Crinetics Pharmaceuticals Grants Inducement Awards to Support Nasdaq Listing Rule 5635

April 12, 2023

Trending News ☀️

Crinetics Pharmaceuticals ($NASDAQ:CRNX), Inc. is a clinical-stage pharmaceutical company that has been dedicated to the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases since its establishment. Recently, on April 10th, 2023, the company made an announcement from San Diego about the grant of inducement awards to three new employees, which complies with Nasdaq Listing Rule 5635(c)(4). This decision was made to further the mission of Crinetics Pharmaceuticals, Inc., to improve treatment outcomes for those suffering from rare endocrine diseases. Furthermore, the grant of these inducement awards is a noteworthy move in support of the company’s listing on the Nasdaq.

In conclusion, Crinetics Pharmaceuticals, Inc. has taken an important step in their mission to bring novel therapeutics to those affected by rare endocrine diseases. As part of the process of listing on the Nasdaq, the company has granted inducement awards to three new employees in accordance with Nasdaq Listing Rule 5635(c)(4).

Market Price

On Tuesday, Crinetics Pharmaceuticals announced that it has granted inducement awards to new employees to support its Nasdaq Listing Rule 5635 compliance. This news sent its stock prices down 1.2%, closing at $15.8 from a previous closing price of $16.0. The inducement awards consist of options to purchase common stock of Crinetics Pharmaceuticals at the closing price of the stock on the date of grant and are intended to help the company with its Nasdaq listing compliance. The company also noted that these awards will not have a material effect on the company’s financial position. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Crinetics Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 4.74 | -163.92 | -3473.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Crinetics Pharmaceuticals. More…

| Operations | Investing | Financing |

| -115.2 | -173.98 | 121.96 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Crinetics Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 352.18 | 35.85 | 5.87 |

Key Ratios Snapshot

Some of the financial key ratios for Crinetics Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -23.7% | – | -3544.1% |

| FCF Margin | ROE | ROA |

| -2467.0% | -31.4% | -29.8% |

Analysis

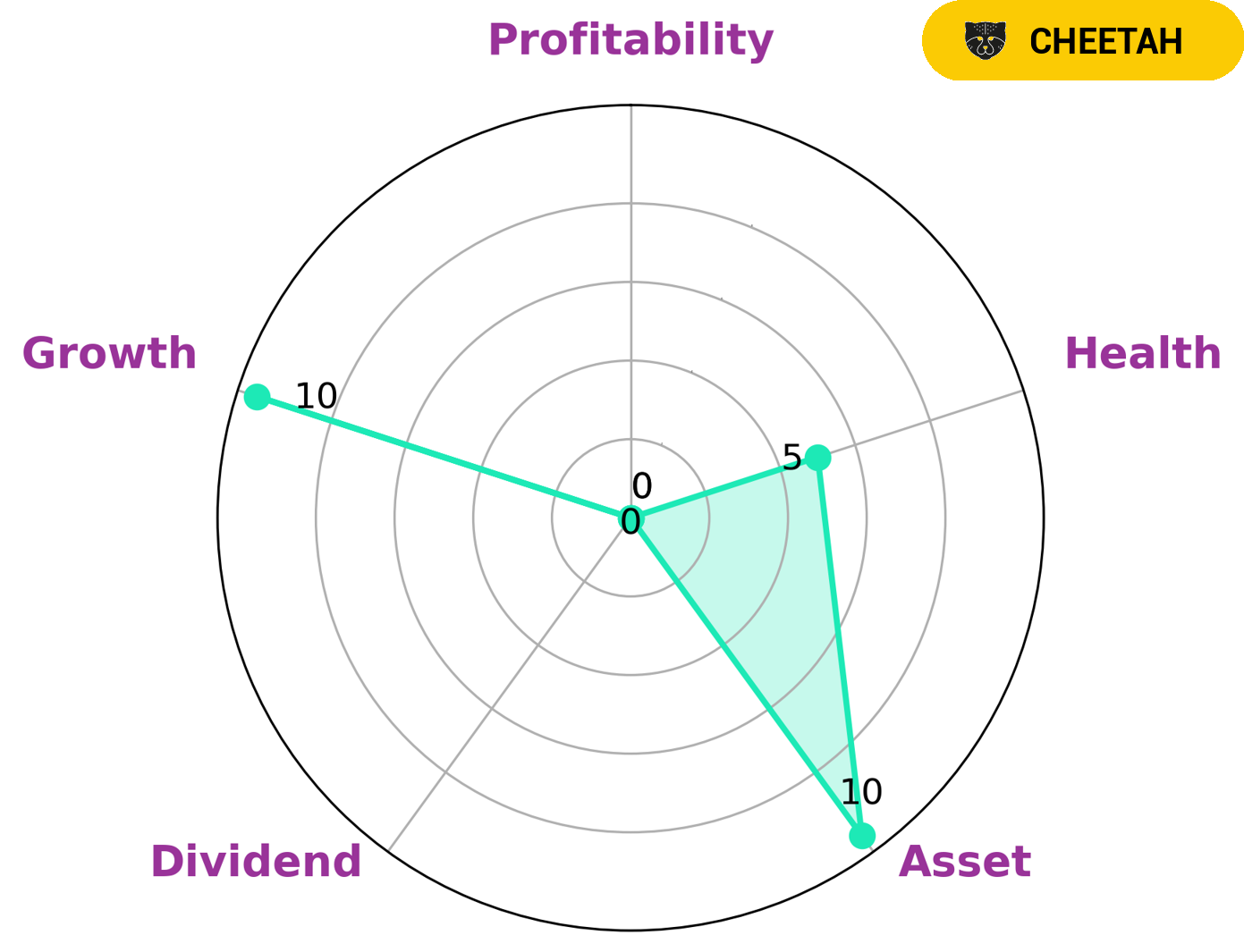

GoodWhale is here to analyze the fundamentals of CRINETICS PHARMACEUTICALS, a biopharmaceutical company. Our Star Chart shows that the company is strong in asset and growth, but weak in dividend and profitability. After further evaluation, we gave it an intermediate health score of 5/10 considering its cashflows and debt. This suggests that CRINETICS PHARMACEUTICALS might be able to pay off debt and fund future operations. Furthermore, we have classified this company as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are looking for high growth potential and are willing to take on more risk than normal might be interested in this kind of company. More…

Peers

Crinetics Pharmaceuticals Inc is currently facing stiff competition within the pharmaceutical industry. It is up against Organicell Regenerative Medicine Inc, Inhibikase Therapeutics Inc, and Belite Bio Inc, all of which are in the race to develop and market the most promising drugs. The competition between these companies is fierce and the stakes are high as they strive to be the first to make a breakthrough in their respective field of medicine.

– Organicell Regenerative Medicine Inc ($OTCPK:OCEL)

Organicell Regenerative Medicine Inc is a publicly traded biotechnology company focused on the development and commercialization of regenerative medicine treatments for a range of medical conditions. Its market cap of 31 million as of 2022 reflects the company’s strong financial performance and strong potential for growth. The company’s Return on Equity (ROE) of 92.4% shows that it has been able to efficiently manage its assets and generate returns for shareholders. The company has a robust pipeline of products and services and is well positioned to capitalize on the growing market for regenerative medicine treatments.

– Inhibikase Therapeutics Inc ($NASDAQ:IKT)

Inhibikase Therapeutics Inc is a biopharmaceutical company that focuses on developing therapies for neurological diseases, especially those related to Parkinson’s and Alzheimer’s. As of 2022, the company has a market cap of 11.6 million, indicating a small but growing presence in the industry. The company’s Return on Equity (ROE) of -43.05%, however, suggests that it has not been able to generate a significant return on investment for its shareholders. This could be due to a variety of factors such as high operating costs, low sales volume, or a lack of efficient management. Despite this, Inhibikase Therapeutics Inc has continued to grow, indicating potential for future success.

Summary

Crinetics Pharmaceuticals, Inc. is an attractive investment opportunity for investors as the company is currently in its clinical stage of development. It is focused on the discovery, development and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors. Recently, the company has announced inducement grants under Nasdaq Listing Rule 5635.

These grants are a great way to build investor confidence in the company and its prospects for long-term success. Investors can look forward to potential gains over time as the company continues to develop new products and seek out new and innovative treatments.

Recent Posts