JPMORGAN CHASE CEO Dimon Warns Bank Failure Risks Could Last For Years

April 9, 2023

Trending News 🌧️

JPMORGAN ($NYSE:JPM): In a recent statement, JPMorgan Chase CEO Jamie Dimon warned that the potential for bank failure is still present and its consequences could last for years. Dimon noted that the current economic crisis is far from over and banks must remain vigilant in order to protect themselves from failure. He said that banks must be extra cautious and ensure they have adequate levels of capital, as well as strong risk management and compliance systems in place. He also stressed the importance of proper oversight of financial institutions by regulators and supervisors, as well as ongoing monitoring of their activities. Dimon warned that the fallout from the banking crisis could be long-lasting, pointing to the fact that some banks may not survive the current economic conditions.

He said that banks should focus on surviving the crisis by making sure they have the right strategies in place, and that they be prepared to make difficult decisions when necessary. Banks must remain vigilant and take all necessary steps to protect themselves from failure, including proper oversight and monitoring by regulators and supervisors. By taking appropriate measures, banks can ensure their survival during these tough economic times.

Price History

Speaking at the Economic Club of New York, Dimon highlighted the potential risks to the banking system posed by an uncertain economic environment. He noted that the current financial situation is “far from perfect” and that the industry continues to face challenges, including the risk of bank failures. Dimon’s remarks come as JPMorgan Chase & Co’s stock opened at $130.5 and closed at $128.4, down by 1.3% from last closing price of 130.2. This signals that investors have not been assured by the CEO’s words and have taken to selling their shares in the company. Dimon said that the risk of bank failure is still present and that banks must remain vigilant and prepared for such an event. He noted that banks are still heavily regulated and that they must maintain adequate capital and liquidity buffers in order to protect against potential losses.

This cautionary advice comes in light of recent turmoil in global markets, which saw several major banks take large losses and some even declare bankruptcy. The CEO also urged banks to focus on their core business activities, and to create more transparency around their lending operations. He also cautioned against taking on too much debt, noting that such a move could be catastrophic in a financial crisis. Ultimately, Dimon’s warnings serve as a reminder of the potential danger facing the banking system if not managed appropriately. While it is unclear whether or not bank failure risks will last for years as Dimon suggested, it is clear that banks must remain vigilant and take steps to protect against such an event. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for JPM. More…

| Total Revenues | Net Income | Net Margin |

| – | 35.89k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for JPM. More…

| Operations | Investing | Financing |

| 107.12k | -137.82k | -126.26k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for JPM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.67M | 3.37M | – |

Key Ratios Snapshot

Some of the financial key ratios for JPM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.6% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

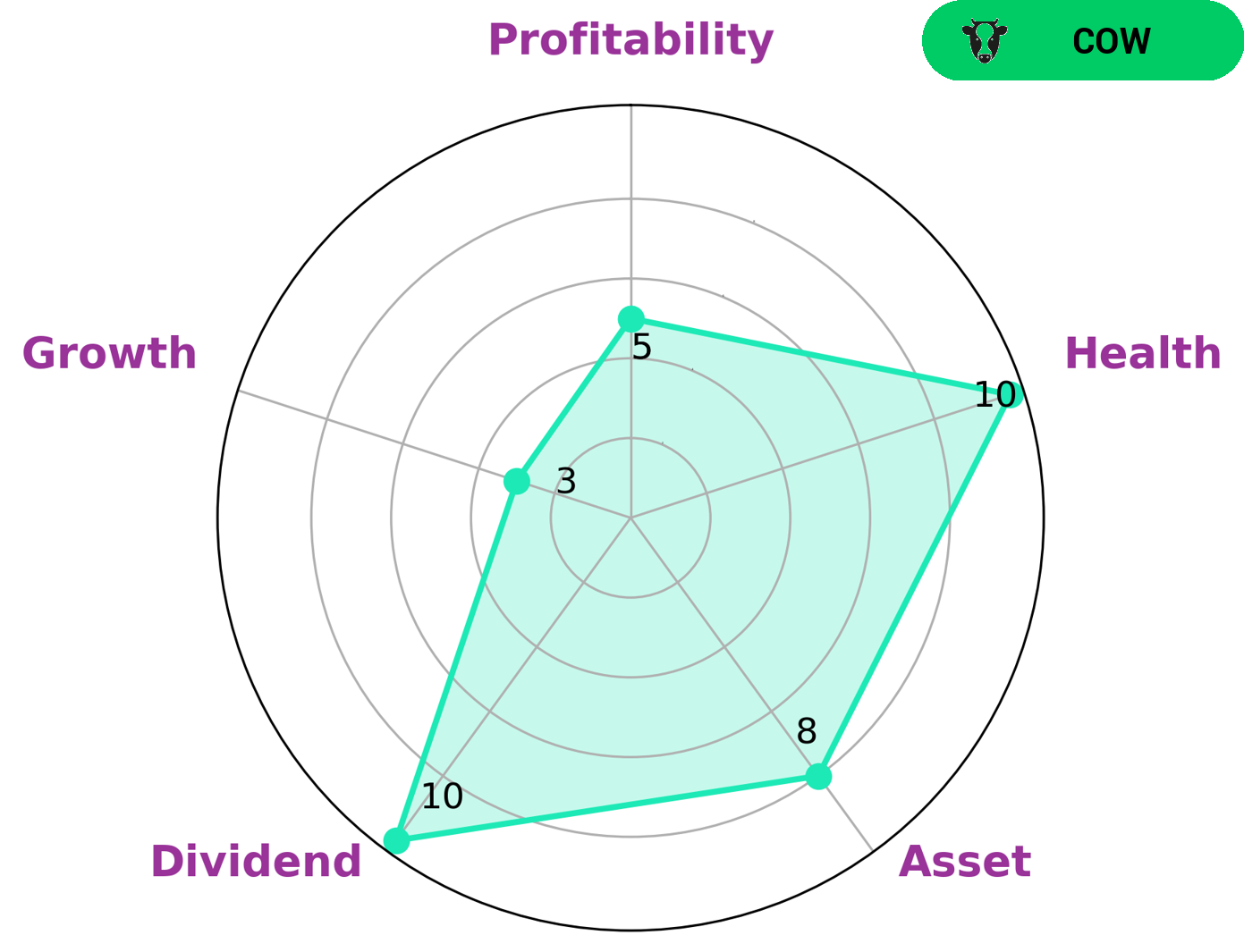

As a GoodWhale analyst, I have been looking into JPMORGAN CHASE &’s financials and the results are quite positive. According to the Star Chart, JPMORGAN CHASE & is strong in both asset and dividend, which is indicative of a company with good fundamentals. Its profitability is medium which suggests it could do better in this area. However, its growth is weak, which is not ideal but may not be significant for investors. Overall, we would classify JPMORGAN CHASE & as a ‘cow’, a type of company that we conclude has the track record of paying out consistent and sustainable dividends. This type of company would likely be attractive to dividend investors who are looking for a steady income. Furthermore, JPMORGAN CHASE & has a high health score of 10/10 considering its cashflows and debt. This suggests that the company is capable of sustaining future operations even in times of crisis. This is obviously a very desirable trait for potential investors. More…

Peers

In the banking industry, JPMorgan Chase & Co and its competitors Wells Fargo & Co, PNC Financial Services Group Inc, Banco BPM SpA compete for customers and market share. Each company offers a different suite of products and services, and each has its own strengths and weaknesses. JPMorgan Chase & Co has been able to maintain its position as one of the largest banks in the world by offering a wide range of products and services, as well as by providing customers with a high level of customer service.

– Wells Fargo & Co ($NYSE:WFC)

Wells Fargo & Co is an American multinational banking and financial services holding company headquartered in San Francisco, California. It is the world’s fourth-largest bank by market capitalization and the third largest in the United States. Wells Fargo & Co. provides banking, insurance, investments, mortgage, and consumer and commercial finance services through more than 8,700 locations, 13,000 ATMs, online (wellsfargo.com), and mobile banking, and has offices in 36 countries.

– PNC Financial Services Group Inc ($NYSE:PNC)

PNC Financial Services Group Inc is a large financial services company with a market cap of $65.38 billion as of 2022. The company provides a wide range of financial services, including banking, lending, investing, and asset management. PNC has a large customer base and a strong presence in the United States.

– Banco BPM SpA ($LTS:0RLA)

Banco BPM SpA is an Italian bank created through the merger of Banco Popolare and Banca Popolare di Milano in January 2017. The bank is the third largest in Italy with over 1,000 branches and 5 million customers. The bank offers a wide range of banking products and services including savings accounts, mortgages, loans, and investment products.

Summary

JPMorgan Chase & Co. is an American multinational investment bank and financial services company. Recently, their Chairman and CEO Jamie Dimon stated that the risks of bank failure were “in plain sight” prior to the global pandemic, and that its repercussions will last for years. He urged investors to remain vigilant in their analysis of potential investments, cautioning that risk management will be more crucial than ever in the years ahead.

He also highlighted the importance of understanding macroeconomic trends, liquidity and leverage, market structure, capital and balance sheet structure, creditworthiness and stress testing. His advice is timely, as investors continuing to navigate the unprecedented waters of today’s global market.

Recent Posts