GOGORO INC Reports 11.5% Increase in Revenue and 20.8% Decrease in Net Income for Fourth Quarter of FY2022

March 6, 2023

Earnings report

GOGORO INC ($NASDAQ:GGR) recently released its financials for the fourth quarter of FY2022, ended December 31 2022, on February 16 2023. The company reported total revenue of USD -12.5 million, an increase of 11.5% compared to the same period of the previous year.

However, net income for the quarter declined to USD 95.5 million, a decrease of 20.8% year-over-year. Despite the increase in revenue, GOGORO INC’s net income declined due to a variety of factors, such as increased expenditure on research and development, increased marketing expenditures, and a higher tax rate. Despite this, GOGORO INC is optimistic about its future prospects and aims to grow its market share in the coming quarters.

Stock Price

GOGORO INC reported a 11.5% increase in revenue for the fourth quarter of FY2022 on Thursday. However, the company also reported a 20.8% decrease in net income for the quarter. In response, the stock opened at $4.8 and closed at $4.4, representing a 9.8% drop from the previous day’s closing price of $4.9. This news caused the stock to take a significant hit, leaving investors uncertain of GOGORO INC’s prospects going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gogoro Inc. More…

| Total Revenues | Net Income | Net Margin |

| 382.83 | -98.91 | -25.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gogoro Inc. More…

| Operations | Investing | Financing |

| -64.79 | -101.1 | 186.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gogoro Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 873.42 | 574.45 | 0.51 |

Key Ratios Snapshot

Some of the financial key ratios for Gogoro Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.5% | – | -23.3% |

| FCF Margin | ROE | ROA |

| -49.1% | -45.1% | -6.4% |

Analysis

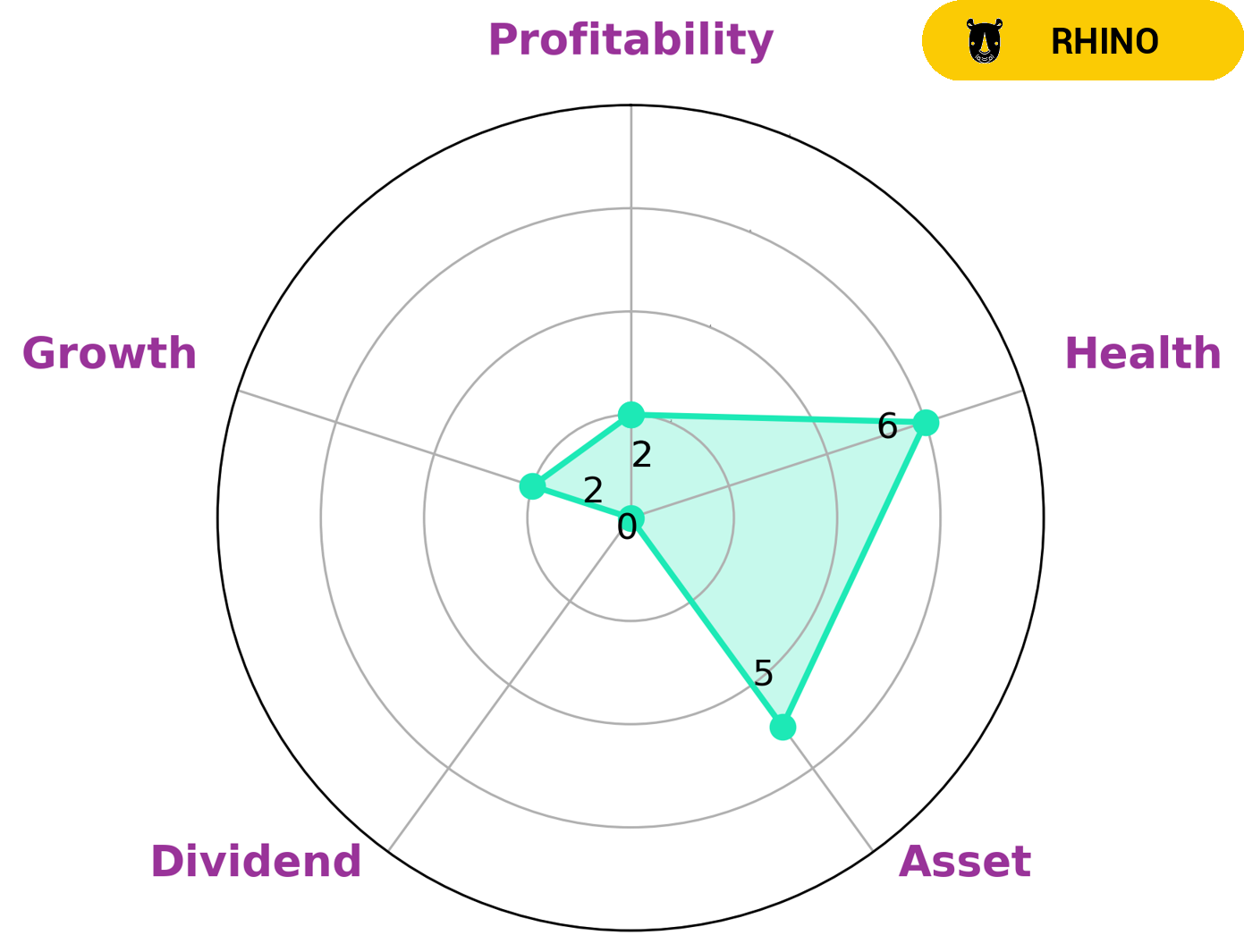

GoodWhale has conducted an analysis of GOGORO INC‘s wellbeing and we have determined that the company is strong in asset and weak in dividend, growth, and profitability. Our Star Chart has given GOGORO INC an intermediate health score of 6/10 due to its ability to pay off debt and fund future operations. GOGORO INC is classified as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Investors who are looking for moderate growth and are willing to take on moderate risk may be interested in investing in GOGORO INC. As the company has an intermediate health score, investors may expect dividends and growth within the range of moderate risk. Furthermore, investors may also be interested in the flexibility of GOGORO INC, as it may give investors the opportunity to increase their returns from the company if they are willing to take on more risk. More…

Peers

Gogoro Inc, Chaowei Power Holdings Ltd, Romeo Power Inc, and Enova Systems Inc are all companies that produce electric vehicles and batteries. They all compete against each other to produce the best products possible. All four companies are constantly trying to improve their products and stay ahead of the competition.

– Chaowei Power Holdings Ltd ($SEHK:00951)

Chaowei Power Holdings Ltd is a Chinese holding company that engages in the manufacture and sale of lead-acid batteries. It operates through the following segments: Lead-Acid Battery, Lithium Battery, and Solar Energy. The Lead-Acid Battery segment manufactures and sells lead-acid batteries for use in automobiles, motorcycles, power tools, and UPS systems. The Lithium Battery segment manufactures and sells lithium batteries for use in electric vehicles, energy storage systems, and consumer electronics. The Solar Energy segment manufactures and sells solar panels and solar power systems.

– Romeo Power Inc ($OTCPK:ENVS)

Enova Systems Inc is a company that designs, manufactures, and sells motor controllers and power conversion products for electric vehicles and industrial applications. They have a market cap of 103.23k as of 2022 and a Return on Equity of 4.24%. The company’s products are used in a variety of applications, including material handling, construction, agricultural, and military vehicles, as well as in stationary power applications such as wind turbines and battery energy storage systems.

Summary

GOGORO INC reported its quarterly financial results, showing total revenue of USD -12.5 million for the quarter, representing an 11.5% increase compared to the same period the previous year. Net income for the quarter was USD 95.5 million, a decrease of 20.8%. This news caused GOGORO INC’s stock price to go down on the same day.

For investors, this could mean that while the company is growing on a quarterly basis, the net income is decreasing, which represents a risk. While there is potential upside to investing in the company, potential investors should consider their risk appetite and monitor future performance to gain an understanding of the company’s financial health.

Recent Posts