. Despite a 13.6% year over year decrease in total revenue to 57.7 million USD, the company had an impressive increase of 77.9% in net income, now at 181.5 million USD. This slight dip in revenue can be attributed to the continuing effects of the global pandemic, which has disrupted many industries. The increase in net income is a testament to the efficiency of the company’s management team in optimizing operational costs and making strategic decisions during these uncertain times.

HALOZYME THERAPEUTICS has managed to weather the storm and come out better off, setting an example for how other companies should approach such situations. Ultimately, the financials speak for themselves as HALOZYME THERAPEUTICS is well-positioned for continued growth in the future. With their strong balance sheet and cash reserves, the company should be able to capitalize on any opportunities that arise in the months ahead and continue to further its success.

Stock Price

Despite the impressive increase in net income and promising outlook for potential product launches, HALOZYME THERAPEUTICS‘ stock price still closed down 0.7%, dropping from its opening price of $49.7 to its closing price of $49.7. The company’s financial performance is expected to remain positive in the coming quarters despite the current uncertain economic climate. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Halozyme Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 660.12 | 202.13 | 30.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Halozyme Therapeutics. More…

| Operations | Investing | Financing |

| 240.11 | -487 | 362.37 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Halozyme Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.84k | 1.67k | 1.26 |

Key Ratios Snapshot

Some of the financial key ratios for Halozyme Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 49.9% | 21.2% | 40.3% |

| FCF Margin | ROE | ROA |

| 35.6% | 124.6% | 9.0% |

Analysis

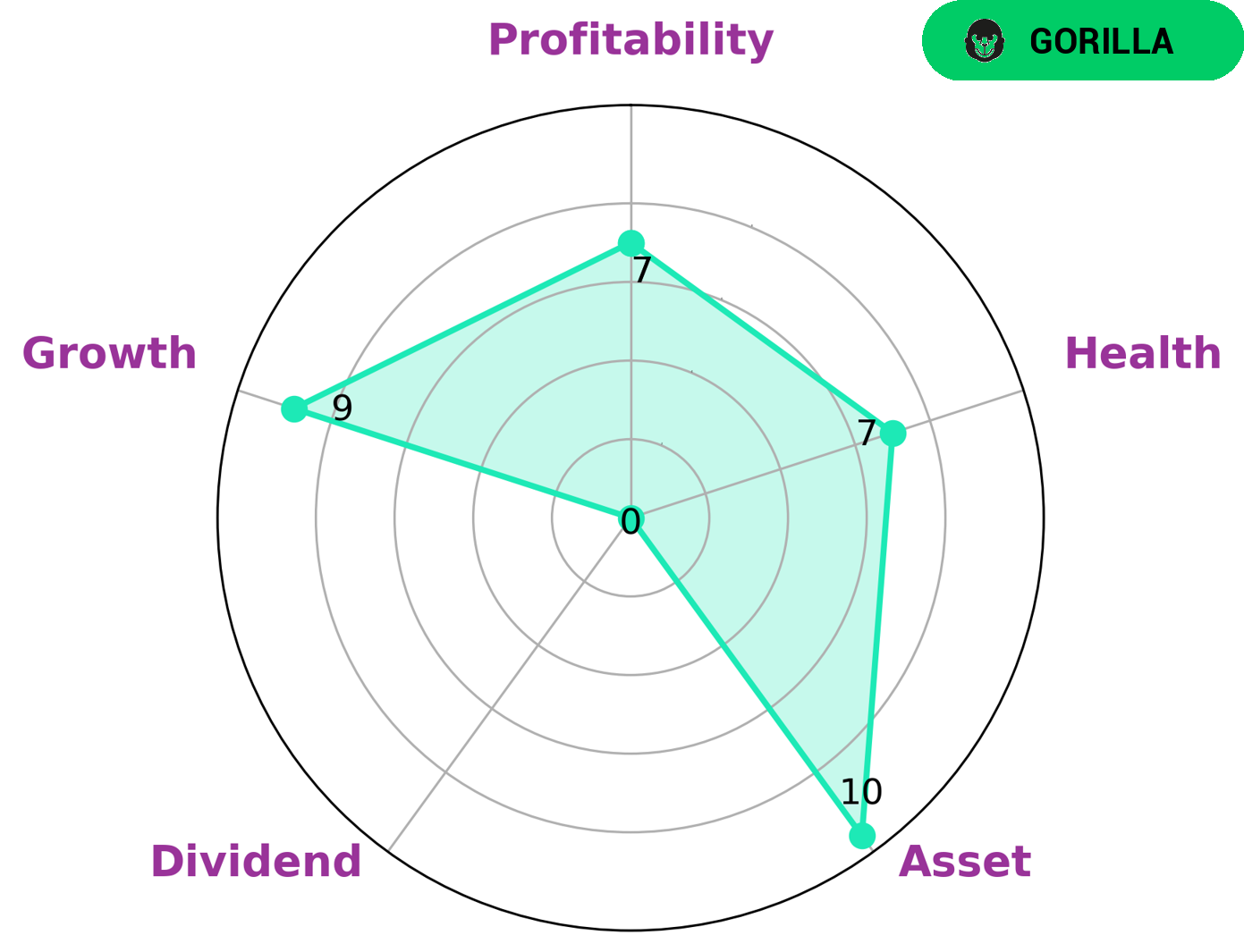

This means that it has achieved stable and high revenue or earning growth due to its strong competitive advantage. This type of company may be of interest to long term investors looking for companies with sustainable long-term success. HALOZYME THERAPEUTICS also has a high health score of 7/10 considering its cashflows and debt, meaning that it has the financial strength to sustain future operations in times of crisis. On the other hand, its weaknesses include a low dividend score, suggesting that it is not an ideal option for investors seeking passive income. GoodWhale’s analysis also shows that HALOZYME THERAPEUTICS is strong in asset, growth and profitability. Overall, its financials indicate a company with solid long-term growth prospects, making it a good option for long-term investors. More…

Peers

The Company’s enzyme-based product candidates target the tumor microenvironment, enabling the delivery of cancer drugs directly to the site of the tumor. Halozyme has four product candidates in clinical development, PEGPH20, Hylenex, HALO-102 and HALO-201. Keymed Biosciences Inc, Verona Pharma PLC, Xencor Inc are Halozyme’s competitors in the biopharmaceutical market.

– Keymed Biosciences Inc ($SEHK:02162)

Keymed Biosciences Inc is a biopharmaceutical company that focuses on the development and commercialization of novel therapeutics for the treatment of cancer and other serious diseases. The company’s market cap is 12.95B as of 2022 and has a ROE of -4.34%. Keymed Biosciences Inc’s products are designed to target key drivers of disease progression and to provide patients with new treatment options. The company’s lead product, KEY-184, is a first-in-class, orally-available small molecule inhibitor of the MDM2 oncoprotein.

– Verona Pharma PLC ($NASDAQ:VRNA)

Verona Pharma PLC is a pharmaceutical company that focuses on the development of drugs for the treatment of respiratory diseases. The company has a market cap of 790.27M as of 2022 and a Return on Equity of -28.69%. Verona Pharma PLC is headquartered in London, United Kingdom.

– Xencor Inc ($NASDAQ:XNCR)

Xencor Inc is a clinical-stage biopharmaceutical company focused on the discovery and development of engineered monoclonal antibodies for the treatment of cancer and autoimmune diseases. The company’s market cap as of 2022 is 1.64B with a ROE of 4.05%. Xencor is currently working on several clinical-stage programs including XmAb5871 for the treatment of B-cell malignancies, autoimmune diseases, and asthma.

Summary

Halozyme Therapeutics, a biopharmaceutical company, reported its financial results for the quarter. Total revenue for the quarter decreased 13.6% year over year to USD 57.7 million.

However, net income for the quarter increased 77.9% year over year to USD 181.5 million. This shows a strong improvement in their profitability and offers investors an opportunity to enter the market at an attractive price. With a strong financial footing and a promising future, Halozyme Therapeutics is a company that investors should consider adding to their portfolios.

Recent Posts