CELSIUS HOLDINGS’ Energy Drink Sales Thrive Despite Economic Challenges

June 14, 2023

☀️Trending News

CELSIUS HOLDINGS ($NASDAQ:CELH), an American fitness lifestyle company, has experienced remarkable success in the energy drink market despite current economic headwinds. Despite a challenging global economy, sales of energy drinks remain impressive. This is largely attributed to CELSIUS HOLDINGS’ continuous innovation and expansion of its product portfolio. The company’s energy drinks are designed to provide consumers with an energizing boost, while also delivering key health benefits. These products have become increasingly popular among health-conscious consumers and athletes who are looking for natural alternatives to conventional energy drinks. CELSIUS HOLDINGS has also made significant investments in research and development, with a focus on creating innovative and healthy energy drinks for its customers. The company is continually developing new products to meet the needs of its customers, while also expanding its presence in the global energy drink market.

In addition, CELSIUS HOLDINGS has established strategic partnerships with other leading companies in the industry to further strengthen its position in the marketplace. The success of CELSIUS HOLDINGS in weathering economic challenges and thriving in the energy drink market is a testament to its creativity and commitment to providing healthier options to its consumers. The company has also established itself as a leader in the health and wellness industry through its impressive product portfolio and strategic partnerships. As CELSIUS HOLDINGS continues to innovate and expand its product range, it is likely that the company will remain a leader in the energy drink market for years to come.

Price History

Despite the current economic challenges, CELSIUS HOLDINGS‘ energy drink sales have been thriving. On Monday, CELSIUS HOLDINGS stock opened at $140.6 and closed at $144.1, up by 3.5% from its previous closing price of 139.2. This marks an impressive increase in share price, indicative of CELSIUS HOLDINGS’ success in the energy drink market.

The company’s strategy of developing premium energy drinks tailored for active lifestyles has clearly been paying off. With their commitment to quality, CELSIUS HOLDINGS’ products have been gaining favor with consumers, and its success is expected to continue in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Celsius Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 780.15 | -171.04 | -19.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Celsius Holdings. More…

| Operations | Investing | Financing |

| 85.23 | -3.95 | 527.01 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Celsius Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.29k | 386.75 | 11.79 |

Key Ratios Snapshot

Some of the financial key ratios for Celsius Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 106.3% | – | -15.1% |

| FCF Margin | ROE | ROA |

| 9.7% | -8.3% | -5.7% |

Analysis

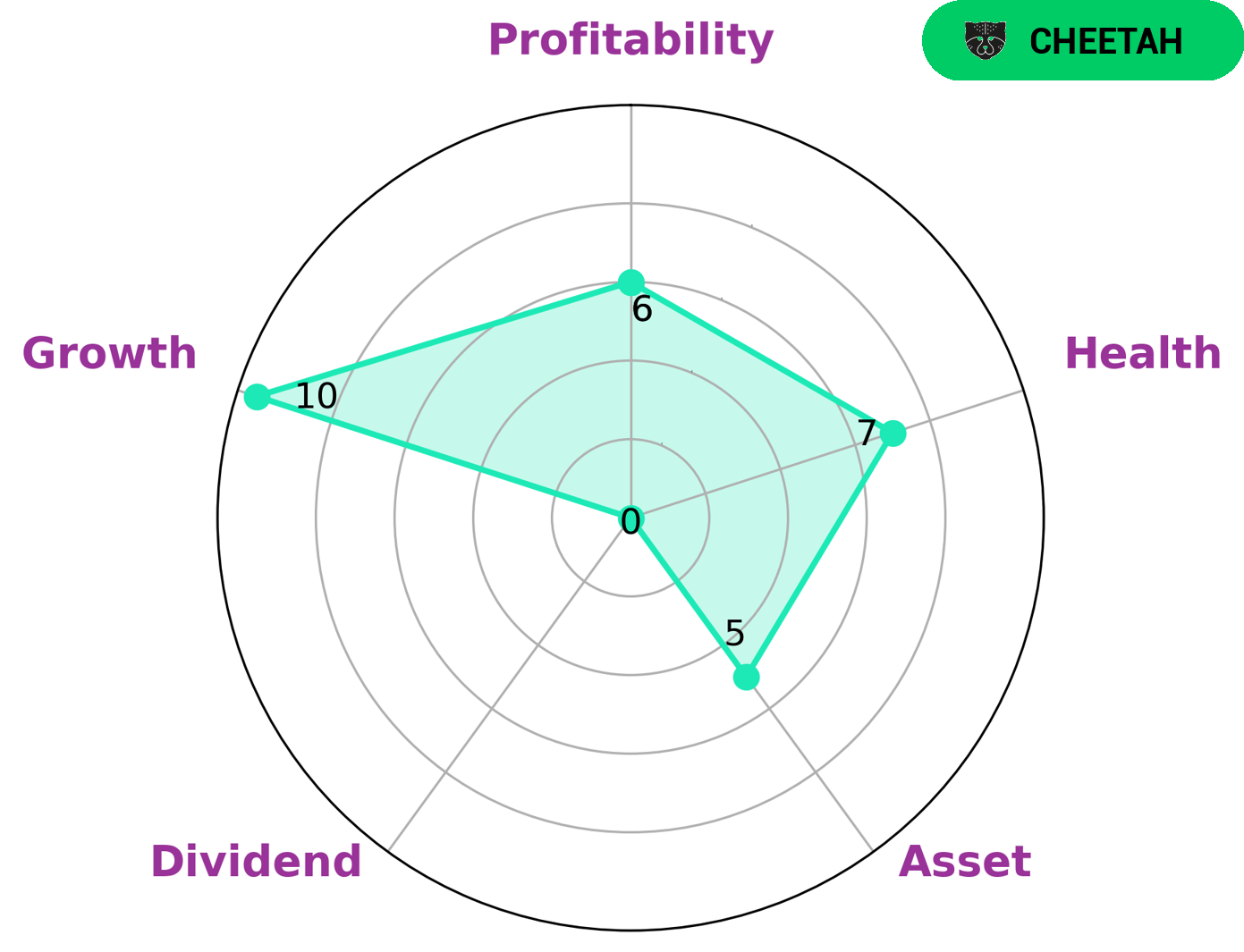

GoodWhale conducted an analysis of CELSIUS HOLDINGS‘s wellbeing and classified them as a ‘cheetah’ based on our Star Chart. A cheetah is a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are looking for high growth and looking to take on some risk may be interested in this type of company. The analysis also showed that CELSIUS HOLDINGS has a high health score of 7/10, which means that it is capable to pay off debt and fund future operations due to its positive cashflows and manageable debt. Our analysis also revealed that CELSIUS HOLDINGS is strong in terms of growth and medium in terms of asset, profitability and dividend. Overall, CELSIUS HOLDINGS is in good shape, which may make it an attractive option for investors looking for a high-growth opportunity. More…

Peers

Celsius Network is a cryptocurrency platform that enables users to earn interest on their digital assets and borrow cash without selling their crypto.

– Monster Beverage Corp ($NASDAQ:MNST)

Beverage Corporation is an American multinational corporation that manufactures, markets, and distributes energy drinks, soda, and juice. The company was founded in 1987 and currently operates in more than 30 countries. Beverage Corporation’s products are sold under the Monster Energy, Hansen’s Natural, and Lost Energy brands. In addition to its own brands, the company also distributes and markets products from other companies, such as Red Bull and Rockstar.

Beverage Corporation has a market capitalization of 53.82 billion as of 2022 and a return on equity of 14.71%. The company’s products are sold in more than 30 countries and its brands include Monster Energy, Hansen’s Natural, and Lost Energy.

– Coca-Cola Co ($NYSE:KO)

Coca-Cola Co has a market cap of 269.63B as of 2022. It is a publicly traded company with a 35.17% return on equity. The company is headquartered in Atlanta, Georgia, and is a provider of nonalcoholic beverages.

– PepsiCo Inc ($NASDAQ:PEP)

PepsiCo Inc is a food and beverage company with a market cap of 254.66B as of 2022. The company has a Return on Equity of 45.25%. PepsiCo Inc is a food and beverage company with a portfolio of brands that includes Pepsi, Gatorade, Quaker, and Tropicana. The company operates in more than 200 countries and employs more than 285,000 people.

Summary

Celsius Holdings, Inc., a leader in the functional beverage industry, has seen its stock price move up despite economic headwinds. The company’s sales of energy drinks continue to impress, with positive revenue growth year-over-year. Analysts have noted that Celsius is well-positioned to benefit from increased consumer demand for healthier beverages, which has grown during the pandemic.

Investors may find Celsius to be an attractive investment, as its innovative products and strong brand have enabled the company to remain competitive in the industry. Along with several strategic partnerships, Celsius has established itself as a leader in the energy drink space and is well-positioned for long-term growth.

Recent Posts