BOK Financial Reports Record-Breaking Quarter with $2.43 EPS and $530.21M Revenue

April 27, 2023

Trending News 🌥️

BOK ($NASDAQ:BOKF) Financial, a financial services company based in Tulsa, Oklahoma, recently reported its third quarter earnings, setting a new record. This quarter, the company reported a GAAP Earnings Per Share of $2.43, surpassing the anticipated $2.31 by $0.12 and also producing a revenue of $530.21M, exceeding the estimated $524.74M by $5.47M. The success of BOK Financial is attributed to its diverse portfolio of services, which range from banking and investments, to retirement planning and trust services.

The company also has extensive experience in the energy sector, providing capital markets, risk management, and other financial solutions to energy companies in the United States and around the world. The strong performance of BOK Financial is expected to continue in the coming quarters as the company looks to capitalize on its diverse portfolio of services and its deep expertise in the energy market.

Stock Price

On Wednesday, BOK Financial Corporation reported record-breaking quarterly results and saw its stock open at $82.1 and close at $82.4, up 3.6% from previous closing price of 79.5. The strong performance was driven by higher net interest income, noninterest income, and average earning assets compared to the prior year. BOK Financial also saw a reduction in their provisions for loan losses, which contributed to the strong earnings performance. The company’s strong financial results were reflective of their successful strategy of diversifying their revenue streams and focusing on cost control.

Additionally, their commitment to providing exceptional customer service and delivering a wide range of financial products has helped drive their growth over the years. Overall, BOK Financial’s record-breaking quarter is indicative of the company’s commitment to delivering value to their shareholders and customers alike. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bok Financial. More…

| Total Revenues | Net Income | Net Margin |

| – | 516.47 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bok Financial. More…

| Operations | Investing | Financing |

| 5.12k | -4.6k | -1.95k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bok Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 47.79k | 43.1k | – |

Key Ratios Snapshot

Some of the financial key ratios for Bok Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.3% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

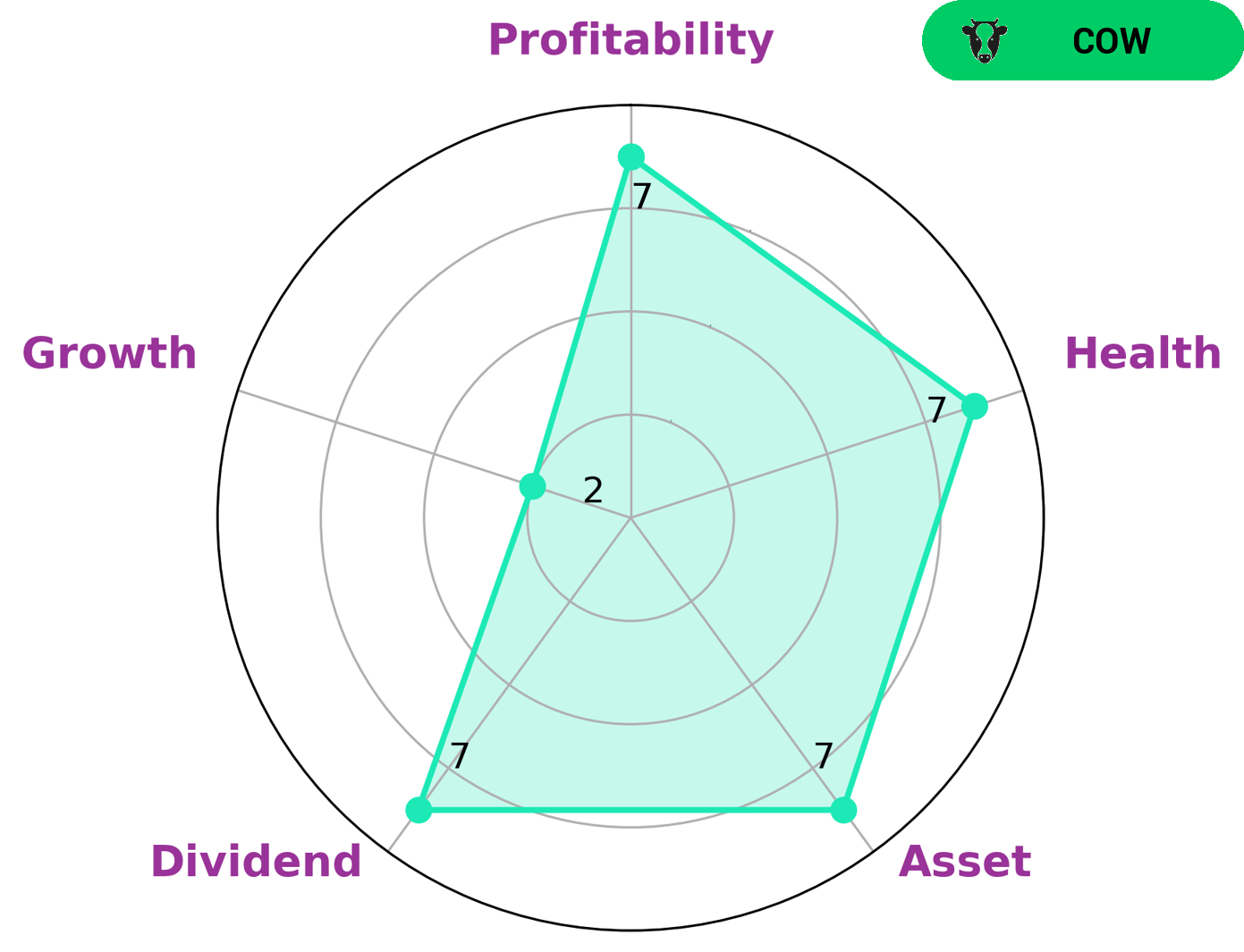

At GoodWhale, we take a look at BOK FINANCIAL‘s financials and come to the conclusion that it is classified as a ‘cow’. This type of company has a track record of paying out consistent and sustainable dividends, making it an attractive option for investors seeking stable, steady returns. Our analysis reveals that BOK FINANCIAL is particularly strong in profitability, asset, and dividend, but does not have as much growth potential. Despite this, the company has a high health score of 7/10 considering its cashflows and debt, which suggests that it is capable of paying off debt and funding future operations. These factors, combined with the reliable dividend payments, make BOK FINANCIAL a great option for investors looking for a low-risk, high-reward investment. More…

Peers

In the financial services industry, BOK Financial Corp competes against First Merchants Corp, First Busey Corp, and Coastal Financial Corp. All four of these companies offer similar products and services, including banking, lending, and investment products. While all four companies are comparable in terms of the products and services they offer, BOK Financial Corp has a competitive advantage in terms of its size, scale, and scope.

– First Merchants Corp ($NASDAQ:FRME)

First Merchants Corp is a financial holding company that operates through its subsidiaries. It offers a range of banking services to individuals and businesses, including checking and savings accounts, loans, and credit cards. The company has a market cap of 2.57B as of 2022. First Merchants Corp is headquartered in Muncie, Indiana.

– First Busey Corp ($NASDAQ:BUSE)

First Busey Corporation is a bank holding company headquartered in Champaign, Illinois. The Company operates through its banking subsidiary, First Busey Bank (the Bank), which offers retail banking, wealth management, commercial banking, and mortgage services to individuals and businesses through its 48 full-service banking centers located in Illinois, Indiana, and Florida.

– Coastal Financial Corp ($NASDAQ:CCB)

Coastal Financial Corp is a bank holding company. The Company, through its subsidiaries, offers a range of banking services to small and medium-sized businesses, professionals and individuals in Washington and Oregon. The Company’s primary products and services include business checking accounts, money market accounts, savings accounts, time deposits, commercial loans, residential loans and personal loans. The Company operates through its subsidiary, Coastal Community Bank.

Summary

BOK Financial is a successful financial services company, with strong performance in their most recent earnings report. The reported GAAP earnings per share (EPS) of $2.43 beat analyst estimates by $0.12, while revenue of $530.21 million beat estimates by $5.47 million. As a result, the market responded positively, with the stock price moving up on the same day.

This indicates a bullish outlook for BOK Financial, and suggests that investors may benefit from investing in the company. It is important to note, however, that this strong performance should be considered within the context of the overall market conditions; any prospective investments should be made with full awareness of the risks.

Recent Posts