Brookline Bancorp Posts Loss of $0.06 on Revenue of $98.98M

April 29, 2023

Trending News 🌧️

Brookline Bancorp ($NASDAQ:BRKL), a financial holding company headquartered in Massachusetts, recently reported a loss of $0.06 on revenue of $98.98M. This fell short of analysts’ expectations, as Non-GAAP EPS of $0.27 was lower than forecasted by $0.06, and revenue of $98.98M fell $4.18M short of the predicted figure. The company cited various factors for this quarter’s disappointing results, including lower loan originations and reduced gains on the sale of securities due to volatility in the market.

In addition, Brookline Bancorp’s net interest income also decreased due to narrower net interest margins and higher expenses. Despite the losses, Brookline Bancorp remains optimistic about its future and is working hard to improve its operations. The company is focusing on enhancing its customer experience by investing in technology, increasing efficiency, and expanding its markets.

Additionally, Brookline Bancorp is proactively managing its capital levels and liquidity position in order to remain competitive in the long-term.

Stock Price

Brookline Bancorp, a diversified financial services company, reported a net loss of $0.06 per diluted share on total revenue of $98.98 million for its most recent quarter. The company’s stock opened at $9.9 on Thursday and closed at $9.8, representing a 1.1% decrease from its previous closing price of $9.9. This marks the third consecutive quarter that the company has posted a net loss. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Brookline Bancorp. More…

| Total Revenues | Net Income | Net Margin |

| – | 92.6 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Brookline Bancorp. More…

| Operations | Investing | Financing |

| 120.76 | -557.69 | 492.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Brookline Bancorp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.52k | 10.36k | – |

Key Ratios Snapshot

Some of the financial key ratios for Brookline Bancorp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.0% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

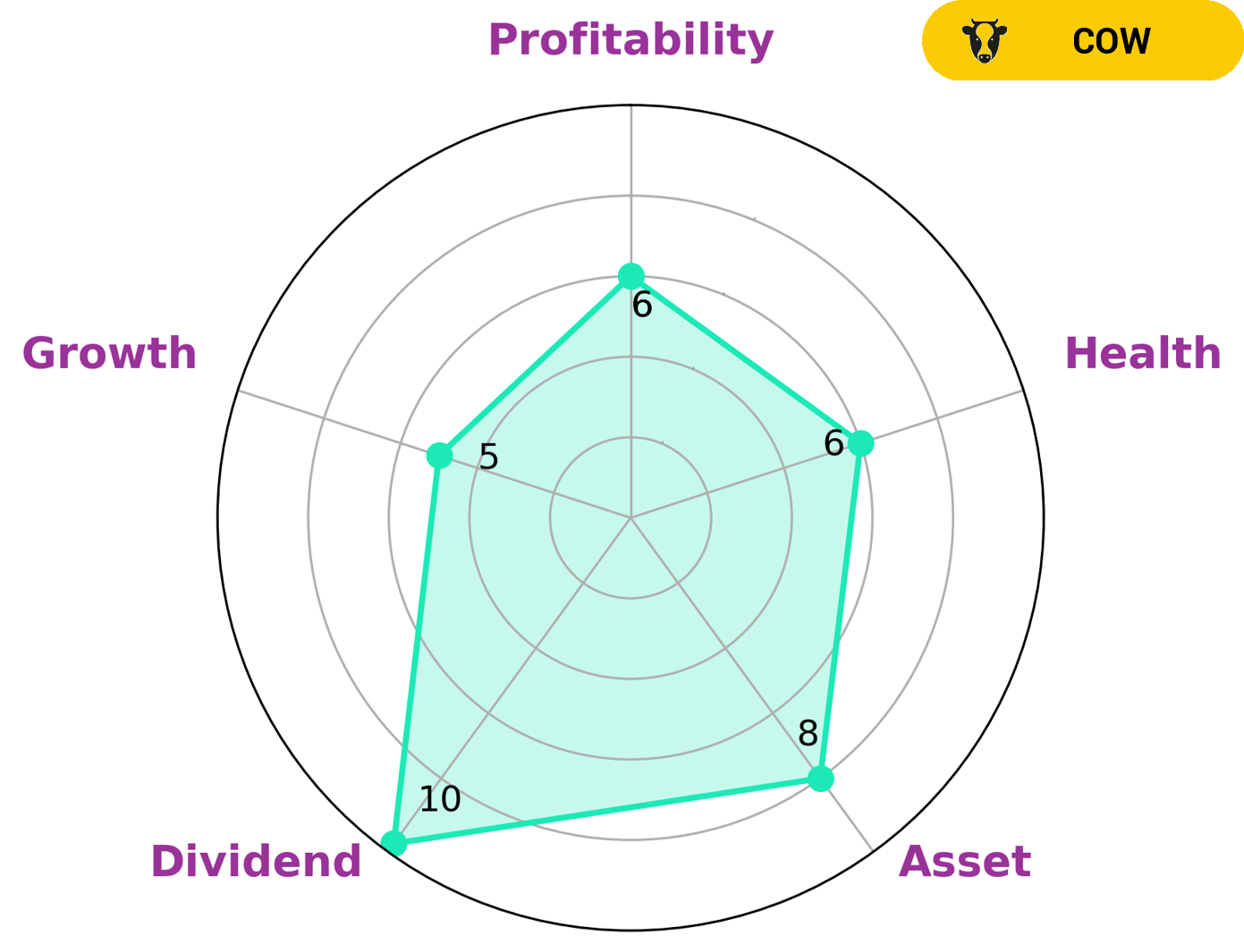

GoodWhale recently conducted an analysis of BROOKLINE BANCORP‘s wellbeing. Using the Star Chart, we can see that BROOKLINE BANCORP is strong in assets, dividend and medium in growth and profitability. This makes the company attractive to investors who are looking for steady income, such as retirees. Additionally, BROOKLINE BANCORP had an intermediate health score of 6/10, considering its cashflows and debt. This indicates that the company might be able to pay off debt and fund future operations. In conclusion, BROOKLINE BANCORP is a good choice for investors who are looking for stability, consistent dividends and steady growth potential. More…

Peers

Brookline Bancorp Inc is one of the leading financial services companies in the United States, providing various banking and financial services to individuals and businesses alike. Along with Brookline Bancorp Inc, the competitive landscape in the banking sector is also comprised of Penns Woods Bancorp Inc, Eagle Financial Services Inc, and Southern Bancshares NC Inc. All four of these companies offer a variety of products and services to their customers to meet their needs.

– Penns Woods Bancorp Inc ($NASDAQ:PWOD)

Penns Woods Bancorp Inc is a financial holding company that operates through its subsidiaries, which provide commercial banking services and trust services in Pennsylvania. The company has a market cap of 189.74M as of 2022, which is the total value of all of its outstanding shares. The company’s market cap provides investors with an indication of the size of the company and its potential for growth. Penns Woods Bancorp Inc offers a range of products and services, including deposits, personal and business loans, commercial real estate loans, and wealth management services. The company also works to ensure that customers have access to competitive rates and access to a wide range of financial services.

– Eagle Financial Services Inc ($OTCPK:EFSI)

Eagle Financial Services Inc is a financial services holding company with a market cap of 127.71M as of 2022. The company provides a wide range of services, including investment banking, asset management, advisory services and insurance through its various subsidiaries. It is headquartered in Richmond, Virginia, and is traded on the Nasdaq stock exchange under the ticker symbol EFSI. Eagle Financial Services Inc has been providing financial services to clients since its inception in 1987, and it has grown to become one of the largest financial service companies in the region. Its mission is to provide the highest quality of financial services for clients, while ensuring the security and protection of their investments.

Summary

Non-GAAP earnings per share of $0.27 were $0.06 lower than the consensus analyst estimate, while revenue of $98.98M missed by $4.18M. Investors should monitor Brookline’s financial results and management’s ability to increase revenue in upcoming quarters for any indication of a turnaround in the stock price.

Recent Posts