PENSKE AUTOMOTIVE Reports 4.3% Decrease in Q4 Revenue for 2022

March 29, 2023

Earnings Overview

PENSKE AUTOMOTIVE ($NYSE:PAG) released their financial results for the fourth quarter of 2022 on December 31, reporting total revenue of USD 298.0 million, a decrease of 4.3% from the same quarter in 2021. Net income, however, was USD 7011.8 million, an increase of 11.4% from the same period the year before.

Transcripts Simplified

Penske Automotive reported record revenue and earnings per share for the fourth quarter of 2022. Revenue increased 11% to $7 billion and earnings per share increased 6% to $4.21. Excluding foreign exchange effects, revenue increased 17% to $7.4 billion and earnings per share increased 8% to $4.30. The company repurchased 2.5 million shares of stock for $284 million during the quarter. Retail automotive operations saw new unit sales increase 11% on a same-store basis, while used units declined 4%.

Revenue increased 4%, but excluding foreign exchange effects, revenue increased 10%. Variable gross profit per unit declined 7%, excluding foreign exchange effects. Service and parts revenue increased 6%, while CarShop unit sales increased 12% and revenue increased 16%. Premier Truck Dealership business saw new commercial truck demand remain very solid, with unit sales increasing 28% and gross profit increasing 16%.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Penske Automotive. More…

| Total Revenues | Net Income | Net Margin |

| 27.81k | 1.38k | 5.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Penske Automotive. More…

| Operations | Investing | Financing |

| 1.46k | -641.7 | -798 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Penske Automotive. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.11k | 9.94k | 59.53 |

Key Ratios Snapshot

Some of the financial key ratios for Penske Automotive are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.3% | 31.6% | 7.1% |

| FCF Margin | ROE | ROA |

| 4.2% | 30.2% | 8.8% |

Price History

The company’s stock opened at $140.4 and closed at $136.4, up by 1.2% from its last closing price of 134.8. It is engaged in the sale of new and used vehicles, aftermarket parts, service contracts, and rental vehicles. This was driven by lower new vehicle sales volumes across most of its markets, partially offset by higher aftermarket product sales. Following the announcement of their financial results, PENSKE AUTOMOTIVE stock opened at $140.4 and closed at $136.4, up by 1.2% from its last closing price of 134.8.

Overall, the decrease in revenue for PENSKE AUTOMOTIVE reflects a challenging market environment for the automotive industry, where demand for new vehicles is decreasing due to changing consumer preferences and rising costs of ownership. Despite these headwinds, the company remains upbeat about their future prospects and is making strategic investments to position itself for long-term growth. Live Quote…

Analysis

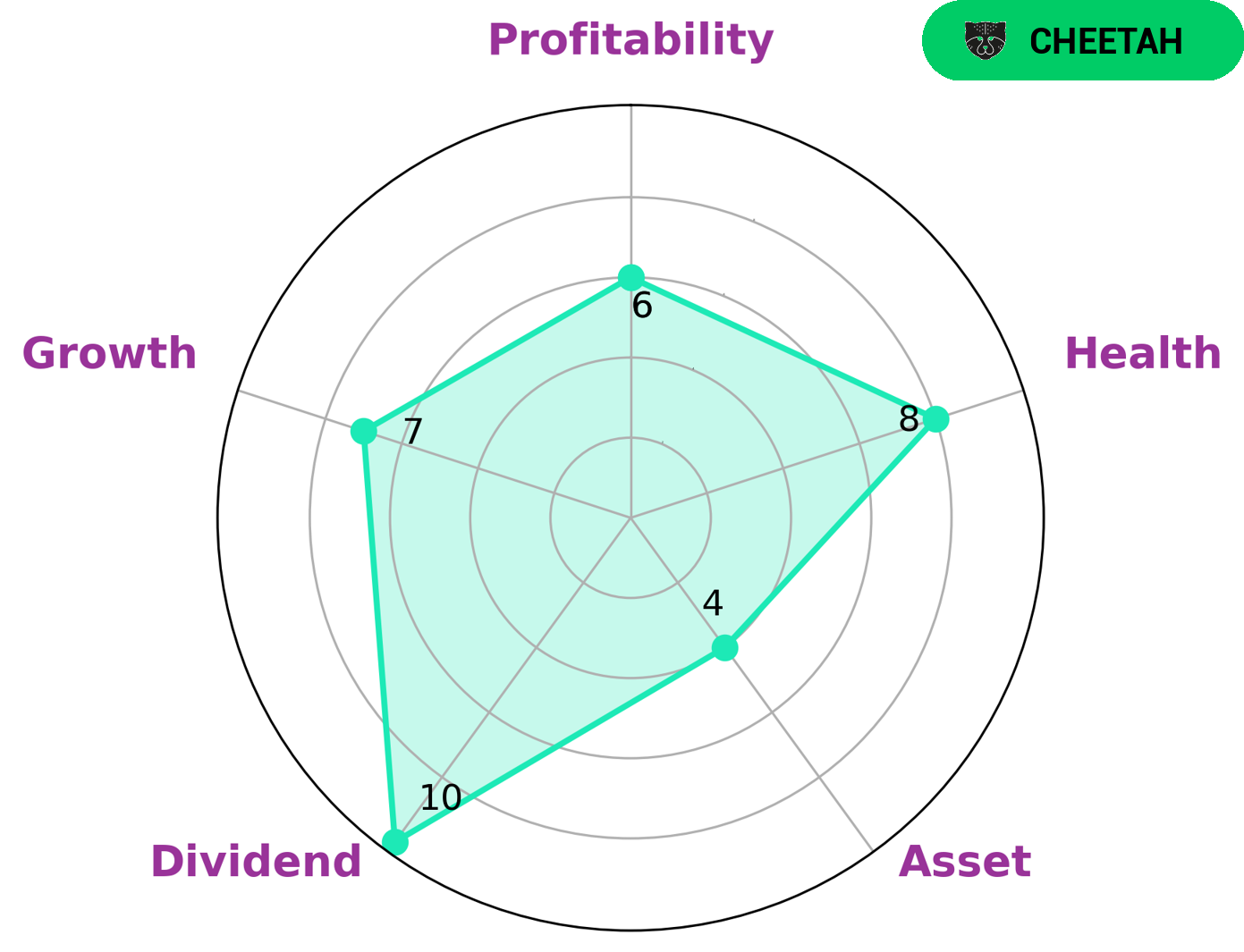

At GoodWhale, we have conducted a financial analysis of PENSKE AUTOMOTIVE. Our Star Chart shows that the company is strong in dividend, growth, and medium in asset and profitability. PENSKE AUTOMOTIVE has a high health score of 8/10, indicating that it is capable of safely riding out any crisis without the risk of bankruptcy. Moreover, our Cheetah Classification Tool has identified PENSKE AUTOMOTIVE as a ‘cheetah’, i.e. a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. From this analysis, we can infer that investors who are looking for potential capital appreciation, but with an appetite for higher risk, may be interested in such a company. More…

Peers

Penske Automotive Group Inc is an American automotive retailer. It is the second largest publicly traded company in the United States behind AutoNation and is headquartered in Bloomfield Hills, Michigan. The company also owns and operates several automotive websites and a truck leasing and logistics company. Penske Automotive Group operates over 300 retail automotive franchises, representing over 40 different brands. The company also operates in the United Kingdom, Australia, and Mexico. Sonic Automotive Inc is an American automotive retailer.Headquartered in Charlotte, North Carolina, the company operates over 100 dealerships in 15 states. Asbury Automotive Group Inc is an American automotive retailer. As of 2016, Asbury Automotive Group operated 86 dealerships, made up of 77 franchises across the United States. Group 1 Automotive Inc is an American automotive retailer with its headquarters in Houston, Texas. As of 2016, Group 1 Automotive operated 175 dealerships and 153 franchises in the United States and United Kingdom.

– Sonic Automotive Inc ($NYSE:SAH)

Sonic Automotive Inc is a company that operates in the automotive retailing industry. As of 2022, it had a market capitalization of 1.77 billion dollars and a return on equity of 32.11%. Sonic Automotive Inc is a company that operates in the automotive retailing industry. It is based in Charlotte, North Carolina, and was founded in 1997. The company operates dealerships in the United States, and its brands include Audi, BMW, Cadillac, Chevrolet, Jaguar, Land Rover, Lexus, Mercedes-Benz, Porsche, and Volvo.

– Asbury Automotive Group Inc ($NYSE:ABG)

Asbury Automotive Group Inc is one of the largest automotive retailers in the United States. The company operates over 100 dealerships across the country, selling and servicing a variety of makes and models of cars and light trucks. Asbury’s return on equity is impressive, coming in at over 31%. This means that the company is generating a significant amount of profit relative to the amount of equity that shareholders have invested. Asbury’s market cap is just over $3.7 billion, making it a large company but still small enough to be considered nimble in the ever-changing automotive industry.

– Group 1 Automotive Inc ($NYSE:GPI)

Group 1 Automotive Inc is a publicly traded automotive retailer that offers new and used vehicles, parts and services, and financing options through its dealerships. As of 2022, the company had a market capitalization of 2.6 billion dollars and a return on equity of 33.54%. Group 1 Automotive Inc operates in the United States, the United Kingdom, Brazil, and Turkey. The company was founded in 1995 and is headquartered in Houston, Texas.

Summary

PENSKE AUTOMOTIVE recently reported their financial results for the fourth quarter of 2022, which saw a decrease in total revenue of 4.3% compared to the same period in 2021. However, net income increased by an impressive 11.4% year-over-year, indicating that the company is still doing well despite the decrease in revenue. Investors may be pleased to note that PENSKE AUTOMOTIVE has continued to remain profitable, with a strong fourth quarter performance, providing reasons to remain optimistic about their long-term prospects.

Recent Posts